How to Choose Outsourced Bookkeeping Services

Choosing the right outsourced bookkeeping services can make or break your business’s financial health. Many companies struggle with managing their books effectively, leading to costly mistakes and missed opportunities.

At Devine Consulting, we’ve seen firsthand how outsourcing bookkeeping can transform a business’s financial operations. This guide will help you navigate the process of selecting the perfect bookkeeping partner for your unique needs.

Why Outsource Your Bookkeeping?

The Telltale Signs

Your business might need outsourced bookkeeping if you constantly play catch-up with your financial records. If you’re among the majority of business owners who find accounts receivable and other accounting tasks challenging, outsourcing could be your solution.

Another indicator is when your business grows faster than your ability to manage the books. As transaction volume increases, so does the complexity of financial management. If you make more mistakes or miss important deadlines, it’s time to seek professional help.

The Game-Changing Benefits

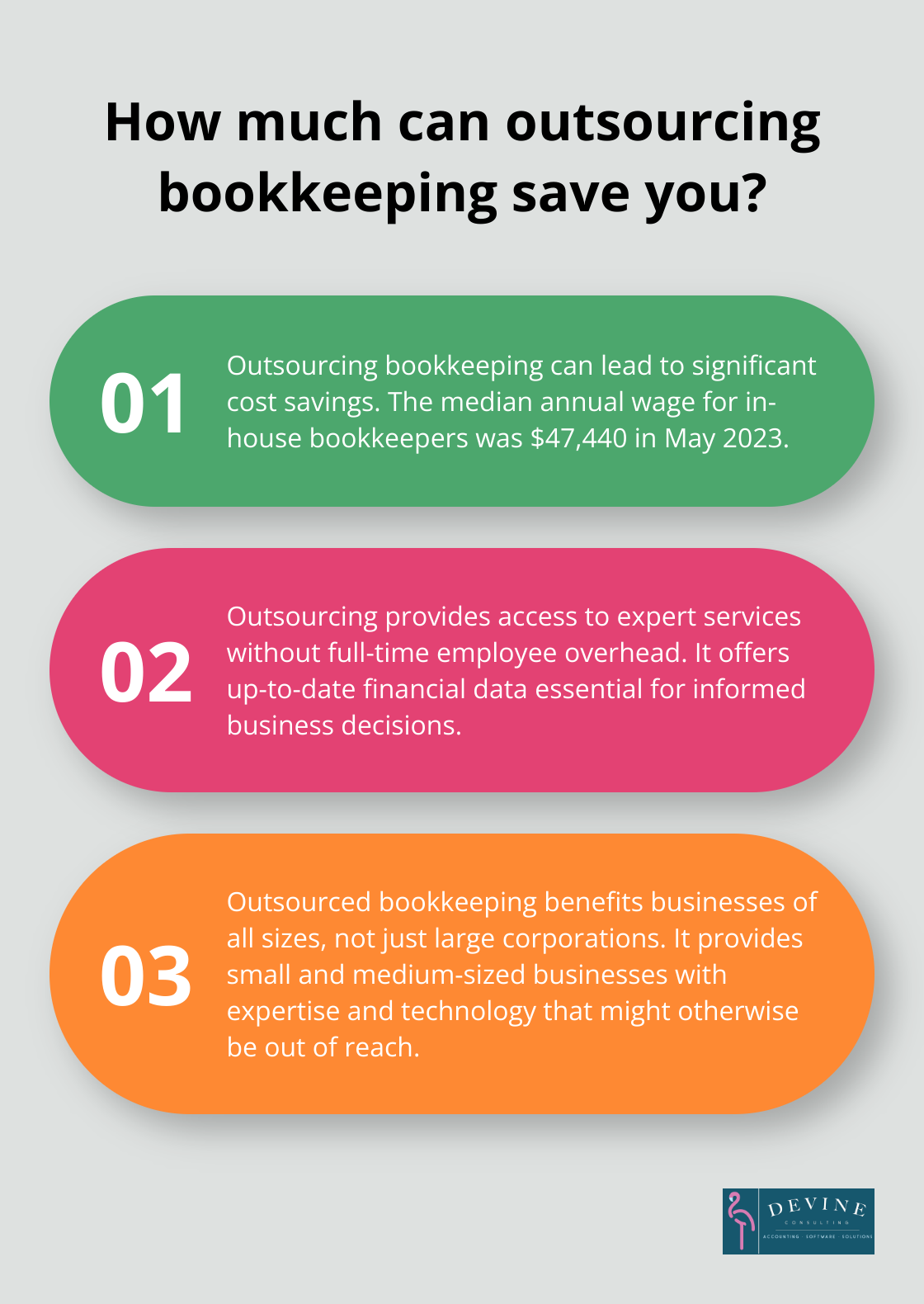

Outsourcing your bookkeeping can lead to significant cost savings. The Bureau of Labor Statistics reports that the median annual wage for bookkeeping, accounting, and auditing clerks was $47,440 in May 2023. Outsourcing allows you to access expert services without the overhead of a full-time employee.

Moreover, outsourced bookkeeping provides up-to-date financial data. This real-time information is essential for making informed business decisions. Outsourcing to experts can bridge any knowledge gaps in finances.

Debunking Common Myths

Many business owners believe outsourcing means losing control over their finances. This is far from the truth. Outsourcing often provides more visibility into your financial situation through regular reporting and analysis.

