Bookkeeping Essentials: A Guide for Small Business Owners

Bookkeeping essentials are the backbone of any successful small business. At Devine Consulting, we’ve seen firsthand how proper financial management can make or break a company.

This guide will walk you through the fundamentals of bookkeeping, from basic practices to leveraging technology for efficiency. Whether you’re a seasoned entrepreneur or just starting out, mastering these skills will help you make informed decisions and drive your business forward.

What Is Bookkeeping and Why Does It Matter?

The Foundation of Financial Management

Bookkeeping is a crucial aspect of running a small business. It involves the systematic recording, organizing, and tracking of all financial transactions within a company. This process creates a clear financial narrative that empowers business owners to make informed decisions and drive their enterprises forward.

Key Financial Statements: Your Business’s Financial Story

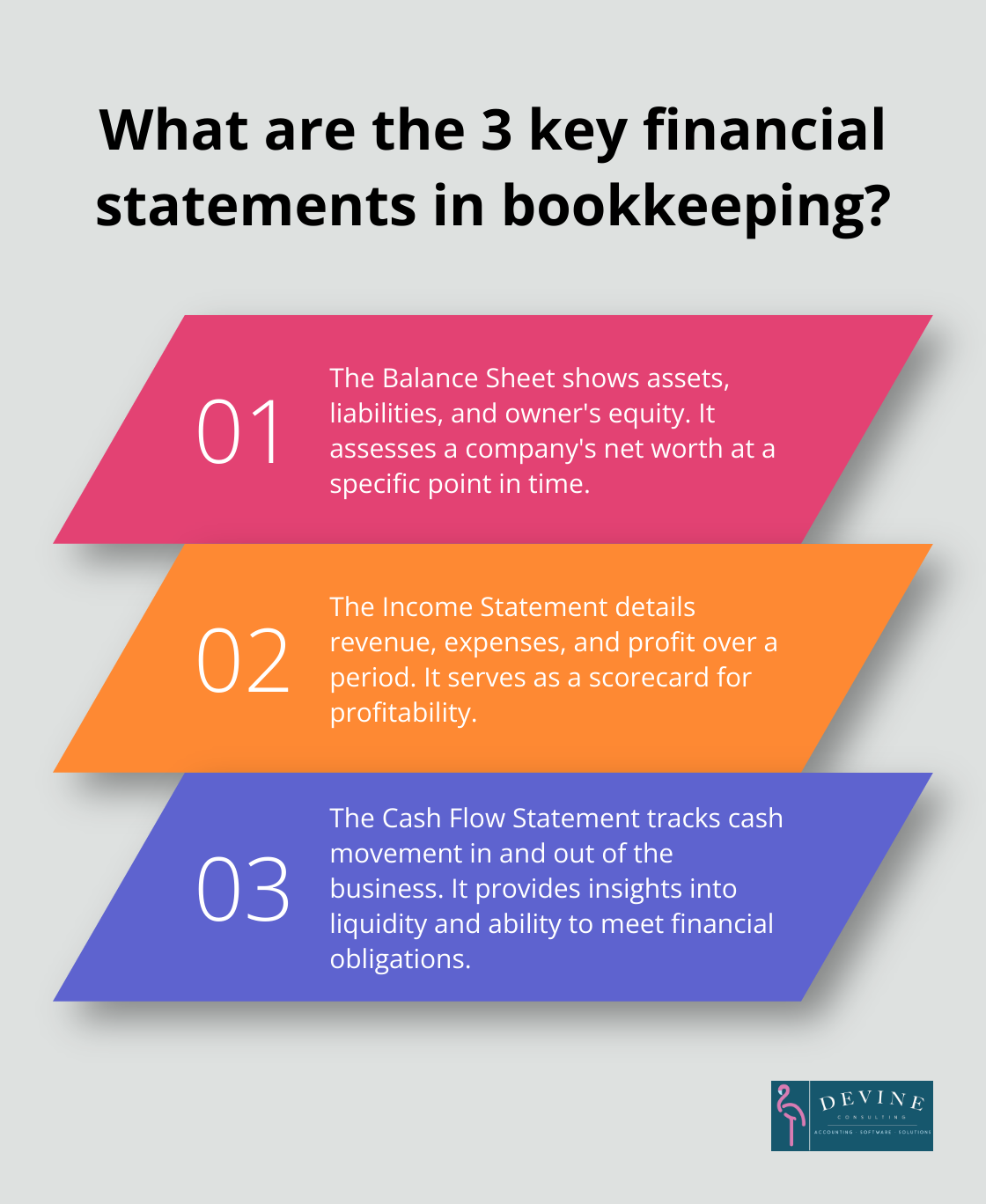

Bookkeeping produces three essential financial statements that provide a comprehensive view of a company’s financial health:

- The Balance Sheet: This statement offers a snapshot of what a business owns (assets), owes (liabilities), and the owner’s equity at a specific point in time. It’s instrumental in assessing a company’s net worth.

- The Income Statement: Also known as the Profit and Loss Statement, this report details revenue, expenses, and profit over a defined period. It serves as a scorecard for profitability.

- The Cash Flow Statement: This document tracks the movement of cash in and out of the business, offering insights into liquidity and the ability to meet financial obligations and invest in growth opportunities.

Essential Bookkeeping Terminology

To navigate the world of bookkeeping effectively, business owners should familiarize themselves with key terms:

- Accounts Receivable: Money customers owe to the business

- Accounts Payable: Money the business owes to suppliers or creditors

- General Ledger: The master record of all financial transactions

- Chart of Accounts: A comprehensive list of accounts used to categorize transactions

Real-World Impact of Effective Bookkeeping

Accurate bookkeeping extends far beyond mere compliance; it serves as a powerful tool for strategic decision-making. Informed decisions about areas for improvement can lead to a more competitive and profitable business. It also plays a crucial role in business valuation and exit strategy planning.

