Accounting Essentials for Construction Contractors

Construction contractors face unique financial challenges that require specialized accounting knowledge. From managing complex job costing to navigating intricate tax regulations, the financial landscape in this industry is far from straightforward.

At Devine Consulting, we’ve seen firsthand how proper accounting for construction contractors can make or break a business. This guide will explore the essential accounting principles and practices that every contractor needs to master for long-term success.

What Makes Construction Accounting Unique?

Project-Based Financial Management

Construction accounting differs significantly from standard business accounting. It focuses on tracking costs and revenues for each project individually. This approach presents unique challenges for contractors.

Each project in construction operates as its own mini-business. Contractors must track expenses, revenues, and profits separately for every job. This level of detail allows contractors to understand which projects are profitable and which are not.

For instance, a contractor working on multiple housing developments needs to know the exact expenditure on materials, labor, and overhead for each site. Without this detailed view, accurate pricing for future projects becomes impossible, and identifying areas for cost-saving remains elusive.

Long-Term Contracts and Revenue Recognition

Construction projects often extend over months or years. This extended timeline complicates financial reporting and cash flow management. Contractors must select appropriate revenue recognition methods to accurately reflect their financial position.

The percentage-of-completion method is common in the industry. This method requires the reporting of revenues and expenses on a period-by-period basis, as determined by the percentage of completion of the contract.

Variable Costs and Change Orders

Construction costs can fluctuate dramatically due to factors like material price changes, weather delays, or unexpected site conditions. Add frequent change orders (modifications to the original contract), and financial complexity increases exponentially.

