How to Choose the Best Outsourced Finance and Accounting

Choosing the right outsourced finance and accounting partner can make or break your business’s financial health. At Devine Consulting, we’ve seen firsthand how this decision impacts companies of all sizes.

Outsourcing these critical functions offers numerous benefits, from cost savings to access to specialized expertise. However, finding the perfect fit requires careful consideration of several key factors.

This guide will walk you through the essential steps to select the best outsourced finance and accounting provider for your unique needs.

Why Outsource Finance and Accounting?

The Financial Challenges Businesses Face

In today’s competitive business landscape, managing finances internally presents significant hurdles. Many companies grapple with cash flow issues, regulatory complexities, and the substantial costs associated with maintaining an in-house finance team.

Small and medium-sized businesses often struggle to maintain accurate financial records. A study revealed that 60% of small business owners feel they aren’t knowledgeable when it comes to accounting. This lack of expertise can result in costly errors and missed growth opportunities.

Keeping pace with ever-changing tax laws and regulations poses another major challenge. The Internal Revenue Service reports that approximately 40% of small businesses incur an average penalty of $845 annually for late or incorrect filings and payments. This statistic underscores the importance of access to current financial expertise.

The Benefits of Outsourcing Financial Functions

Outsourcing finance and accounting functions effectively addresses these challenges. Cost savings stand out as a primary advantage. A Deloitte report found that outsourcing can slash accounting costs by 40-60% compared to maintaining an in-house team. This reduction allows businesses to redirect resources to core activities that fuel growth.

Access to specialized expertise provides another crucial benefit. Outsourced accounting boosts efficiency, saves costs, and enhances financial accuracy for your business. This expertise proves particularly valuable in complex areas such as tax planning, financial forecasting, and strategic decision-making.

Comprehensive Financial Services Offered

Outsourced finance and accounting providers offer a wide array of services to meet diverse business needs. These typically include:

- Bookkeeping

- Payroll processing

- Tax preparation

- Financial reporting

More advanced services often encompass cash flow management, budgeting, and financial analysis.

For instance, some providers (like Devine Consulting) offer tailored solutions for specific industries such as construction, oil and gas, and real estate. This approach ensures that businesses receive not just accurate financial data, but also strategic insights to drive growth.

The Impact on Business Operations

Leveraging these comprehensive services allows businesses to streamline their financial operations, improve accuracy, and gain valuable insights for informed decision-making. Companies that outsource their finance and accounting functions often report:

- Improved focus on core business activities

- Enhanced financial visibility and control

- Reduced risk of errors and non-compliance

- Access to cutting-edge financial technologies

The key lies in finding a provider that aligns with your specific industry needs and business goals. As we move forward, we’ll explore the critical factors to consider when choosing an outsourced finance partner.

What Makes a Great Outsourced Finance Partner?

Industry-Specific Expertise

The selection of an outsourced finance and accounting partner can significantly impact your business’s financial health and growth trajectory. One of the most important elements to consider is the provider’s industry-specific expertise. Generic financial services often fail to address the unique challenges and regulations of your particular sector. Construction companies require specialized knowledge of job costing and progress billing, while real estate firms need expertise in property management accounting and complex lease arrangements.

When you evaluate potential partners, ask for concrete examples of their experience in your industry. Request case studies or client testimonials that demonstrate their ability to handle industry-specific financial complexities. A provider with a proven track record in your sector will offer tailored solutions and valuable insights that drive your business forward.

Cutting-Edge Technology Integration

The technology and tools used by your outsourced finance partner can dramatically improve the efficiency and accuracy of your financial operations. Look for providers that use state-of-the-art accounting software and automation tools. Public cloud service revenues in 2023 are predicted to reach $526 billion, with Infrastructure as a Service (IaaS) revenues growing 29.7% in 2022 to reach $120.3 billion.

Ask potential partners about their tech stack. Do they use cloud-based platforms that allow for real-time collaboration and data access? Do they employ artificial intelligence and machine learning for tasks like data entry and reconciliation? The right technology can streamline processes and provide deeper financial insights through advanced analytics.

