Accounting and Bookkeeping Essentials: What to Know

At Devine Consulting, we know that understanding bookkeeping and accounting essentials is vital for business success. Many entrepreneurs find these topics daunting, but they’re crucial for making informed financial decisions.

This guide will break down the key concepts, best practices, and compliance requirements you need to know. We’ll also share practical tips to help you streamline your financial processes and avoid common pitfalls.

What Are the Accounting Basics?

The Language of Business

Accounting forms the foundation of business communication. At Devine Consulting, we believe mastering this language is essential for financial success. It’s not just about numbers; it’s about narrating your business’s financial story.

The Pillars of Financial Statements

Financial statements serve as the cornerstone of accounting. The balance sheet reports a company’s financial health through its liquidity and solvency, while the income statement reports its profitability. The cash flow statement tracks money movement in and out of your business (critical for daily operations).

Small business owners must choose among complicated financial decisions daily, whether they are equipped to make these decisions or not.

Cash vs. Accrual: Selecting Your Accounting Method

Two main accounting methods exist: cash and accrual. Cash accounting records income upon receipt and expenses when paid. It’s simple but can distort your financial picture. Accrual accounting, while more complex, offers a more accurate view of financial health by recording transactions when they occur, not just when money changes hands.

Harnessing Real-Time Financial Data

In today’s fast-paced business world, access to real-time financial data is a game-changer. Cloud-based accounting software allows you to view your financial position instantly, not just at month-end or quarter-end. This immediacy enables quicker, more informed decision-making.

The Role of Professional Accounting Services

While understanding accounting basics is valuable, professional services can elevate your financial management. Devine Consulting offers comprehensive solutions tailored for various industries, including construction, oil and gas, and real estate. Our services encompass accurate bookkeeping, financial reporting, and strategic planning, allowing businesses to focus on core operations while achieving financial stability and growth.

As we move forward, let’s explore the best practices in bookkeeping that complement these accounting fundamentals and help maintain financial clarity.

Mastering Bookkeeping Practices

The Foundation of Financial Management

Proper bookkeeping forms the backbone of sound financial management. It’s not just about tracking numbers; it creates a clear financial narrative for your business. Accurate record-keeping can make or break a company’s success.

