How to Calculate Profit Maximization: A Practical Guide

At Devine Consulting, we know that profit maximization is the cornerstone of successful business strategies. It’s a concept that can significantly impact your bottom line and drive growth.

In this guide, we’ll walk you through the process of calculating profit maximization, complete with practical examples. You’ll learn how to apply these techniques to your business, helping you make informed decisions and optimize your pricing strategies.

What is Profit Maximization?

The Core Concept

Profit maximisation is a strategy that fosters both efficiency and sustained business growth. It represents the point where a company’s total revenue surpasses its total costs by the largest possible margin. This concept can transform a business’s financial health when understood and applied correctly.

The Numbers in Action

Let’s illustrate this with a real-world scenario. Consider a small bakery selling cupcakes for $3 each. Their fixed costs (rent, equipment) amount to $500 per month, and each cupcake costs $1 to produce. The bakery’s challenge lies in finding the optimal balance between production volume and pricing to maximize profits.

If they sell 300 cupcakes, their profit calculation looks like this:

(300 × $3) – ($500 + 300 × $1) = $400

However, if they increase production to 400 cupcakes:

(400 × $3) – ($500 + 400 × $1) = $700

This example underscores the importance of analyzing numbers to identify the optimal production level.

The Significance of Maximizing Profits

Profit maximization extends beyond mere money-making. It encompasses efficiency and sustainability. Businesses that maximize profits position themselves to:

