How Can Virtual Bookkeeping Services Benefit Construction Companies?

Construction companies face unique financial challenges. From project-based accounting to fluctuating cash flows, managing finances in this industry can be complex.

At Devine Consulting, we’ve seen how virtual bookkeeping services for construction companies can transform financial management. These services offer a cost-effective solution that improves accuracy and allows businesses to focus on their core activities.

How Virtual Bookkeeping Cuts Costs for Construction Companies

Virtual bookkeeping services revolutionize financial management for construction companies. These services offer a cost-effective solution that improves accuracy and allows businesses to concentrate on their core activities.

Dramatic Reduction in Overhead Expenses

Virtual bookkeeping slashes overhead costs significantly. Construction companies can save big on bookkeeping expenses by eliminating the need for full-time, in-house staff. This includes savings on office space, employee benefits, and overhead. A study by Deloitte found that businesses outsourcing their accounting functions reported an average cost savings of 40% compared to maintaining an in-house team.

Flexible Scaling to Match Project Demands

Construction projects often have fluctuating financial needs. Virtual bookkeeping services allow companies to adjust their financial support based on project demands. This flexibility means you only pay for the services you need, when you need them. During peak seasons, you can easily increase support without the long-term commitment of hiring additional staff. In slower periods, you can reduce services without the complications of layoffs.

Expert Knowledge at a Fraction of the Cost

Access to specialized construction accounting expertise often comes with a hefty price tag when hiring full-time professionals. Virtual bookkeeping services provide this expertise at a much lower cost. These services employ professionals well-versed in construction-specific accounting practices (such as job costing, progress billing, and compliance with industry regulations). This specialized knowledge ensures accurate financial management without the ongoing expense of a high-salary position.

Improved Cash Flow Management

Virtual bookkeeping services offer real-time financial insights, which lead to better cash flow management. Construction companies can make informed decisions quickly, reducing the risk of cash flow problems that often plague the industry. With up-to-date financial data at their fingertips, managers can optimize payment schedules, manage expenses more effectively, and maintain a healthy cash reserve.

Enhanced Financial Reporting and Analysis

Virtual bookkeepers use advanced software to generate comprehensive financial reports. These reports provide valuable insights into project profitability, cost trends, and overall financial health. Construction companies can use this information to identify areas for improvement, make data-driven decisions, and plan for future growth. The ability to access these reports anytime, anywhere (thanks to cloud-based systems) further enhances the decision-making process.

As we move forward, let’s explore how virtual bookkeeping services not only cut costs but also improve accuracy and compliance in construction accounting.

How Virtual Bookkeeping Enhances Accuracy in Construction Accounting

Specialized Expertise in Construction-Specific Practices

Virtual bookkeeping services excel in construction accounting due to their specialized knowledge. These services employ professionals who understand the unique challenges of the industry. They handle complex issues such as progress billing, change orders, and retainage with precision.