Organizing Financial Documents

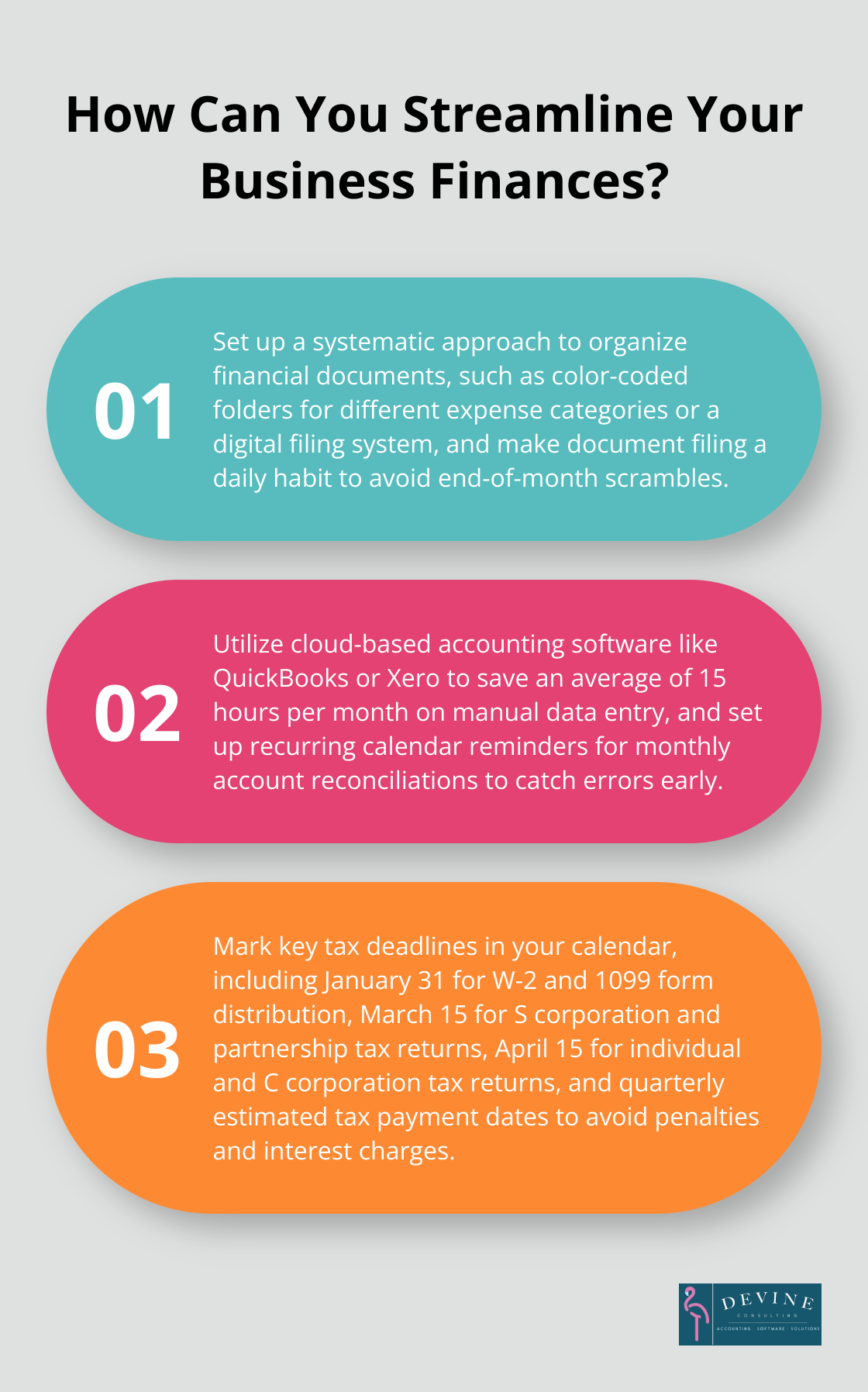

A systematic approach to organizing financial documents is essential. Create a system that works for you, such as color-coded folders for different expense categories or a digital filing system. Consistency is key. Make document filing a daily habit to avoid the end-of-month scramble.