Another misconception is that outsourced bookkeeping only benefits large corporations. In reality, small and medium-sized businesses often reap the most rewards from these services. They gain access to expertise and technology that might otherwise be out of reach.

Some worry about data security when outsourcing. However, reputable firms use advanced security measures to protect your financial information, often surpassing what small businesses can implement on their own.

The Strategic Advantage

Outsourcing your bookkeeping isn’t just about number crunching; it’s about gaining a strategic partner in your business’s financial journey. Whether you’re a growing startup or an established company, professional bookkeeping services can provide the financial clarity and expertise you need to thrive.

With the benefits of outsourced bookkeeping clear, the next step is to understand how to choose the right service for your business. Let’s explore the key factors to consider when selecting a bookkeeping partner that aligns with your unique needs and goals.

What Makes a Great Bookkeeping Service?

Industry-Specific Expertise

A bookkeeper who understands your industry’s nuances will provide invaluable insights. Construction companies need bookkeepers familiar with job costing and progress billing. Real estate firms require expertise in property management accounting. Look for a service with a proven track record in your sector. Ask for client references within your industry to gauge their experience.

Comprehensive Service Offerings

The best bookkeeping services offer more than just data entry. They should provide a full spectrum of financial services, including accounts payable and receivable management, payroll processing, and financial reporting. Choose a service that can grow with your business, offering scalable solutions as your needs evolve.

Cutting-Edge Technology

Modern bookkeeping relies heavily on technology. Your bookkeeping service should use up-to-date, cloud-based accounting software (like QuickBooks Online or Xero). These platforms offer real-time financial data access and seamless integration with other business tools. Ask potential providers about their tech stack and how it will streamline your financial processes.

Robust Security Measures

Financial data protection should be a top priority. IBM’s report states that the global average cost of a data breach in 2024 is $4.88 million. Inquire about the security protocols of potential bookkeeping services. Look for features like multi-factor authentication, encrypted data transmission, and regular security audits. Don’t hesitate to ask for their data breach response plan.

Transparent Pricing

Pricing structures for bookkeeping services can vary widely. Some charge hourly rates, while others offer fixed monthly fees. Request detailed pricing information and ensure there are no hidden fees. A transparent pricing model allows for better budgeting and prevents unexpected costs down the line.

Communication and Accessibility

Your bookkeeper should be more than just a number cruncher; they should be a trusted advisor. Look for a service that offers regular check-ins and clear communication channels. Ask about their response times for queries and how often they provide financial updates. Choose a service that values open communication and is readily available when you need them.

Now that you understand what to look for in a great bookkeeping service, it’s time to evaluate potential partners. The next section will guide you through the process of assessing and selecting the right bookkeeping service for your business.

How to Evaluate Potential Bookkeeping Partners

Verify Credentials and Certifications

Start your evaluation by checking the credentials and certifications of potential bookkeeping services. Look for providers certified by recognized accounting bodies such as the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB). These certifications indicate a commitment to professional standards and ongoing education. For example, the NACPB bookkeeping license must be renewed annually, requiring at least 24 continuing professional education (CPE) credits and a fee.

Examine Client Testimonials and Case Studies

Review client testimonials and case studies to gain real-world insights into a provider’s performance. Focus on testimonials from businesses similar to yours in size or industry. Case studies can offer detailed examples of how the bookkeeping service solved specific financial challenges (which can be particularly helpful if you face similar issues).

Assess Communication and Responsiveness

Communication plays a vital role in bookkeeping partnerships. During initial consultations, note how quickly and thoroughly the provider responds to your inquiries. Ask about their typical response times for urgent matters. Test their ability to explain complex financial concepts in simple terms. A good bookkeeping partner should break down financial jargon into understandable language.

Understand the Onboarding Process

Ask potential providers to explain their onboarding steps. Look for a structured approach that includes a thorough review of your current financial systems, data migration plans, and staff training if needed. Inquire about the estimated timeline for full implementation. A well-organized provider should give you a clear schedule (typically ranging from a few weeks to a couple of months, depending on the complexity of your financial setup).

Evaluate Scalability Options

As your business grows, your bookkeeping needs will evolve. Ask potential partners about their ability to scale services. Can they handle increased transaction volumes? Do they offer additional services like tax preparation or CFO-level advisory that you might need in the future? Some providers offer tiered service packages that can grow with your business. Others might provide à la carte options for added flexibility. Ensure the bookkeeping service can adapt to your changing needs without requiring you to switch providers down the line.

Final Thoughts

Selecting the right outsourced bookkeeping services will significantly impact your business’s financial health and growth potential. You must evaluate potential partners based on their industry expertise, service offerings, technology, security measures, pricing transparency, and communication style. This evaluation will help you find a bookkeeping service that aligns perfectly with your unique needs.

Devine Consulting understands the importance of reliable and efficient financial management. We offer comprehensive accounting solutions tailored to various industries, including construction, oil and gas, and real estate. Our services include accurate bookkeeping, detailed financial reporting, and strategic financial planning (allowing you to focus on your core business operations).

Don’t let financial complexities hold your business back. With the right outsourced bookkeeping services, you can gain clarity, save time and money, and make informed decisions that drive your business forward. Take the next step towards financial success by choosing a bookkeeping partner that understands your industry and can grow with your business.