Unethical Financial Reporting: Risks and Consequences

Unethical financial reporting is a serious issue that can have far-reaching consequences for businesses and stakeholders. At Devine Consulting, we’ve seen firsthand the devastating impact of fraudulent financial practices on companies of all sizes.

This blog post will explore the common types of unethical reporting, the risks involved, and effective prevention strategies. By understanding these aspects, businesses can safeguard their financial integrity and build lasting trust with investors and regulators.

Unethical Financial Tricks Exposed

Inflating Revenue

Companies often employ deceptive practices to artificially boost their revenue figures. This tactic involves recording sales prematurely or creating fake invoices for non-existent customers. In 2022, the SEC charged Synchronoss Technologies with improperly recognizing revenue, which underscores the ongoing prevalence of this issue.

Hiding Expenses

Expense manipulation represents another common strategy in unethical financial reporting. Businesses might delay expense recording, improperly capitalize costs that should be expensed, or simply omit certain liabilities. WorldCom’s $3.8 billion fraud in the early 2000s (primarily involving capitalized operating expenses) demonstrates the massive scale this deception can reach.

Overstating Assets

Asset misrepresentation often involves inflating the value of inventory or other assets. For example, a company might overstate its accounts receivable by including amounts unlikely to be collected. In 2019, Under Armour settled with the SEC for $9 million over charges of misleading investors about its revenue growth, partly through pulling forward sales from future quarters.

Concealing Liabilities

Some companies attempt to hide their true financial position by understating or completely omitting liabilities from their balance sheets. Enron’s infamous off-balance-sheet entities (used to conceal billions in liabilities) serve as a stark reminder of how devastating this practice can be.

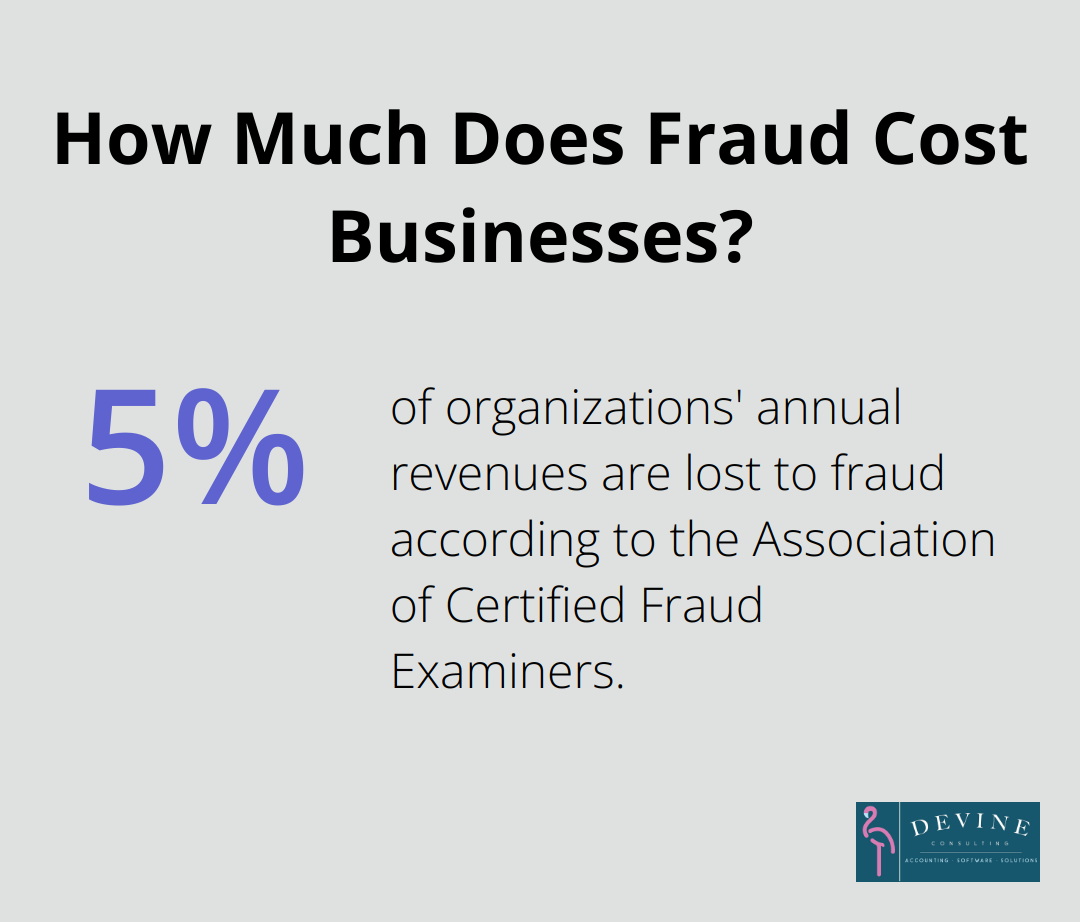

These unethical practices not only violate accounting standards but also erode trust in financial markets. The Association of Certified Fraud Examiners estimates that organizations lose 5% of their annual revenues to fraud, which underscores the financial impact of these deceptive tactics.