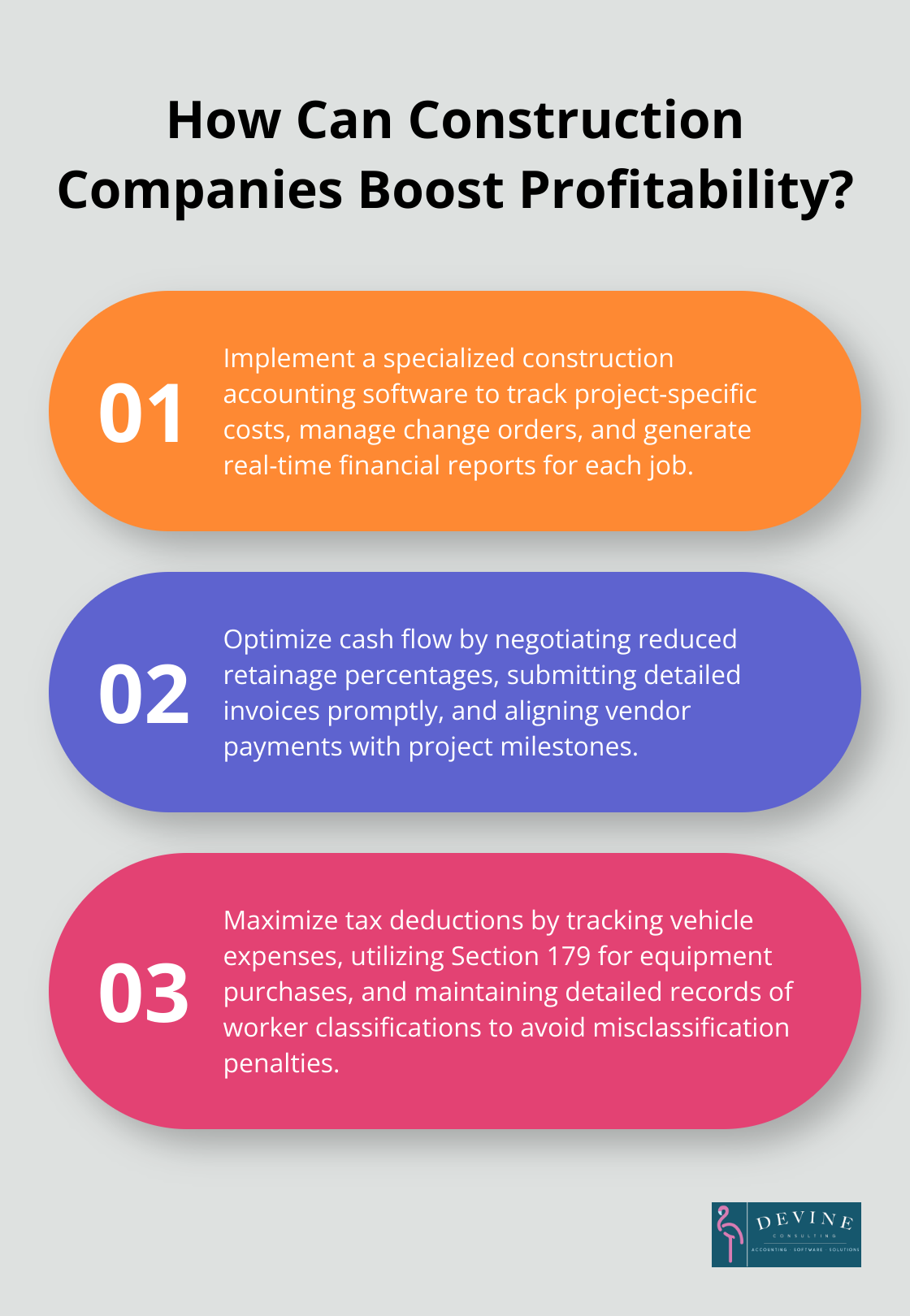

Accurate tracking of these variables is essential. Specialized construction accounting software can handle change orders and cost variations in real-time. This allows contractors to adjust their financial projections quickly and communicate changes to clients effectively.

The Importance of Job Costing

Job costing forms the backbone of construction accounting. It involves assigning all costs (direct and indirect) to specific projects. This includes materials, labor, equipment, and overhead expenses.

Effective job costing allows contractors to:

- Estimate future projects accurately

- Identify cost overruns early

- Make informed decisions about resource allocation

- Determine true project profitability

For example, a contractor might discover through job costing that they consistently underestimate labor costs for foundation work. This insight allows them to adjust future bids and potentially save thousands of dollars.

Key Financial Statements for Contractors

While contractors use many of the same financial statements as other businesses, some industry-specific reports are essential:

- Work-in-Progress (WIP) Report: Shows the financial status of all ongoing projects, including costs incurred, estimated costs to complete, and projected profit or loss.

- Job Cost Report: Provides a detailed breakdown of all costs associated with each project.

- Cash Flow Projection: Given the irregular payment schedules in construction, this report is vital for managing liquidity.

- Backlog Report: Shows the value of contracted work that has not yet started, helping with resource planning and future revenue projections.

Understanding these reports is essential for making informed business decisions. Many contractors find that working with a specialized accounting firm can help them interpret these reports and use them to drive strategic decisions.

As we move forward, it’s clear that managing cash flow in construction projects presents its own set of challenges. Let’s explore how contractors can effectively navigate this critical aspect of financial management.

How Contractors Can Master Cash Flow Management

The Challenge of Construction Cash Flow

Construction projects present unique cash flow patterns. Poor cash flow management can devastate even the most promising contractors. Effective strategies and tools can help contractors navigate this critical aspect of financial management.

Accurate Forecasting: The Foundation of Cash Flow Management

Precise forecasting forms the cornerstone of effective cash flow management. Contractors should create detailed cash flow projections for each project. These projections should factor in expected inflows and outflows on a weekly or monthly basis. This granular approach allows contractors to anticipate cash crunches and surpluses better.

A study by the Construction Financial Management Association reveals that contractors who regularly update their cash flow forecasts are 30% more likely to complete projects on budget. This statistic highlights the importance of maintaining current financial projections.

Optimizing Progress Payments and Retainage

Progress payments fuel construction projects, but they can also cause cash flow problems. To optimize this process, contractors should:

- Define payment terms clearly in contracts

- Submit detailed and timely invoices

- Follow up promptly on overdue payments

Retainage (typically 5-10% of the contract value) can significantly impact cash flow. To mitigate its effects, contractors can negotiate reduced retainage percentages or early release clauses for completed portions of the project.

Technology: A Game-Changer for Financial Control

Modern construction accounting software can revolutionize cash flow management. These tools offer real-time visibility into project finances, automate invoicing processes, and provide accurate forecasting capabilities.