Robust Security and Compliance Measures

In an era where data breaches can cost companies millions, the security measures of your outsourced finance partner should top your priority list. The global average cost of a data breach in 2024 is USD 4.88M, a 10% increase over the previous year and the highest total ever. This staggering figure underscores the importance of partnering with a provider that takes security seriously.

Inquire about the provider’s data encryption methods, access controls, and backup procedures. They should comply with industry standards such as SOC 2 and understand relevant regulations like GDPR or CCPA. Don’t hesitate to ask for detailed information about their security protocols and any third-party security audits they’ve undergone.

Scalability and Service Flexibility

As your business grows and evolves, your financial needs will change. The ideal outsourced finance partner should offer scalable solutions that can adapt to your changing requirements. This flexibility ensures that you don’t pay for services you don’t need or scramble to find additional support during periods of rapid growth.

Discuss potential growth scenarios with prospective providers and ask how they would accommodate increased transaction volumes or more complex financial reporting needs. A provider that offers a full range of services (from basic bookkeeping to strategic CFO support) can become an invaluable partner as your business scales.

These factors should guide your decision-making process when you evaluate outsourced finance and accounting providers. Prioritize industry expertise, technological advancement, security measures, and scalability to position yourself for success. The next step involves a deeper examination of how to effectively assess potential providers based on these criteria.