- Invest in growth and innovation

- Withstand economic downturns

- Attract investors and secure financing

- Provide job security and improved wages for employees

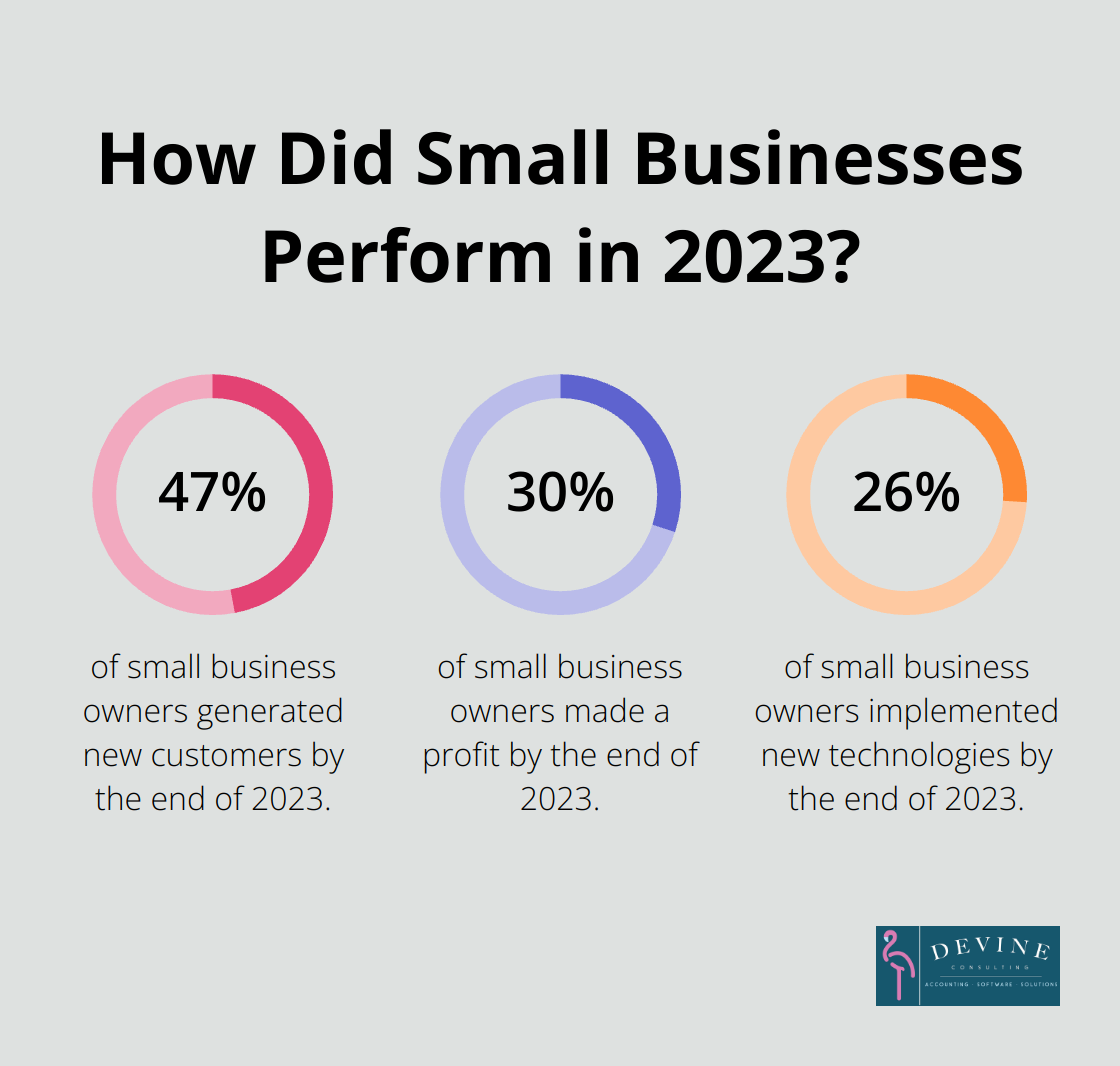

A recent study revealed that by the end of 2023, 47% of small business owners generated new customers, 30% made a profit, and 26% implemented new technologies.

Key Components

To calculate profit maximization effectively, you must understand three fundamental elements:

- Revenue: The total amount of money earned from sales

- Costs: Both fixed (rent, salaries) and variable (materials, utilities)

- Profit: The difference between revenue and costs

These components form the foundation of your profit function, which we will explore in greater detail in the subsequent section.

Practical Application

Let’s examine the case of a local landscaping company. They charge $50 per hour for their services. Their fixed costs total $2,000 per month, and their variable costs (fuel, equipment maintenance) amount to $15 per hour worked.

Their profit function would appear as follows:

Profit = (50 × Hours Worked) – (2000 + 15 × Hours Worked)

Through analysis of this function, they can determine the optimal number of monthly work hours to maximize their profits.

Understanding these concepts marks just the beginning of your journey towards profit maximization. In the next section, we will guide you through the step-by-step process of calculating profit maximization, equipping you with the tools to apply these principles to your own business operations.

How to Calculate Profit Maximization

At Devine Consulting, we understand the importance of profit maximization for business success. This chapter will guide you through the process of calculating profit maximization, providing you with practical steps to optimize your business’s financial performance.

Determine Your Total Revenue Function

The first step in calculating profit maximization involves identifying your total revenue function. This function represents the relationship between the price of your product or service and the quantity sold. To create your revenue function, use the formula:

TR = P × Q

Where:

TR = Total Revenue

P = Price per unit

Q = Quantity sold

For example, if you sell a product for $50 and expect to sell 1,000 units, your total revenue would be $50,000. However, it’s important to consider how demand might change with price. If lowering your price to $45 could increase sales to 1,200 units, your total revenue would rise to $54,000.

Calculate Your Total Cost Function

The next step involves breaking down your costs into fixed and variable components. Fixed costs remain constant regardless of production volume, while variable costs change with output. Your total cost function will look like this:

TC = FC + (VC × Q)

Where:

TC = Total Cost

FC = Fixed Costs

VC = Variable Cost per unit

Q = Quantity produced

For instance, a small manufacturing company might have fixed costs of $10,000 per month for rent and equipment leases, and variable costs of $20 per unit produced.

Find Your Profit Function

With your revenue and cost functions in hand, you can now determine your profit function. Subtract your total cost function from your total revenue function:

Profit = TR – TC

Profit = (P × Q) – [FC + (VC × Q)]

Using our previous examples:

Profit = (50 × Q) – [10,000 + (20 × Q)]

Identify the Maximum Profit Point

To find the point of maximum profit, you need to determine where the rate of change in profit equals zero. This involves taking the derivative of your profit function with respect to Q and setting it equal to zero.

For our example:

d(Profit)/dQ = 50 – 20 = 30

30 = 0

This indicates that profit increases by $30 for each additional unit sold, regardless of the quantity. In this case, the business should produce as many units as possible, as long as there’s demand.