To combat these issues, companies should implement robust internal controls and foster a culture of transparency. Regular audits (both internal and external) play a vital role in detecting and preventing fraudulent activities. Additionally, whistleblower programs can encourage employees to report suspicious financial practices without fear of retaliation.

As we move forward, we’ll explore the significant risks associated with these unethical financial reporting practices and their potential consequences for businesses and stakeholders alike. Understanding cash accounting basics can help in identifying some of these unethical practices.

The Hidden Costs of Cooking the Books

Legal Fallout and Hefty Fines

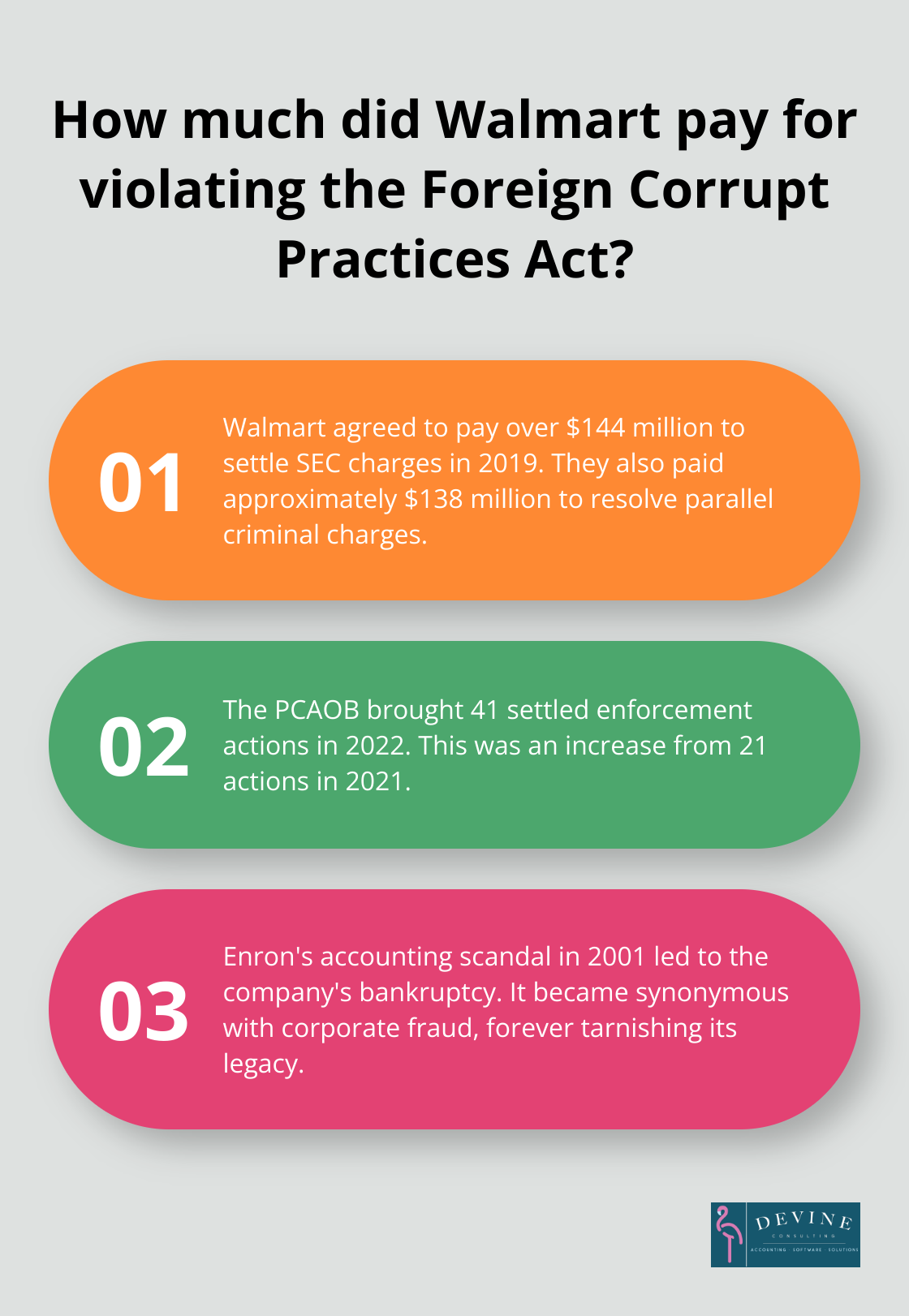

Companies caught engaging in unethical financial reporting face steep legal penalties. In 2019, Walmart agreed to pay more than $144 million to settle the SEC’s charges and approximately $138 million to resolve parallel criminal charges related to violating the Foreign Corrupt Practices Act. The SEC’s enforcement actions related to issuer reporting and accounting violations have seen significant changes, with the PCAOB bringing 41 settled enforcement actions in 2022 compared to 21 in 2021. These numbers highlight the growing risk of regulatory scrutiny and the potential for crippling fines.

