How to Benefit from an Outsourced Financial Controller?

At Devine Consulting, we’ve seen firsthand how businesses can transform their financial operations. One powerful strategy is bringing in an outsourced financial controller.

This approach offers a unique blend of expertise and cost-effectiveness that can significantly impact your bottom line. In this post, we’ll explore how you can leverage an outsourced financial controller to drive your business forward.

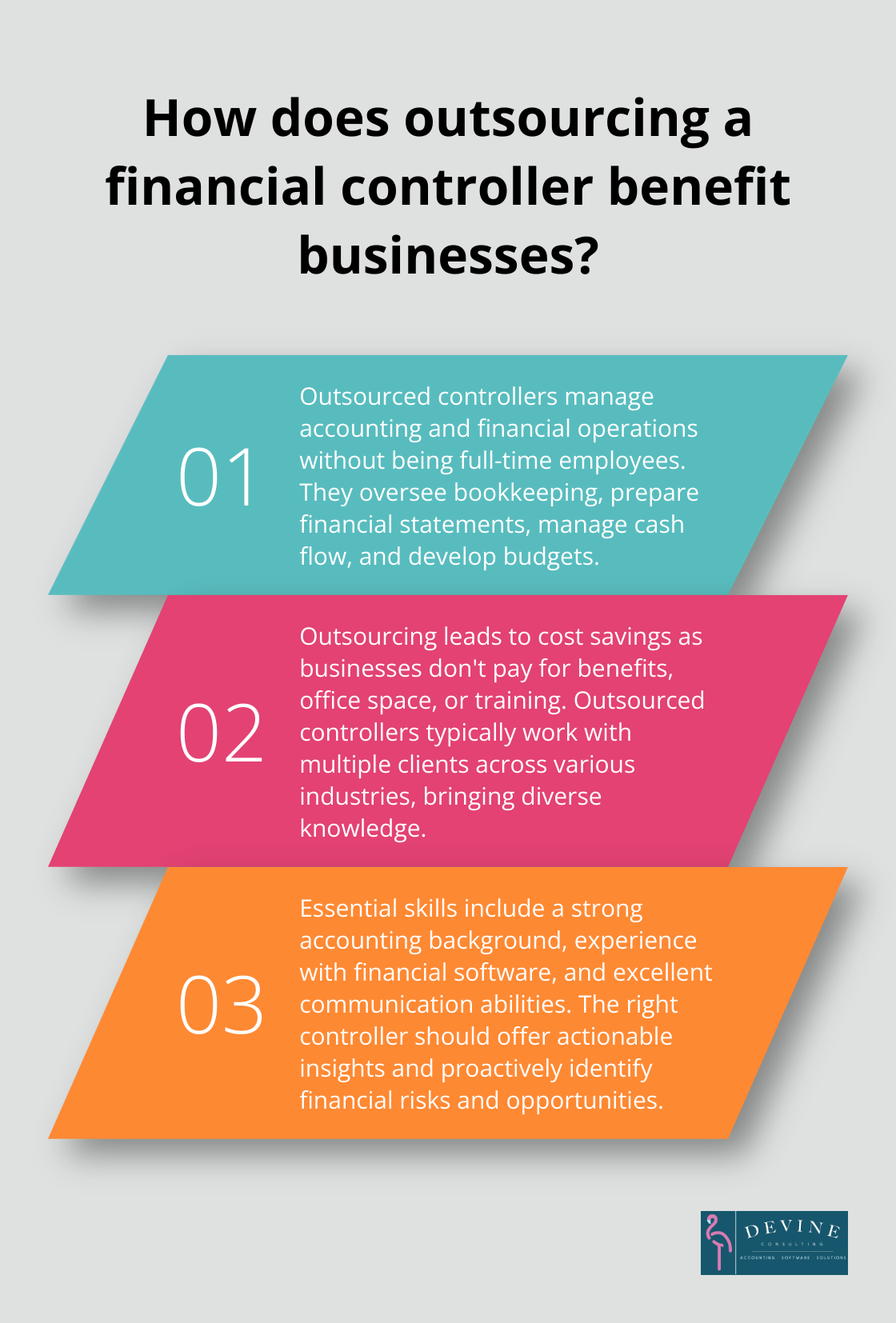

What Does an Outsourced Financial Controller Do?

Core Responsibilities

An outsourced financial controller manages a company’s accounting and financial operations without being a full-time employee. This role can transform a business’s financial management. These professionals oversee bookkeeping, prepare financial statements, manage cash flow, and develop budgets. They also contribute to financial planning, tax compliance, and provide insights for strategic decision-making.

In-House vs. Outsourced Controllers

The main difference between in-house and outsourced controllers lies in their employment status and cost structure. In-house controllers work as full-time employees, while outsourced controllers operate on a contract basis. This arrangement often leads to significant cost savings for businesses (no need to pay for benefits, office space, or training).