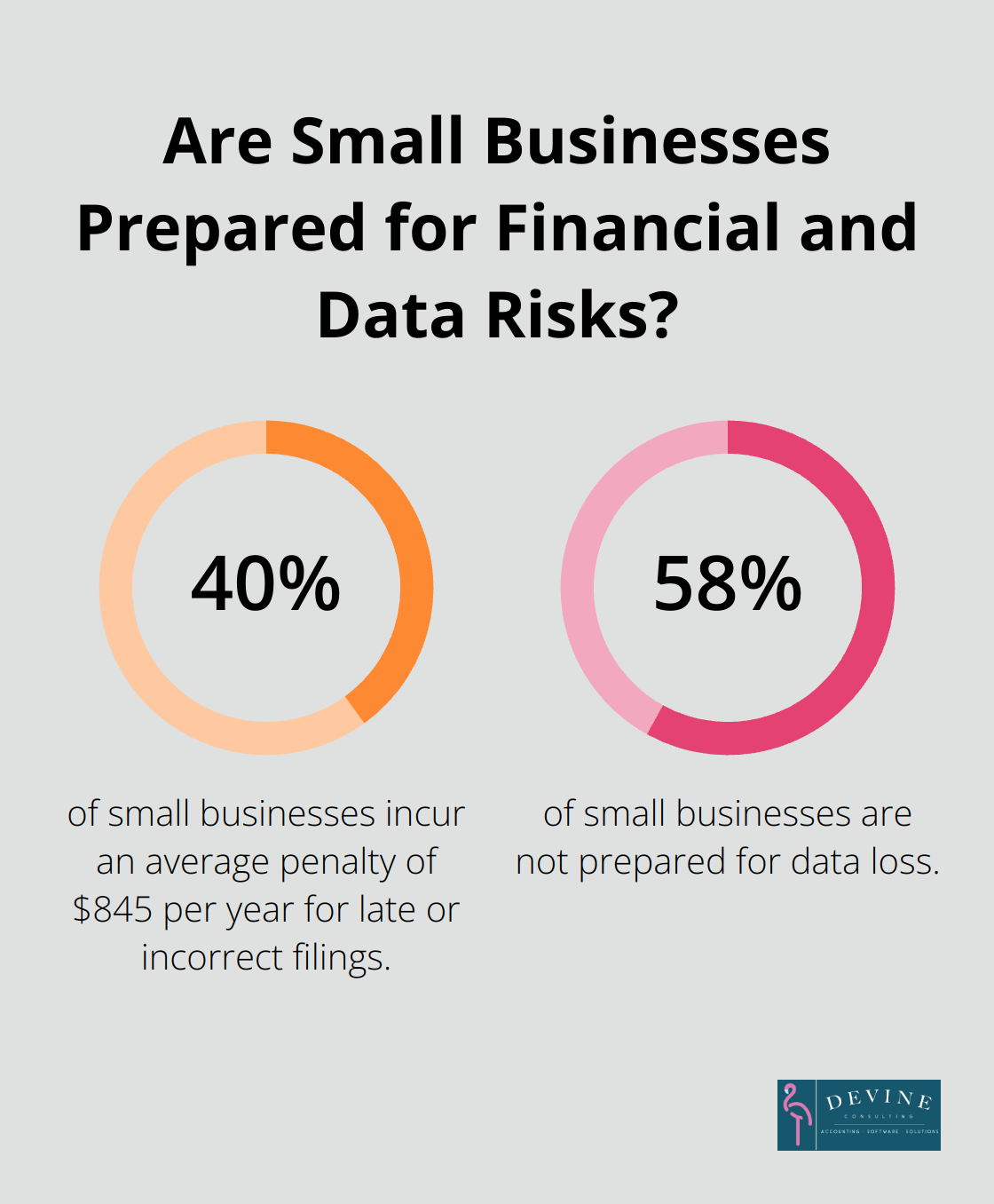

The IRS reports that 40% of small businesses incur an average penalty of $845 per year for late or incorrect filings. Proper organization helps you sidestep these costly mistakes.

Harnessing Technology for Efficiency

Modern bookkeeping software offers powerful tools to streamline your processes. QuickBooks and Xero are popular choices, but the right software depends on your specific business needs and industry. Cloud-based solutions provide real-time access to your financial data from anywhere, offering invaluable flexibility in today’s fast-paced business environment.

A survey by Sage reveals that businesses using cloud accounting software save an average of 15 hours per month on manual data entry. This time savings allows you to focus on strategic business growth.

Avoiding Common Pitfalls

Even with the best intentions, bookkeeping mistakes occur. One frequent error is the mixing of personal and business expenses. This not only complicates your bookkeeping but can also raise red flags during an audit. Always maintain separate accounts for business and personal use.

Another common mistake is the neglect of regular account reconciliations. Monthly reconciliations help catch errors early and provide an accurate picture of your financial health. Set a recurring calendar reminder to ensure this task doesn’t slip through the cracks.

Don’t underestimate the importance of backing up your financial data. A 2023 study by Clutch found that 58% of small businesses are not prepared for data loss. Regular backups to a secure cloud service or an external hard drive can save you from potential disaster.

The Value of Professional Services

While these best practices can significantly improve your bookkeeping processes, many businesses find professional services invaluable. Outsourcing to experts can free up your time to focus on core business operations. Professional bookkeepers bring expertise and efficiency to your financial management, ensuring accuracy and compliance while providing insights for strategic decision-making.

As we move forward, let’s explore the critical aspects of tax compliance and reporting that build upon these solid bookkeeping practices.

Navigating Tax Obligations

The Complexity of Business Taxes

The U.S. tax code presents a labyrinth of requirements that vary based on business structure and industry. Your business structure determines which income tax return form you file. Consider legal and tax issues when selecting a business structure. The IRS reports that approximately 40% of small to mid-sized businesses often face IRS penalties for incorrect payroll filings, with an average penalty amounting to $845. This statistic highlights the need for businesses to understand and meet their specific tax obligations.

Record-Keeping: A Cornerstone of Compliance

Accurate records support income, deductions, and credits reported on tax returns. The IRS mandates that businesses keep these records for at least three years from the filing date or two years from the tax payment date (whichever is later). A robust record-keeping system saves time and reduces stress during tax season. Cloud-based accounting software that integrates with tax preparation tools can streamline the process of gathering necessary information for tax returns.

Critical Tax Deadlines

Missing tax deadlines results in penalties and interest charges. Key dates include:

- January 31: Deadline for W-2 and 1099 form distribution

- March 15: S corporation and partnership tax returns due

- April 15: Individual and C corporation tax returns due (for calendar year filers)

- Quarterly estimated tax payments (typically due April 15, June 15, September 15, and January 15 of the following year)

Setting up automatic reminders for these dates helps ensure timely compliance. Many accounting software packages offer this feature, or a simple calendar app can suffice.