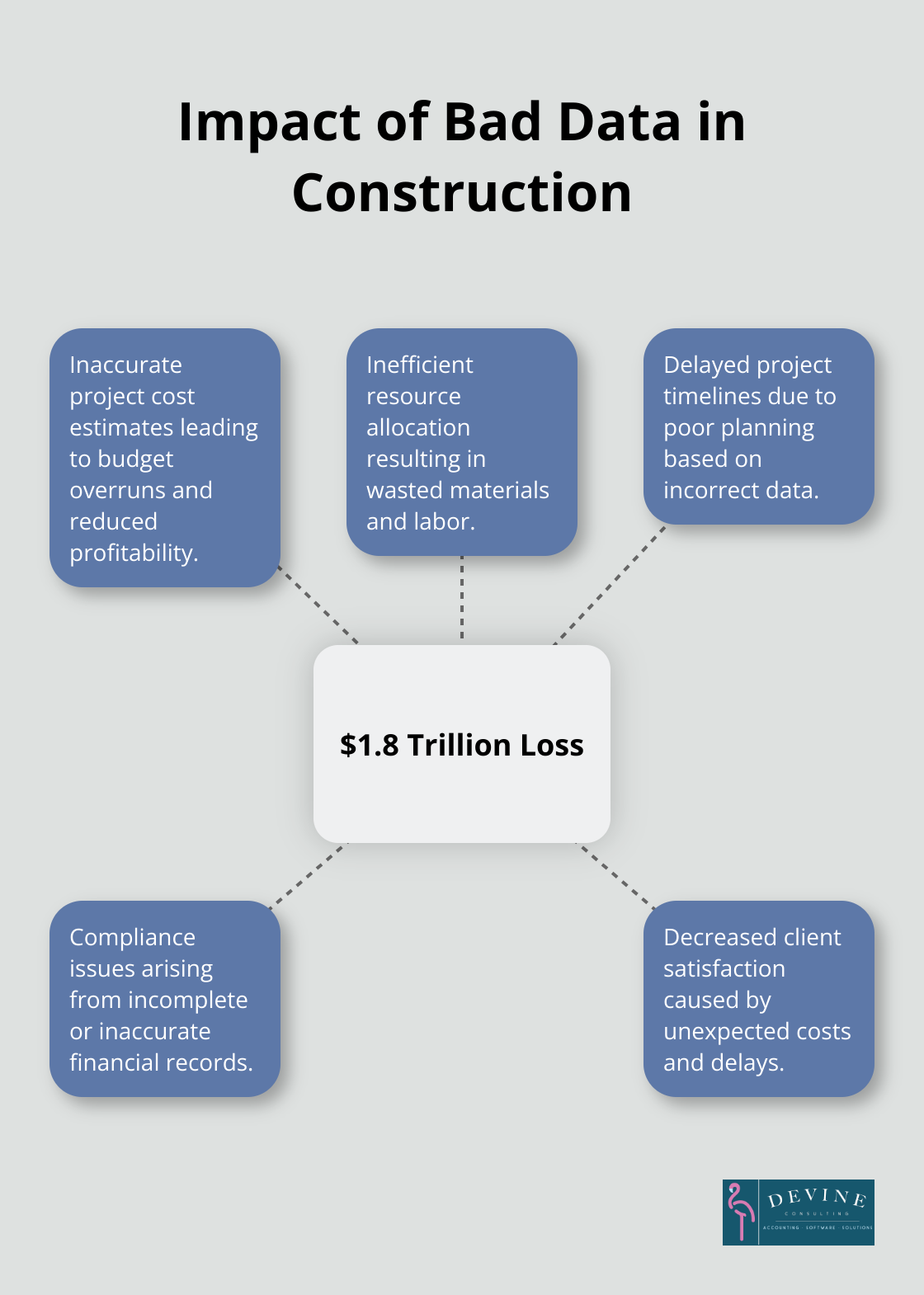

Contractors lost an estimated US$1.8 trillion to bad data in 2020. Virtual bookkeepers address this issue by implementing robust job costing systems. They track costs at a granular level and allocate each expense to the correct project and cost code.

Advanced Technology for Real-Time Financial Insights

Virtual bookkeeping services use cutting-edge accounting software tailored to the construction industry. These tools provide real-time financial data, which allows construction managers to make quick, informed decisions.

A study found that companies using cloud-based accounting systems showed strong growth in Client Accounting Services (CAS). This growth stems from the ability to access up-to-date financial information anytime, anywhere.

Real-time data also helps identify potential issues early. If a project exceeds its budget, managers can take immediate corrective action rather than discovering the problem at the project’s end.

Compliance with Industry Regulations

The construction industry faces numerous regulations, including those related to taxes, labor laws, and contract requirements. Virtual bookkeeping services stay updated on these regulations, which ensures your company remains compliant.

According to the Associated General Contractors of America, non-compliance can result in fines of up to $70,000 for serious violations. Virtual bookkeepers help mitigate this risk by maintaining accurate records and preparing compliant financial statements.

Improved Accuracy Through Automation

Automation plays a significant role in enhancing accuracy in construction accounting. Virtual bookkeeping services utilize automated systems that reduce human error in data entry and calculations. These systems can automatically categorize expenses, reconcile accounts, and generate financial reports (saving time and improving accuracy).

Enhanced Financial Reporting and Analysis

Virtual bookkeepers provide comprehensive financial reports that offer valuable insights into project profitability, cost trends, and overall financial health. Construction companies can use this information to identify areas for improvement and make data-driven decisions.

The ability to access these reports anytime, anywhere (thanks to cloud-based systems) further enhances the decision-making process. This accessibility allows construction managers to respond quickly to financial changes and opportunities.

As we explore the benefits of virtual bookkeeping for construction companies, it becomes clear that these services not only improve accuracy but also free up valuable time. Let’s examine how this time savings allows construction companies to focus on their core activities and grow their business.

