How to Write an Executive Summary for a Finance Report?

At Devine Consulting, we know that crafting an executive summary for a finance report is a critical skill for financial professionals. This concise document serves as the gateway to your financial insights, providing key stakeholders with a quick overview of your report’s most important findings.

In this blog post, we’ll guide you through the process of creating an impactful executive summary for your finance report. We’ll cover essential components, best practices, and tips to ensure your summary effectively communicates your financial analysis to decision-makers.

Why Executive Summaries Matter in Finance Reports

The Gateway to Financial Insights

Executive summaries serve as the entry point to finance reports. They provide key stakeholders with a quick overview of the most important findings. A well-crafted executive summary can determine the impact of a financial report.

Capturing Attention in a Fast-Paced World

An executive summary is not a mere formality; it’s a powerful communication tool. It transforms complex financial data into digestible insights, allowing busy executives to grasp key points quickly. Smart finance executives know that a well-designed, technology-enabled close has significant benefits for the organization.

Addressing Diverse Stakeholder Needs

Different stakeholders have varying information requirements. CEOs often focus on overall financial health, while investors pay close attention to growth metrics. CFOs examine cash flow and profitability ratios in detail. An effective executive summary caters to these diverse needs without overwhelming readers.

The Art of Conciseness and Clarity

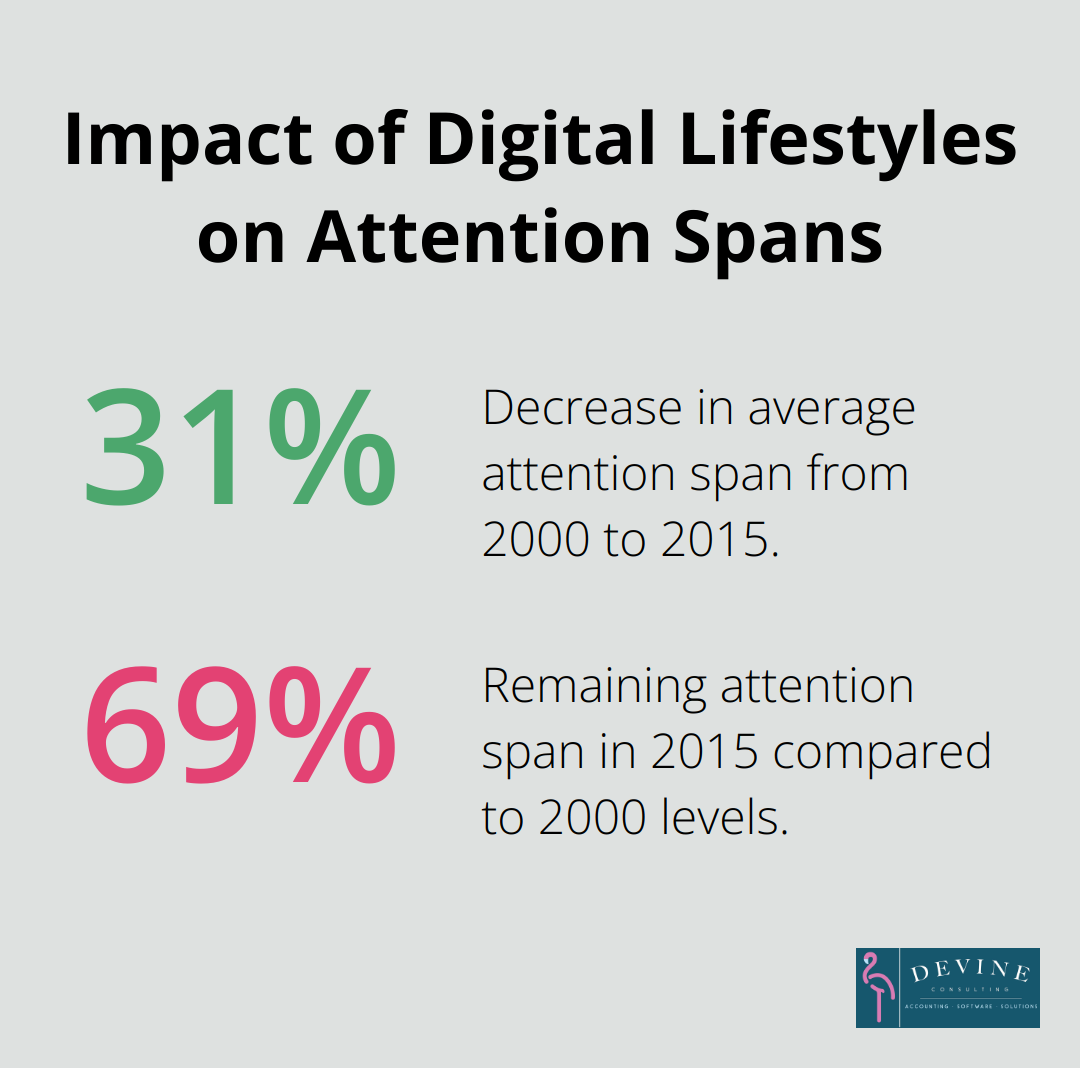

In our current business landscape, time is a scarce resource. Research indicates that increased media consumption and digital lifestyles reduce the ability for consumers to focus for extended periods of time. This fact underscores the importance of conciseness and clarity in your executive summary.

Try to avoid jargon and complex financial terms. Use plain language that anyone can understand. Highlight the most impactful metrics and trends. Your goal is to provide a snapshot (not a detailed analysis) that drives action and facilitates faster decision-making.

Tailoring Your Summary for Maximum Impact

To create an effective executive summary, consider these key points:

- Know your audience (their roles, priorities, and level of financial expertise)

- Highlight the most relevant information for each stakeholder group

- Use visual aids (charts, graphs) to illustrate key trends

- Keep it brief (ideally one to two pages)

- Ensure the summary can stand alone without the full report

As we move forward, we’ll explore the essential components that make up an effective executive summary for finance reports. These elements will help you structure your summary for maximum impact and clarity.

What Makes an Executive Summary Effective?