For example, financial management software can reduce invoicing time by up to 50%, freeing up resources for more strategic financial planning. While many software options exist, companies like Devine Consulting offer tailored accounting services that combine cutting-edge technology with personalized expertise to transform financial management processes.

Strategic Vendor Management

Proactive management of accounts payable can significantly improve cash flow. Contractors should negotiate favorable payment terms with suppliers, taking advantage of early payment discounts when cash flow allows. Some contractors have found success in aligning vendor payments with project milestones, ensuring smoother cash flow throughout the project lifecycle.

With these strategies in place, contractors can take control of their cash flow. However, managing finances is only one piece of the puzzle. The next critical area for contractors to understand is the complex world of construction taxes.

How Construction Contractors Can Optimize Their Tax Strategy

Maximizing Deductions in Construction

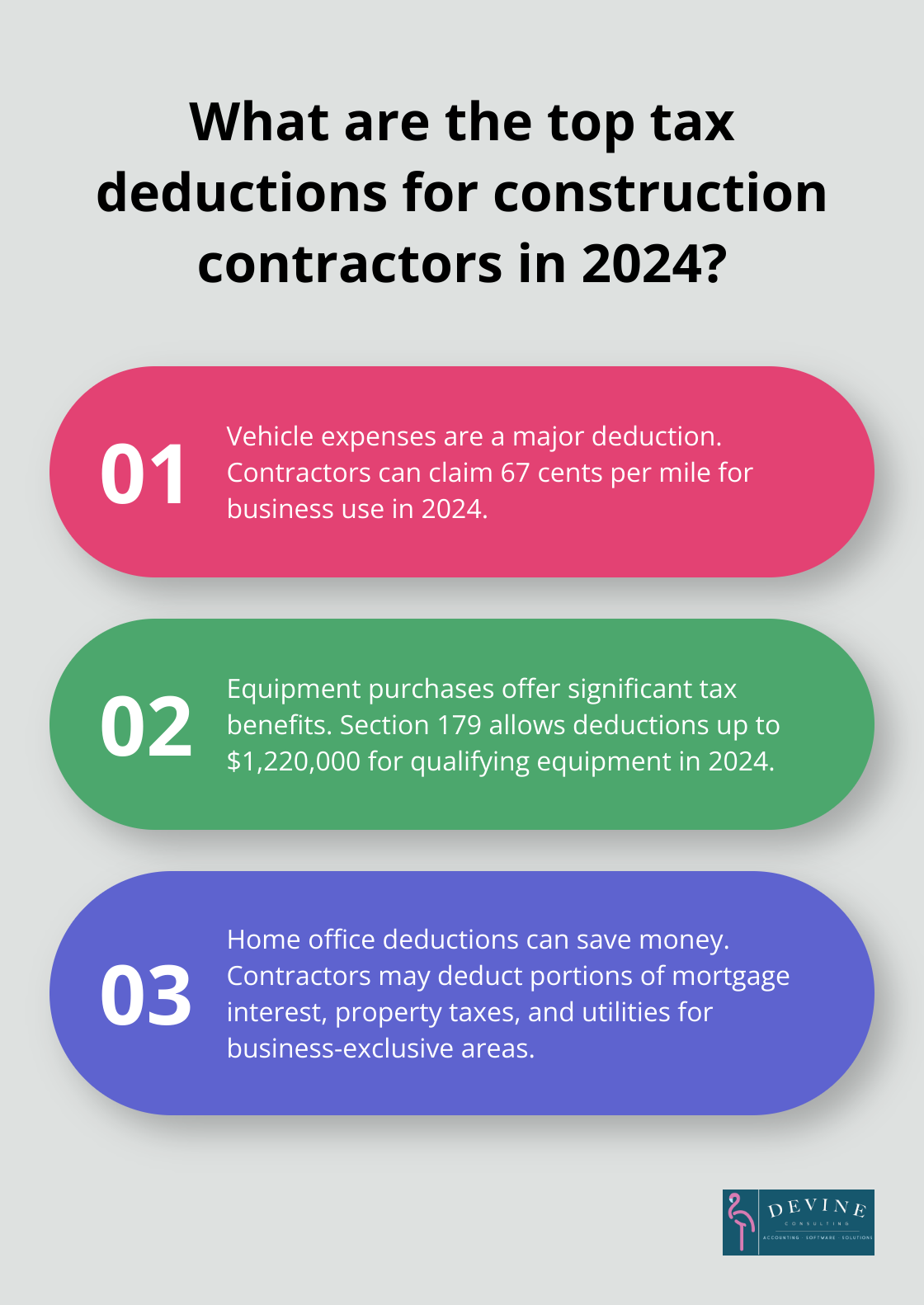

Construction contractors have numerous tax deduction opportunities. Vehicle expenses often represent a substantial deduction. The IRS allows either actual expenses or a standard mileage rate (67 cents per mile for business use in 2024).

Equipment purchases can yield significant tax benefits. Section 179 of the tax code allows contractors to deduct the full purchase price of qualifying equipment in the year it’s put into service (capped at $1,220,000 for 2024).

Home office deductions can also save contractors money. If a part of your home is used exclusively for business, you may deduct a portion of your mortgage interest, property taxes, and utilities.

Tackling Sales Tax Complexities

Sales tax in construction varies by state and often by municipality. In some areas, contractors pay sales tax on materials they purchase, while in others, they collect sales tax from customers.

For example, Texas contractors pay sales tax on materials used in construction projects but don’t collect sales tax on labor charges. Florida contractors, however, must collect sales tax on the entire job (both materials and labor) for residential projects.

Many contractors use specialized software to track sales tax obligations across different jurisdictions. This approach helps ensure compliance with local regulations.

Managing Payroll Taxes in Construction

Payroll taxes present unique challenges in construction due to factors like prevailing wage laws and multi-state projects. The Davis-Bacon Act requires contractors on federally funded projects to pay prevailing wages, which complicates payroll calculations.

For multi-state projects, contractors must know different state tax withholding requirements. Some states have reciprocity agreements, while others require withholding from the first day of work.