Adjust for Real-World Scenarios

In real-world scenarios, price often decreases as quantity increases. Let’s adjust our example to reflect this:

Suppose the price function is P = 100 – 0.05Q

Our new profit function becomes:

Profit = (100 – 0.05Q)Q – [10,000 + (20 × Q)]

Profit = 100Q – 0.05Q² – 10,000 – 20Q

Profit = -0.05Q² + 80Q – 10,000

Now, let’s find the maximum profit point:

d(Profit)/dQ = -0.1Q + 80 = 0

0.1Q = 80

Q = 800

This tells us that profit is maximized when we produce and sell 800 units. At this point, the price would be $60 per unit (100 – 0.05 × 800), resulting in a maximum profit of $22,000.

These calculations provide a solid foundation for optimizing your business’s profitability. In the next chapter, we’ll explore practical examples of profit maximization across different industries, helping you apply these concepts to your specific business scenario.

Real-World Profit Maximization Examples

Manufacturing Company Boosts Profits

A medium-sized furniture manufacturer faced declining profits due to rising material costs. They implemented a two-pronged approach to maximize profits:

- Cost reduction: The company negotiated bulk discounts with suppliers and optimized their production process, which reduced variable costs by 15%.

- Price adjustment: Market research revealed that customers would accept a 5% price increase for high-quality products.

The result? Their profit margin jumped from 12% to 18% within six months, adding $500,000 to annual profits.

Service-Based Business Optimizes Pricing

An IT consulting firm struggled with competitive pricing while maintaining profitability. They took these steps:

- They analyzed their cost structure, which showed each billable hour cost $75 (including overhead).

- A market survey revealed competitors charged between $100 and $150 per hour.

- They created a tiered pricing strategy:

- Standard rate: $125/hour

- Rush jobs: $150/hour

- Volume discounts for long-term projects

This approach increased their average hourly rate from $100 to $135, boosting profits by 35% without losing clients.

E-commerce Company Leverages Dynamic Pricing

An online electronics retailer adopted a dynamic pricing strategy to maximize profits:

- They implemented AI-powered pricing software that adjusts prices based on:

- Competitor pricing

- Time of day

- Day of the week

- Seasonal trends

- They set pricing rules to ensure a minimum profit margin of 15% on all products.

- Prices fluctuated within a 20% range of the base price.

The results proved impressive:

- Overall profit increased by 22% in the first year

- Sales volume grew by 15% due to more competitive pricing during off-peak hours

- Customer satisfaction improved as they often found better deals during non-peak times

Small Business Embraces Cost-Cutting Measures

A local bakery struggled with thin profit margins. They decided to focus on cost reduction:

- They switched to energy-efficient appliances, cutting utility costs by 20%.

- The bakery started buying ingredients in bulk, reducing raw material costs by 15%.

- They optimized staff schedules to match peak hours, reducing labor costs without sacrificing service quality.

These changes increased their profit margin from 5% to 12%, allowing them to invest in new equipment and expand their product line.

Tech Startup Implements Value-Based Pricing

A software-as-a-service (SaaS) startup moved from a flat-rate pricing model to value-based pricing:

- They segmented their customer base according to company size and usage patterns.

- The startup created tiered pricing plans that aligned with the value each segment received from the software.

- They introduced add-on features for power users, creating additional revenue streams.

This strategy resulted in a 40% increase in average revenue per user and a 25% boost in overall profitability (while reducing churn rates by 10%).

Final Thoughts

Profit maximization empowers businesses to optimize their financial performance. Our profit maximization calculation examples demonstrate how companies across industries can boost profitability by applying these principles. You can pinpoint optimal production levels or pricing strategies that yield the highest profits for your business.

Implementing profit maximization techniques offers numerous benefits. It helps you allocate resources more efficiently, make data-driven pricing decisions, and identify areas for cost reduction. You can gain a clear picture of your business’s financial health, which enables you to plan for future growth and investment opportunities.

Devine Consulting provides comprehensive accounting solutions to help you navigate financial complexities. We offer accurate bookkeeping, financial reporting, and strategic planning services (allowing you to focus on your core operations). You can take the first step towards optimizing your profitability today and position your business for success in the competitive marketplace.