How to Evaluate Outsourced Finance Providers

Assess Reputation and Client Feedback

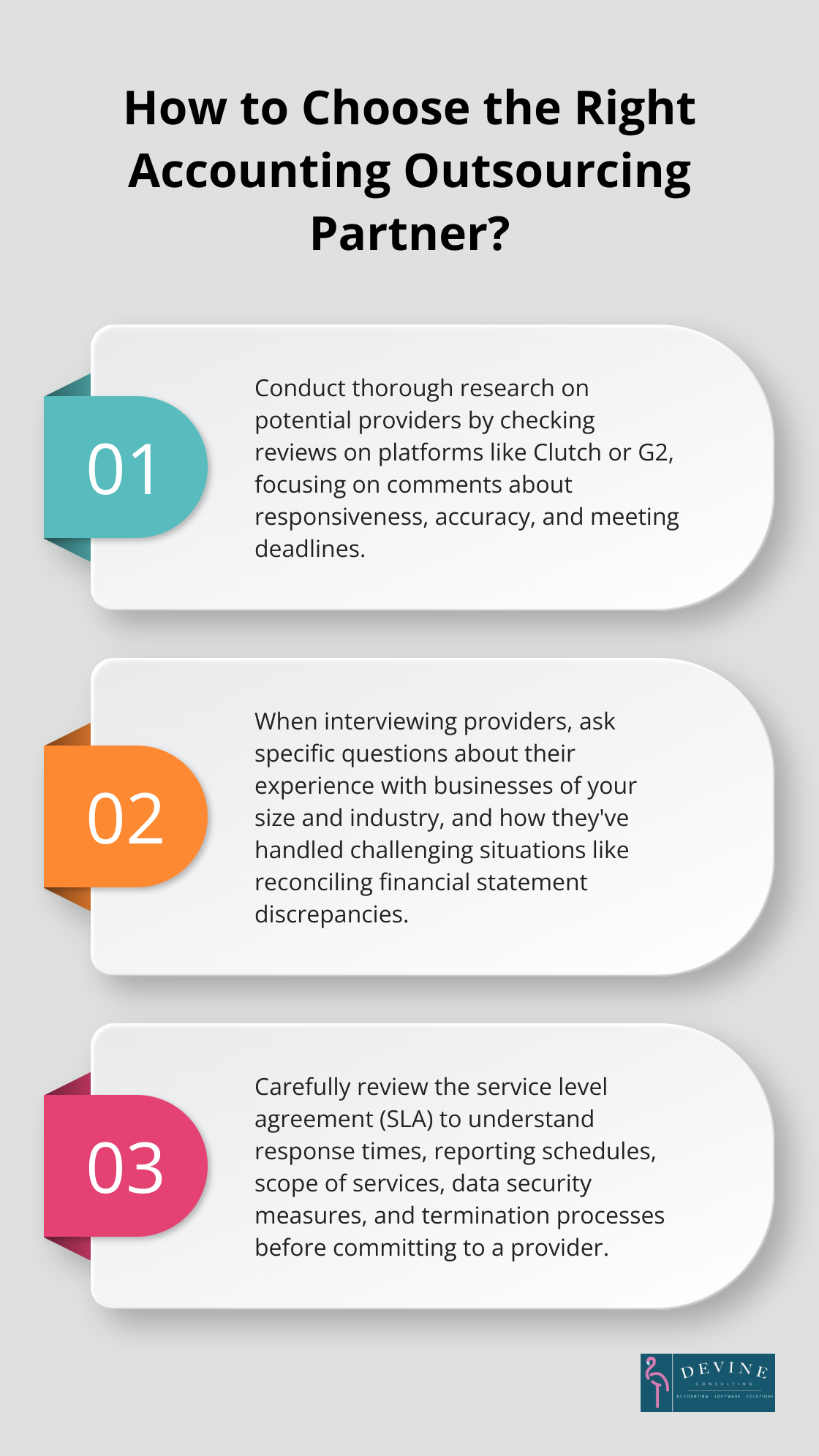

Start your evaluation by examining the provider’s reputation in the industry. Check reviews on platforms like Clutch or G2, which offer verified client feedback. Focus on comments about responsiveness, accuracy, and the provider’s ability to meet deadlines.

Client testimonials provide valuable insights into a provider’s strengths and potential weaknesses. For example, a testimonial praising a provider’s expertise in handling complex tax situations for tech startups could prove particularly relevant if you operate in a similar industry.

Analyze Case Studies and Success Stories

Request detailed case studies from potential providers. These should outline specific challenges faced by clients and how the provider solved them. A case study might describe how the provider helped a retail chain streamline its multi-state tax compliance, resulting in significant time and cost savings.

Success stories reveal a provider’s ability to drive tangible results. Look for metrics like improved cash flow, reduced audit findings, or accelerated financial close times. These concrete outcomes demonstrate the provider’s impact on a business’s financial health.

Conduct Effective Interviews

When interviewing potential providers, ask pointed questions about their processes, team structure, and communication protocols. Inquire about their experience with businesses of your size and in your industry. If you run a SaaS company, ask how they handle revenue recognition under ASC 606.

Address potential challenges head-on. Ask how they’ve handled difficult situations in the past, such as reconciling discrepancies in financial statements or managing cash flow during a crisis. Their answers will give you insight into their problem-solving abilities and approach to client relationships.

Understand Pricing Models and Service Agreements

Thoroughly examine the pricing structure. Some providers offer fixed monthly fees, while others charge based on transaction volume or time spent. Make sure you understand what’s included in the base price and what might incur additional charges.

Carefully review the service level agreement (SLA). This document should clearly outline response times, reporting schedules, and the scope of services. Pay attention to clauses about data security, confidentiality, and the process for terminating the agreement if needed.

Consider Long-Term Value

When evaluating providers, consider not just the immediate cost savings but the long-term value they can bring to your business. A provider that offers strategic insights and proactive financial planning can contribute significantly to your company’s growth and stability.

The right outsourced finance and accounting partner should feel like an extension of your team, aligned with your business goals and values. Take the time to find a provider (such as Devine Consulting) that not only meets your current needs but can also support your future growth.

Final Thoughts

Selecting the right outsourced finance and accounting partner will significantly impact your business’s financial health and growth trajectory. You must evaluate potential providers based on their industry expertise, technological capabilities, security measures, and scalability. This thorough assessment positions your company for long-term success and allows you to focus on core operations while maintaining confidence in your financial management.

The benefits of outsourced finance and accounting extend far beyond cost savings. With the right partner, you gain access to specialized expertise, cutting-edge technology, and strategic insights that can drive your business forward. These advantages (including accurate bookkeeping, detailed financial reporting, and strategic planning) support your business’s financial stability and growth.

You should take the time to carefully evaluate your options and choose a partner that aligns with your business goals and values. Consider providers like Devine Consulting that offer comprehensive services tailored to various industries. With the right outsourced finance and accounting partner, you’ll navigate financial challenges and seize opportunities for growth in the years to come.