Outsourced controllers typically work with multiple clients across various industries, bringing a wealth of diverse knowledge to your business. This exposure to different financial scenarios proves invaluable when tackling complex financial challenges.

Essential Skills and Qualifications

When selecting an outsourced financial controller, certain skills and qualifications are essential:

- Strong accounting and finance background (typically including a CPA certification or equivalent)

- Experience with financial software and data analysis tools

- Excellent communication abilities (explaining complex financial concepts in simple terms)

- Problem-solving skills and attention to detail

- Industry-specific knowledge (e.g., construction or oil and gas sectors)

The right outsourced controller should not just crunch numbers but also offer actionable insights to drive your business forward. They should proactively identify financial risks and opportunities, helping you make informed decisions for sustainable growth.

Benefits of Outsourcing

Outsourcing your financial controller role offers several advantages:

- Cost-effectiveness: Pay only for the services you need

- Flexibility: Scale services up or down based on your business needs

- Diverse experience: Benefit from knowledge gained across multiple industries

- Objective perspective: Get unbiased financial advice and insights

- Focus on core business: Dedicate more time to your primary operations

Choosing the Right Partner

Selecting the right outsourced financial controller is critical for your business’s financial health. Look for a provider with a proven track record in your industry and a comprehensive range of services. For instance, Devine Consulting offers tailored solutions for various sectors, including construction, oil and gas, and real estate.

As you consider the benefits of an outsourced financial controller, it’s important to understand how this role can directly impact your business’s bottom line. Let’s explore the specific advantages that come with hiring an outsourced financial expert.

Why Outsourced Financial Controllers Transform Businesses

Cost Reduction and Flexibility

Outsourced financial controllers offer significant cost advantages. This reduction stems from eliminating overhead costs (such as benefits, office space, and training) and paying only for required services. The flexibility proves particularly valuable for seasonal businesses or those experiencing rapid growth.

Diverse Expertise

Outsourced controllers bring a wealth of experience from various industries. This broad perspective proves invaluable when addressing complex financial challenges. For example, a controller with experience in both tech startups and established manufacturing firms can apply cross-industry insights to optimize your financial strategies.

Enhanced Financial Reporting

An outsourced financial controller elevates your financial analysis and reporting. These professionals utilize advanced tools and methodologies to provide deep insights into your financial health. They identify trends, anticipate potential issues, and facilitate data-driven decision-making. This level of reporting can significantly impact businesses seeking funding or aiming to attract investors.

Strategic Decision Support

Outsourced financial controllers do more than process numbers; they interpret data to guide business strategy. They analyze cash flow patterns to determine optimal expansion timing or pinpoint underperforming areas that require attention. This strategic input can propel a business from stagnation to rapid growth.

Industry-Specific Knowledge

Many outsourced financial controllers specialize in specific sectors. For instance, Devine Consulting offers tailored solutions for industries like construction, oil and gas, and real estate. This specialized knowledge allows for more accurate financial planning and risk assessment within your particular business context.

As businesses continue to recognize the value of outsourced financial expertise, the next step involves understanding how to effectively implement this role within your organization. Let’s explore the practical aspects of integrating an outsourced financial controller into your business operations.