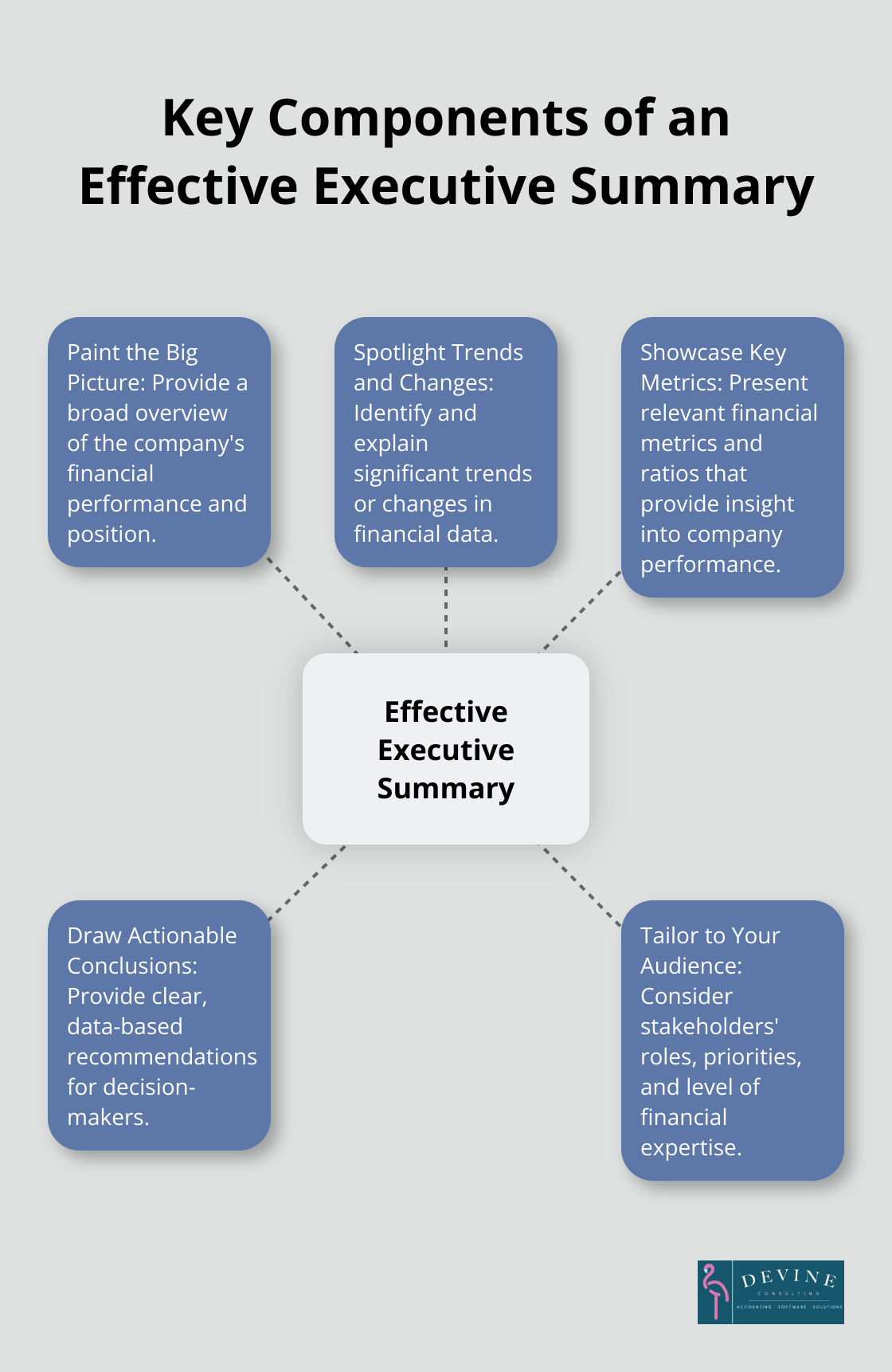

Paint the Big Picture

An effective executive summary for a finance report distills complex financial data into actionable insights. Start your summary with a broad overview of the company’s financial performance and position. This sets the stage for the detailed analysis that follows. For example, you might begin with a statement like “In Q2 2025, our company achieved a 15% year-over-year revenue growth, driven primarily by expansion in the Asian market.”

Spotlight Trends and Changes

Identify and explain significant trends or changes in the financial data. This could include shifts in revenue streams, cost structures, or profitability. For instance, “Our gross margin improved from 30% to 35% due to successful cost-cutting measures in our supply chain.”

Showcase Key Metrics

Present the most relevant financial metrics and ratios that provide insight into the company’s performance. These might include:

- Revenue growth rate

- EBITDA margin

- Return on Equity (ROE)

- Debt-to-Equity ratio

- Current ratio

Choose metrics that align with your company’s strategic goals and industry benchmarks. A McKinsey survey reveals how customer analytics can improve profits and growth.

Draw Actionable Conclusions

Conclude your summary with clear, actionable conclusions and recommendations. Base these on the data presented and provide a roadmap for decision-makers. Effective financial executive summaries typically include several essential components: Revenue and profitability metrics, cash flow analysis, and key performance indicators.

Tailor to Your Audience

Consider your audience (their roles, priorities, and level of financial expertise) when crafting your summary. Highlight the most relevant information for each stakeholder group. Use visual aids (charts, graphs) to illustrate key trends. Try to keep it brief (ideally one to two pages). Ensure the summary can stand alone without the full report.

The goal of your executive summary is to provide a snapshot that drives action and facilitates faster decision-making. Focus on these key components to create a summary that not only informs but also influences strategic decisions. In the next section, we’ll walk you through a step-by-step guide to writing an impactful executive summary for your finance report.