These examples underscore the transformative power of robust bookkeeping practices. As we move forward, we’ll explore the essential bookkeeping practices that can help small business owners establish a solid financial foundation for their enterprises.

How to Master Essential Bookkeeping Practices

Separate Your Finances

The first step in effective bookkeeping is to separate your personal and business finances. Open a dedicated business bank account and use it exclusively for business transactions. This separation not only simplifies your bookkeeping but also protects your personal assets. A survey by Clutch found that 27% of small business owners don’t separate their personal and business finances, potentially exposing themselves to legal and financial risks.

Choose Your Accounting Method Wisely

Deciding between cash and accrual accounting is important. Cash accounting records transactions when money changes hands, while accrual accounting records them when they’re incurred. For most small businesses, cash accounting is simpler and more intuitive. However, as your business grows, accrual accounting provides a more accurate picture of your financial health. The IRS requires businesses with annual gross receipts exceeding $26 million to use accrual accounting.

Implement a Robust Record-Keeping System

Accurate and organized financial records form the backbone of effective bookkeeping. Invest in reliable accounting software that suits your business needs. QuickBooks Online is a popular option that offers in-depth contact records and transaction forms, excellent inventory management, and time tracking features. It’s also considered the best for multiple users, making it suitable for growing businesses.

Track Every Penny

Effective expense and income tracking is vital for understanding your business’s financial health. Use your accounting software to categorize all transactions properly. Set up a system to capture receipts digitally – apps like Expensify or Receipt Bank can prove invaluable here. For income, ensure you issue invoices promptly and follow up on overdue payments. Late payments can severely impact your cash flow – a study by Fundbox found that 79% of small business owners can’t pay themselves due to late payments.