The Value of Professional Tax Services

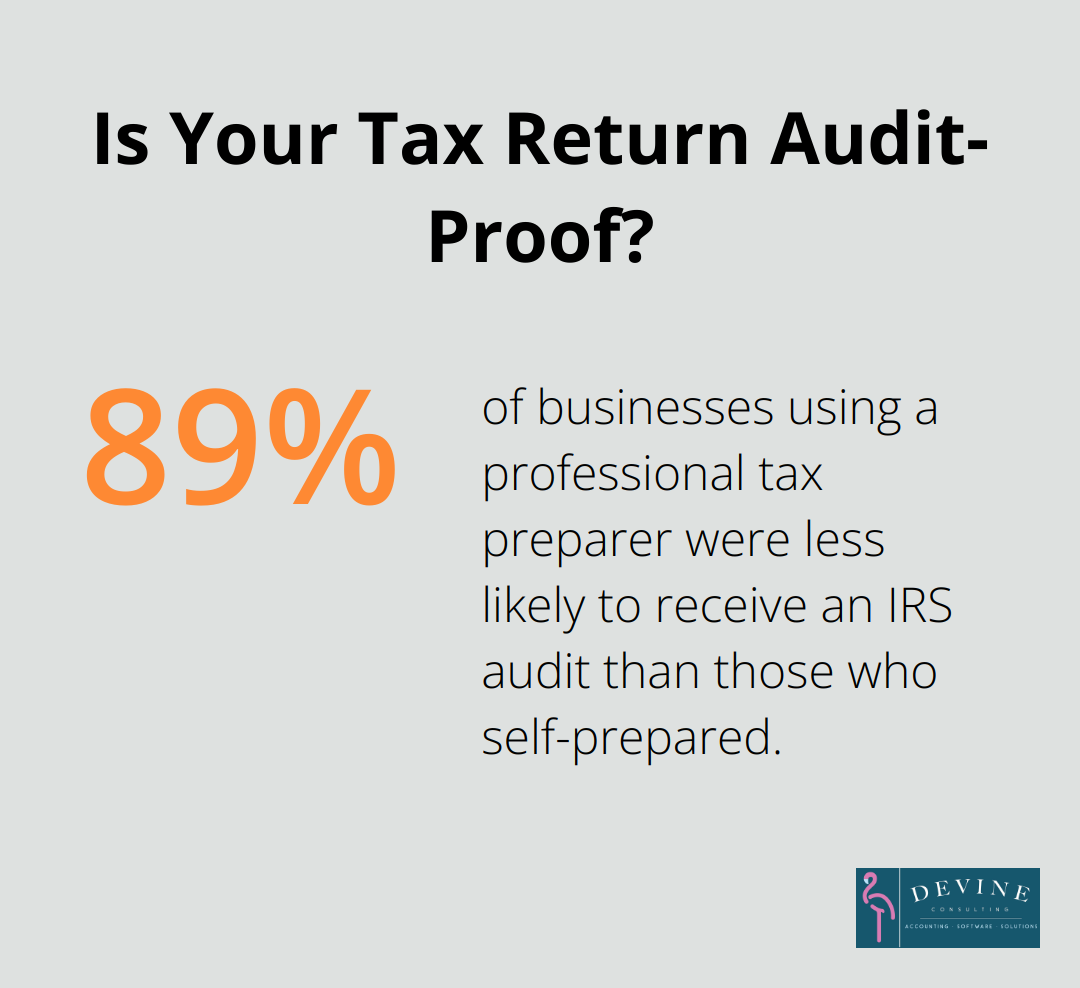

While some businesses manage taxes in-house, professional accountants provide significant benefits. A study by the National Society of Accountants found that businesses using a professional tax preparer were 89% less likely to receive an IRS audit than those who self-prepared. Professional tax services offer more than mere compliance; they provide up-to-date knowledge of tax laws and regulations, ensuring businesses take advantage of all available deductions and credits.

Moreover, outsourcing tax services frees up time for core business activities. The same study found that the average taxpayer spends 13 hours preparing and filing their tax return. This time could be reinvested into business growth and development.

Choosing the Right Tax Professional

When selecting a tax professional, consider their expertise in your specific industry. For instance, Devine Consulting offers comprehensive tax services tailored to various industries, including construction, oil and gas, and real estate. Their team stays current with the latest tax laws, helping businesses develop strategies that align with their goals and potentially save money in the long run.

Final Thoughts

Bookkeeping and accounting essentials form the foundation of business success. Understanding financial statements, selecting the right accounting method, and implementing effective practices provide clarity for strategic decisions. Professional accounting services can significantly enhance financial management, especially as businesses grow and face more complex challenges.

Devine Consulting offers comprehensive solutions tailored to various industries (including construction, oil and gas, and real estate). Their expertise in accurate bookkeeping, financial reporting, and strategic planning allows businesses to focus on core operations. Outsourcing financial management to experts provides access to up-to-date knowledge of tax laws and industry-specific insights.

Professional accounting services can lead to cost savings, improved efficiency, and valuable strategic support. In today’s fast-paced business environment, a trusted partner to manage finances can make the difference between struggling and thriving. Investing in professional accounting services can provide the financial clarity and strategic guidance needed to achieve business goals.