Reputation in Ruins

The damage to a company’s reputation from financial fraud can be irreparable. When Enron’s accounting scandal came to light in 2001, it didn’t just lead to the company’s bankruptcy – it became synonymous with corporate fraud, forever tarnishing its legacy. In today’s interconnected world, news of financial misconduct spreads rapidly, erodes customer trust, and damages business relationships that may have taken years to build.

Investors Heading for the Exit

Unethical financial reporting inevitably leads to a loss of investor confidence. When HealthSouth’s $3.8 billion accounting fraud was revealed in 2003, its stock price plummeted 97% in a single day. This dramatic reaction shows how quickly investors can lose faith in a company’s financial statements. The long-term impact is often even more severe, with companies struggling to attract new investment and facing higher costs of capital.

Financial Instability and Bankruptcy Risk

Fraudulent financial reporting often masks underlying financial problems, allowing them to worsen over time. When the truth eventually comes out, companies can find themselves in dire financial straits. WorldCom’s $3.8 billion fraud led to a $750 million fine and ultimately bankruptcy, costing thousands of jobs and billions in investor losses.

The ripple effects of financial instability can be far-reaching. Suppliers may tighten credit terms, banks may call in loans, and customers may seek more stable business partners. This perfect storm of financial pressure can quickly push a company towards insolvency.

The Path Forward

To avoid these devastating consequences, businesses must prioritize ethical financial reporting. Implementing robust internal controls, fostering a culture of integrity, and working with trusted financial partners are essential steps in safeguarding a company’s future. The next chapter will explore effective strategies to prevent unethical financial reporting and maintain the highest standards of financial integrity.

How to Prevent Unethical Financial Reporting

At Devine Consulting, we understand the devastating impact of unethical financial reporting on businesses. Companies can take concrete steps to prevent these issues. Let’s explore some practical strategies to maintain financial integrity.

Build a Fortress of Financial Controls

Strong internal controls serve as your first line of defense against unethical practices. Implement a robust segregation of duties. No single employee should control an entire financial process. For example, the person who approves purchases shouldn’t record those transactions.

Invest in advanced accounting software with built-in controls. These systems flag unusual transactions, enforce approval processes, and maintain detailed audit trails. The American Institute of CPAs (AICPA) reports that companies using integrated financial software experience 50% fewer errors in their financial statements.

Create a Culture of Honesty

Your company’s culture plays a vital role in preventing unethical behavior. Leadership must consistently demonstrate a commitment to financial integrity. This means transparency about financial challenges and never pressuring employees to meet unrealistic targets.

Implement a clear code of ethics that specifically addresses financial reporting. Ensure every employee understands these guidelines through regular training sessions. The ethical climate and culture of a company is a strong predictor of its vulnerability to fraud.

Scrutinize Your Finances Regularly

Don’t wait for your annual audit to catch problems. Implement a system of regular internal audits and financial reviews. These should occur at least quarterly (if not monthly). Focus on high-risk areas like revenue recognition, expense allocation, and asset valuation.

Consider rotating your external auditors every few years. While this might seem disruptive, it brings fresh eyes to your financial processes. A study by the Public Company Accounting Oversight Board (PCAOB) found that companies who switched auditors were 33% more likely to have material weaknesses in internal controls identified.

Empower Whistleblowers

Create a safe environment for employees to report suspected financial misconduct. Implement an anonymous reporting hotline and a clear non-retaliation policy. The Association of Certified Fraud Examiners reports that organizations with hotlines detect fraud 50% more quickly and experience fraud losses that are 62% smaller than those without.

Train managers on how to handle reports of misconduct and ensure thorough investigation of all allegations. Many major financial frauds have been uncovered by whistleblowers (not auditors).

Leverage Technology for Compliance

Try to harness the power of technology to enhance your financial reporting processes. Artificial Intelligence (AI) and machine learning algorithms can analyze vast amounts of financial data to detect anomalies and potential fraud. These tools can identify patterns that humans might miss, providing an additional layer of security.

Implement blockchain technology for financial transactions. The transparency and traceability of accounting blockchain will increase the probability of fraud being found and largely increase the counterfeiting costs.

Final Thoughts

Unethical financial reporting poses severe risks to businesses. It erodes trust, invites legal consequences, and can lead to financial ruin. The costs of financial misconduct far outweigh any short-term gains, as demonstrated by the cases we explored.

Companies that prioritize transparency and integrity in their reporting build stronger relationships with stakeholders. They attract investment and create a foundation for sustainable growth. Ethical practices contribute to a positive work environment, attracting and retaining top talent who value integrity.

Devine Consulting understands the challenges businesses face in maintaining financial integrity. Our comprehensive accounting solutions help companies establish robust financial processes and ensure accurate reporting. We support businesses in their commitment to transparency, protecting them from the devastating consequences of unethical financial reporting.