How to Craft a Powerful Executive Summary

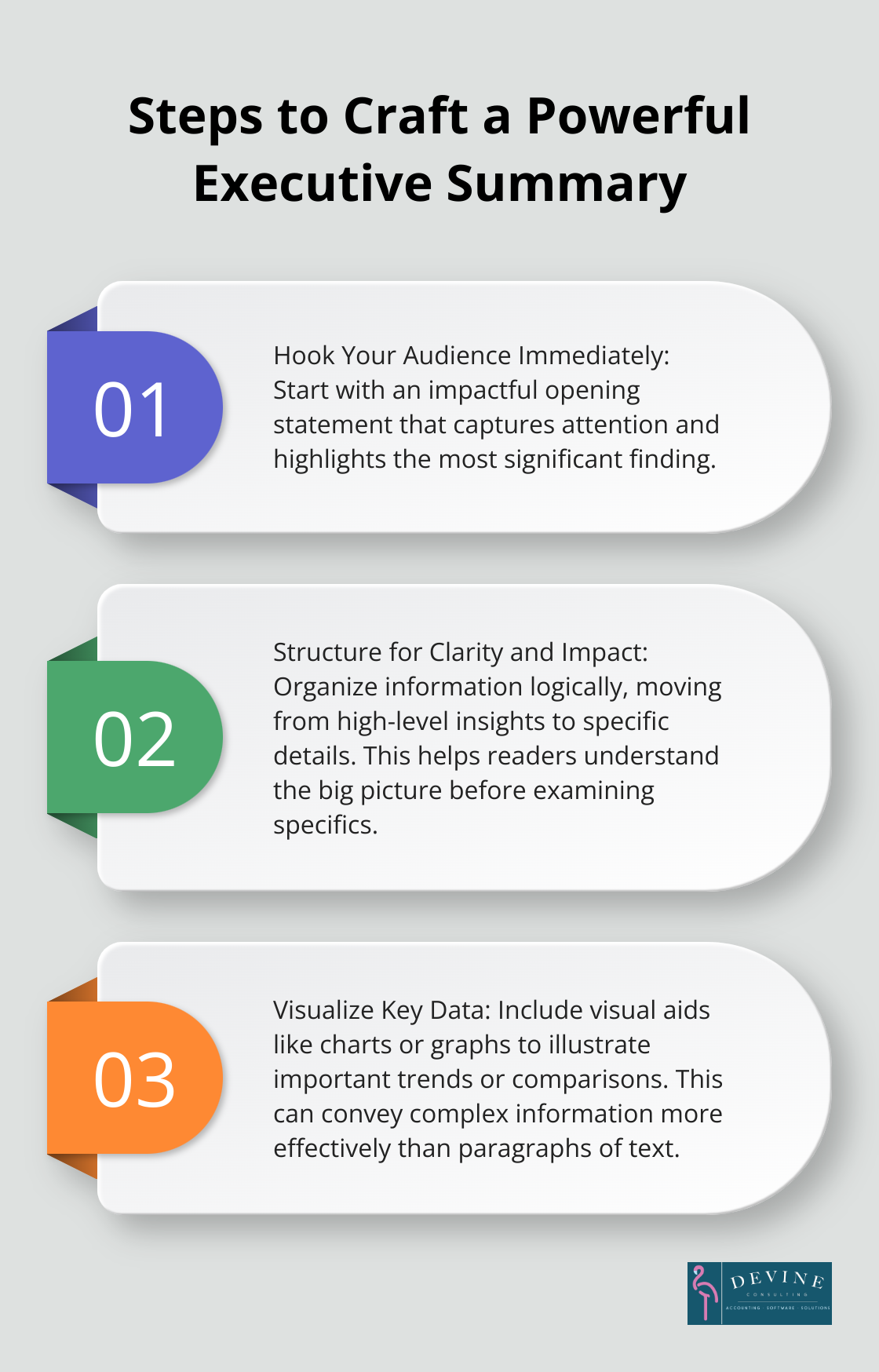

Hook Your Audience Immediately

Start your executive summary with impact. Your opening statement should capture the reader’s attention and highlight the report’s most significant finding. For example, “Q2 revenue surged 30% year-over-year, outpacing industry growth by 15 percentage points.” This approach communicates value instantly and sets the tone for the rest of the summary.

Structure for Clarity and Impact

Organize your information logically. Move from high-level insights to specific details. Start with overall financial performance, then focus on key areas like revenue streams, cost structures, and profitability. This structure helps readers understand the big picture before examining specifics.

C-suite executives prefer summaries that follow a clear, logical structure. This approach allows for quick comprehension and facilitates better decision-making.

Speak Their Language

Avoid financial jargon and complex terms. Use clear, concise language that any stakeholder can understand. For instance, instead of “Our EBITDA margin improved,” say “Our profitability before accounting for taxes and depreciation increased.”

When you must use technical terms, explain them briefly. This ensures all readers, regardless of their financial background, can grasp the key points.

Visualize Key Data

Include visual aids to illustrate important trends or comparisons. A well-designed chart or graph can convey complex information more effectively than paragraphs of text. Consider simple examples such as providing summary statistics, total amount, and average amount alongside tabular data to suggest key insights.

Polish and Perfect

After you draft your summary, take a break. Return with fresh eyes to proofread and refine. Look for ways to tighten your language, eliminate redundancies, and enhance clarity.

Ask a colleague to review your summary. They might spot areas that need clarification or offer valuable suggestions for improvement. This extra step can significantly enhance the quality and effectiveness of your executive summary.

Your executive summary is often the only part of your finance report that busy executives will read. Make every word count. These steps will help you create a summary that not only informs but also influences key decision-makers in your organization.

Final Thoughts

An executive summary for a finance report transforms complex data into clear, actionable insights. This skill empowers stakeholders to make informed decisions quickly. The effectiveness of your summary depends on its clarity, conciseness, and relevance to your specific audience.

Practice improves your ability to create impactful executive summaries. Seek feedback from colleagues and stay updated on financial reporting best practices. Your refined approach will enhance your ability to communicate complex financial information effectively.

We at Devine Consulting offer comprehensive accounting solutions to help businesses achieve financial stability and growth. Our partnership allows you to focus on core operations while we ensure your financial reporting (including executive summaries) meets high standards. Master this skill to become an invaluable asset to your organization.