Worker misclassification is a common pitfall. The IRS scrutinizes worker classification closely, and misclassifying employees as independent contractors can result in hefty penalties. Employers found in violation may incur massive penalties, including unpaid overtime costs and minimum wage deficits – plus liquidated damages equal to unpaid wages.

Contractors should keep detailed records of worker classifications and job duties to support their decisions in case of an audit. A robust time-tracking system can help ensure accurate payroll tax calculations and compliance with labor laws.

Staying Current with Tax Regulations

Tax regulations change frequently, and contractors must stay informed. Subscribe to industry publications, attend seminars, and consult with tax professionals who specialize in construction accounting.

Devine Consulting offers expert guidance on construction tax strategies, helping contractors navigate complex regulations and maximize their tax benefits. Their team stays up-to-date with the latest tax laws, ensuring clients receive the most current and beneficial advice.

Planning for the Long Term

Effective tax planning extends beyond the current year. Contractors should consider long-term strategies such as retirement planning, succession planning, and entity structure optimization.

For example, setting up a self-employed 401(k) or a Simplified Employee Pension (SEP) IRA can provide significant tax advantages while also securing your financial future.

Regular consultations with tax professionals who understand the nuances of the construction industry can lead to substantial savings and peace of mind. (Devine Consulting specializes in providing this tailored advice to construction contractors.)

Final Thoughts

Accounting for construction contractors demands specialized knowledge and expertise. Contractors must master project-based finances, job costing, cash flow management, and complex tax regulations to maintain financial health. Professional accounting support proves invaluable for contractors who want to thrive in this competitive industry.

Expert guidance optimizes financial processes, ensures compliance with regulations, and provides strategic insights for growth. Devine Consulting offers comprehensive accounting solutions tailored for construction contractors. Our team understands the unique challenges of the industry and provides services from accurate bookkeeping to strategic financial planning.

A trusted partner can make a significant difference in today’s complex financial landscape. We empower contractors to make informed decisions, maximize profitability, and navigate the intricacies of construction accounting with confidence. Our support helps construction businesses build a solid financial foundation that supports their growth and success.