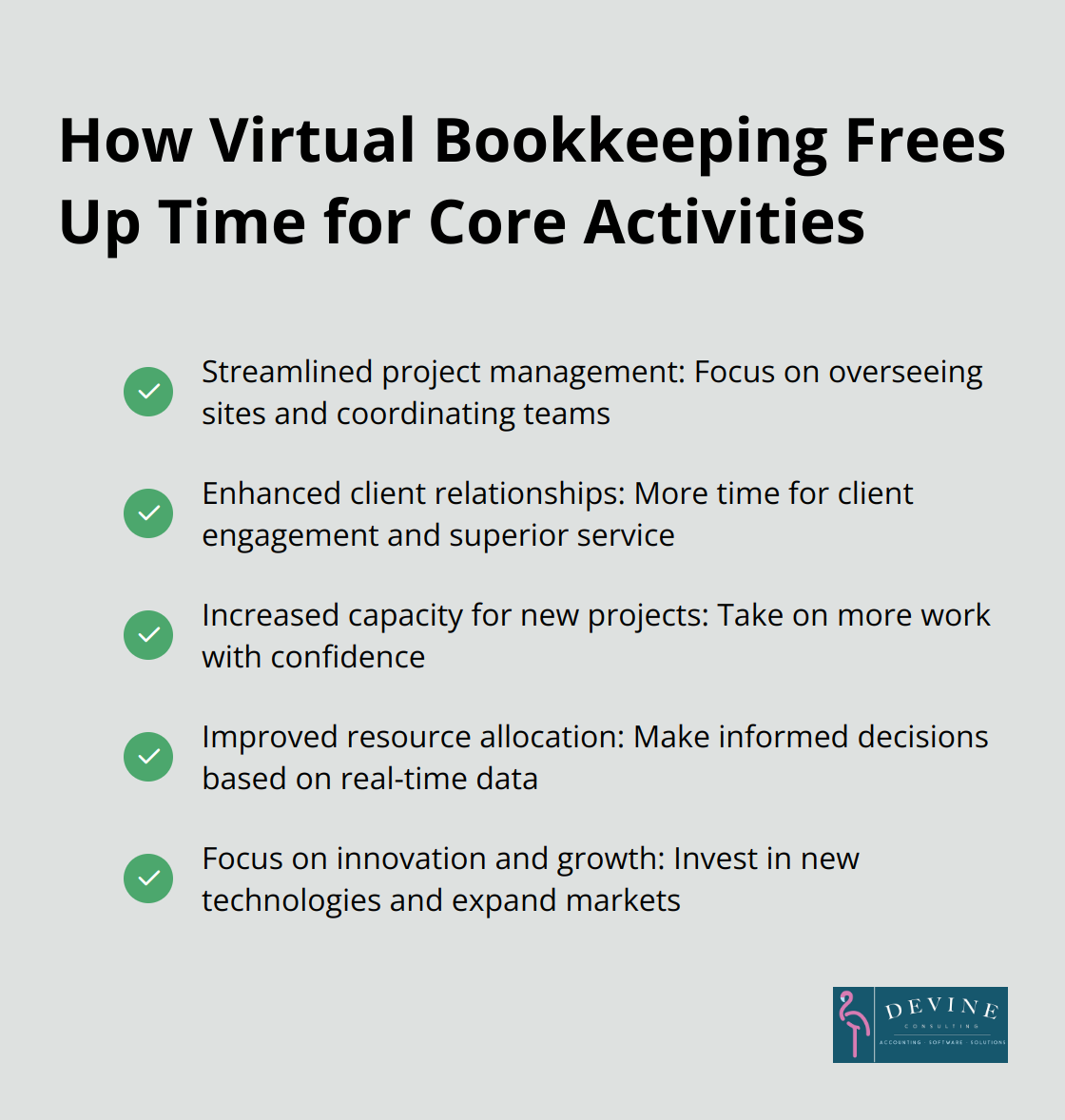

How Virtual Bookkeeping Frees Up Time for Core Construction Activities

Streamlined Project Management

Virtual bookkeeping services handle financial tasks, which allows project managers to focus on overseeing construction sites, coordinating teams, and meeting project timelines. This shift in focus enables construction firms to enhance their project management without compromising financial accuracy.

Enhanced Client Relationships

The time saved on bookkeeping creates more opportunities for client engagement. Construction companies can dedicate their efforts to building stronger relationships with clients, understanding their needs better, and providing superior customer service. Virtual bookkeeping indirectly contributes to business growth by freeing up time for these essential interactions.

Increased Capacity for New Projects

With financial management off their plate, construction companies can take on more projects with confidence. This increased capacity not only boosts revenue but also allows for diversification of project types and clients (reducing overall business risk).

Improved Resource Allocation

Virtual bookkeeping services provide real-time financial insights, which enable construction companies to allocate resources more effectively. Managers can make informed decisions about equipment purchases, labor allocation, and material procurement based on accurate financial data. This improved resource allocation leads to better project outcomes and increased profitability.

Focus on Innovation and Growth

The time and mental energy saved through virtual bookkeeping allows construction companies to focus on innovation and growth strategies. Companies can invest in new technologies, explore sustainable building practices, or expand into new markets. This forward-thinking approach (facilitated by efficient financial management) positions construction firms for long-term success in a competitive industry.

Final Thoughts

Virtual bookkeeping services for construction companies revolutionize financial management in the industry. These services slash overhead costs, provide scalable solutions, and offer expert knowledge at competitive rates. Construction firms can optimize their financial operations, navigate complex regulations, and make data-driven decisions with confidence.

Virtual bookkeeping frees up valuable time for construction companies to focus on core activities. This shift allows for improved project management, stronger client relationships, and increased capacity for new projects. Companies can allocate resources more effectively and pursue innovation and growth strategies (essential for long-term success in a competitive market).

Devine Consulting understands the unique financial needs of construction companies. We offer comprehensive accounting solutions tailored to the construction industry, including accurate bookkeeping, detailed financial reporting, and strategic planning. Our mascot FRANK the Flamingo represents our commitment to supporting your construction business every step of the way.