Regular Reconciliation is Key

Bank reconciliation is essential for catching errors and preventing fraud. It helps you know your accounts receivables, payables, and available cash reserve, thereby helping you plan your expenses well. Set aside time each month to compare your bank statements with your bookkeeping records. Many accounting software options offer automated reconciliation features, making this process much less time-consuming. Regular reconciliation can help you identify discrepancies early, saving you from potential financial headaches down the line.

Implementing these practices will significantly improve your business’s financial management. However, if you find yourself overwhelmed, consider outsourcing your bookkeeping to experts. Devine Consulting offers comprehensive accounting solutions tailored for various industries, ensuring businesses can focus on core operations while achieving financial stability and growth. Their full-service approach (represented by their mascot FRANK the Flamingo) emphasizes fun, reliability, accessibility, nurturing, and knowledge.

As we move forward, we’ll explore how technology can further enhance your bookkeeping processes, making them more efficient and accurate.

How Technology Revolutionizes Your Bookkeeping

The Digital Transformation of Financial Management

In today’s digital age, technology transforms bookkeeping from a time-consuming chore to a streamlined process that provides valuable insights. The right tech tools can significantly improve a business’s financial management efficiency and accuracy.

Cloud-Based Accounting Systems: A Game-Changer

Cloud-based accounting software has revolutionized bookkeeping for small businesses. These systems offer real-time access to financial data from anywhere, anytime. This accessibility proves essential for business owners who need to make quick decisions based on up-to-date information. Cloud accounting cuts down on costs and makes managing finances easier. It automates tasks like invoicing and report generation.

Popular options like QuickBooks Online, Xero, and FreshBooks offer features tailored to small businesses. These platforms typically include invoicing, expense tracking, and financial reporting capabilities. They also often integrate with bank feeds, automatically importing and categorizing transactions, which significantly reduces manual data entry.

Automation: Streamlining Repetitive Tasks

Automation stands as a key factor in efficient bookkeeping. Many cloud-based systems can automate repetitive tasks such as data entry, invoice creation, and even payment reminders. Research indicates that about 60% of small businesses struggle with organizing their financial documents, which can lead to costly mistakes.

Receipt scanning apps like Receipt Bank or Expensify automatically extract data from receipts and bills, categorize expenses, and sync with your accounting software. This not only saves time but also improves accuracy by reducing human error.

Integration: Creating a Seamless Financial Ecosystem

The true power of bookkeeping technology lies in its ability to integrate with other business systems. For example, e-commerce platforms like Shopify can directly sync sales data with accounting software, eliminating the need for manual sales entry. Similarly, payroll systems can integrate with bookkeeping software to automatically record payroll expenses and liabilities.

This integration not only saves time but also provides a more holistic view of your business finances.

Expert Support: Maximizing Technology’s Potential

While technology can significantly streamline bookkeeping processes, it doesn’t completely replace human expertise. The insights and strategic planning that come from understanding your financial data remain essential. Partnering with financial experts (like Devine Consulting) can make a real difference in turning your bookkeeping data into actionable business strategies.

Devine Consulting specializes in setting up these integrated systems for clients, ensuring that their financial data flows seamlessly across all platforms. Their expertise in various industries allows them to recommend and implement the most effective tech solutions for each unique business need.

Final Thoughts

Mastering bookkeeping essentials forms the cornerstone of small business success. Accurate financial records empower entrepreneurs to make informed decisions, identify growth opportunities, and navigate challenges with confidence. These practices provide a clear picture of a business’s financial health, ensuring compliance with tax regulations and facilitating smoother operations.

Technology has revolutionized bookkeeping, making it more accessible and efficient for small business owners. Cloud-based accounting systems, automation tools, and integrated platforms streamline financial management processes. However, expert guidance can elevate financial management to new heights, especially when dealing with complex financial situations or industry-specific requirements.

Devine Consulting offers comprehensive accounting solutions tailored to various industries. Our full-service approach (represented by FRANK the Flamingo) emphasizes fun, reliability, accessibility, nurturing, and knowledge. We help businesses focus on core operations while achieving financial stability and growth.