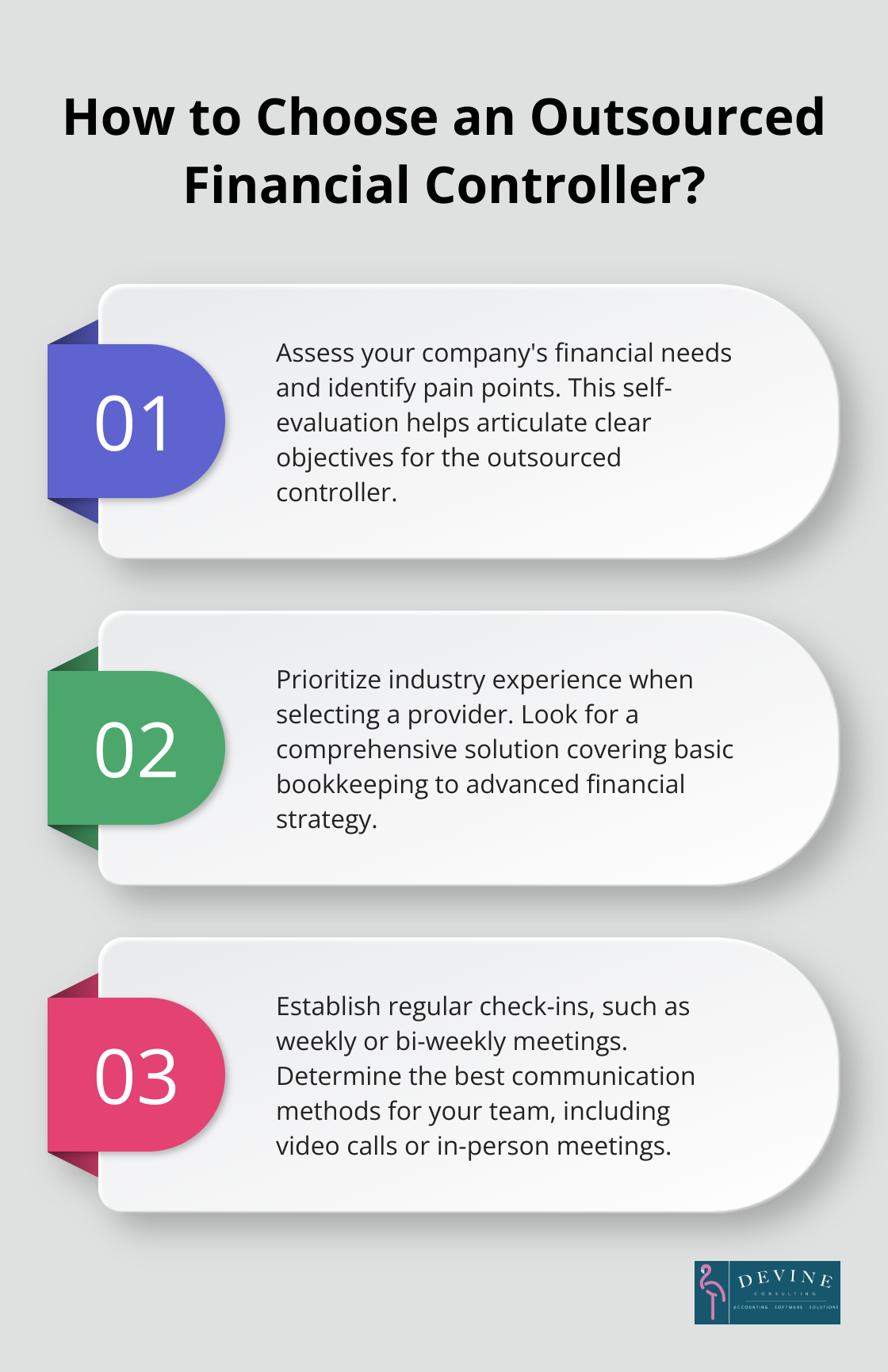

How to Integrate an Outsourced Financial Controller

Assess Your Company’s Financial Needs

The integration of an outsourced financial controller starts with a thorough evaluation of your company’s financial processes. Identify pain points and areas where expert input could drive improvement. This self-evaluation helps you articulate clear objectives for the outsourced controller.

Find the Right Fit

When selecting an outsourced financial controller, prioritize experience in your industry. For example, if you operate in construction, look for a provider with a strong track record in that sector. Consider the range of services offered. A comprehensive solution should cover everything from basic bookkeeping to advanced financial strategy. Ask potential providers about their approach to financial reporting, cash flow management, and strategic planning.

Establish Clear Communication Channels

After choosing a provider, set up regular check-ins to discuss financial performance and address concerns. Many businesses find weekly or bi-weekly meetings effective for staying aligned on financial matters. Determine the best communication methods for your team (video calls, in-person meetings, or a combination of both).

Define Performance Metrics

To ensure the partnership delivers value, specify performance metrics. These could include improvements in financial reporting accuracy, reduction in accounts receivable days, or enhanced budget forecasting. Set realistic timelines for achieving these goals and review progress regularly.

Implement a Financial Dashboard

Consider setting up a financial dashboard that tracks key performance indicators (KPIs) in real-time. This tool provides visibility into your financial health and helps you quickly identify areas needing attention. Your outsourced controller should be able to set up and maintain this dashboard, providing you with actionable insights.

The integration of an outsourced financial controller is a strategic move that can significantly impact your business’s financial health. Through careful assessment, selection, communication, and performance tracking, you’ll position your business to maximize the benefits of this valuable resource.

Final Thoughts

Outsourced financial controllers offer a powerful solution for businesses to optimize their financial operations. Companies can achieve significant cost savings while gaining access to high-level financial insights without the overhead of a full-time employee. This approach enhances financial reporting and analysis, and provides support for strategic decision-making.

The long-term impact of integrating an outsourced financial controller extends far beyond immediate cost savings. Businesses can expect improved financial health through more accurate forecasting, better cash flow management, and enhanced risk mitigation strategies. This financial stability creates a solid foundation for sustainable growth, allowing companies to seize opportunities with confidence.

For businesses considering outsourced financial services, the next step is to evaluate specific needs and find a partner that aligns with industry and goals. Devine Consulting offers tailored solutions for various sectors (including construction, oil and gas, and real estate). Their approach ensures businesses receive not just financial management but also strategic guidance for future planning.