How to Organize Financial Records for Better Management

Poor financial record organization costs businesses an average of $12,000 annually in missed deductions and compliance penalties. Most companies lose 21% of their time searching for misplaced documents.

We at Devine Consulting see this challenge daily. Learning how to organize financial records transforms business operations and reduces costly errors that drain profits.

Essential Financial Documents Every Business Needs

Income Statements and Profit Loss Records

Smart businesses prioritize three document categories that directly impact profitability and compliance. Income statements track revenue streams and operating expenses monthly, which reveals profit margins that vary significantly across industries according to NYU Stern School data. These statements expose cost inefficiencies within 30 days and allow rapid corrections that prevent quarterly losses.

Companies that review their numbers monthly spot problems faster than competitors who wait for quarterly assessments. Revenue tracking shows exactly where money flows in, while expense categorization highlights areas where costs spiral out of control.

Balance Sheets and Cash Flow Statements

Balance sheets provide snapshot views of assets, liabilities, and equity positions at specific dates. Companies that review balance sheets monthly identify cash flow problems 40% faster than those conducting quarterly reviews. This advantage translates into better vendor relationships and improved credit terms.

Cash flow statements track money movement through operations, investments, and financing activities. These documents predict liquidity issues before they become critical business threats. Smart managers use cash flow projections to negotiate payment terms and plan major purchases (equipment, inventory, or expansion projects).

Tax Documents and Receipts

Tax documentation requires systematic collection throughout the year rather than frantic December searches. The IRS recommends that businesses retain tax returns for six years if unreported income exceeds 25% of gross income, while supporting receipts and invoices need three-year retention minimum. Receipt management software like Expensify processes documentation 75% faster than manual systems.

Bank statements, payroll records, and depreciation schedules form the foundation of accurate tax preparation. Businesses that maintain organized tax files reduce preparation costs by an average of $2,400 annually compared to those with scattered documentation. Digital receipt capture eliminates lost deductions worth approximately $1,800 per year for typical small businesses (particularly meal expenses and travel costs).

Professional bookkeeping services streamline this process through automated categorization systems that flag missing documents before tax deadlines approach. The next step involves choosing between digital and physical storage methods that protect these valuable records.

Digital vs Physical Record Keeping Systems

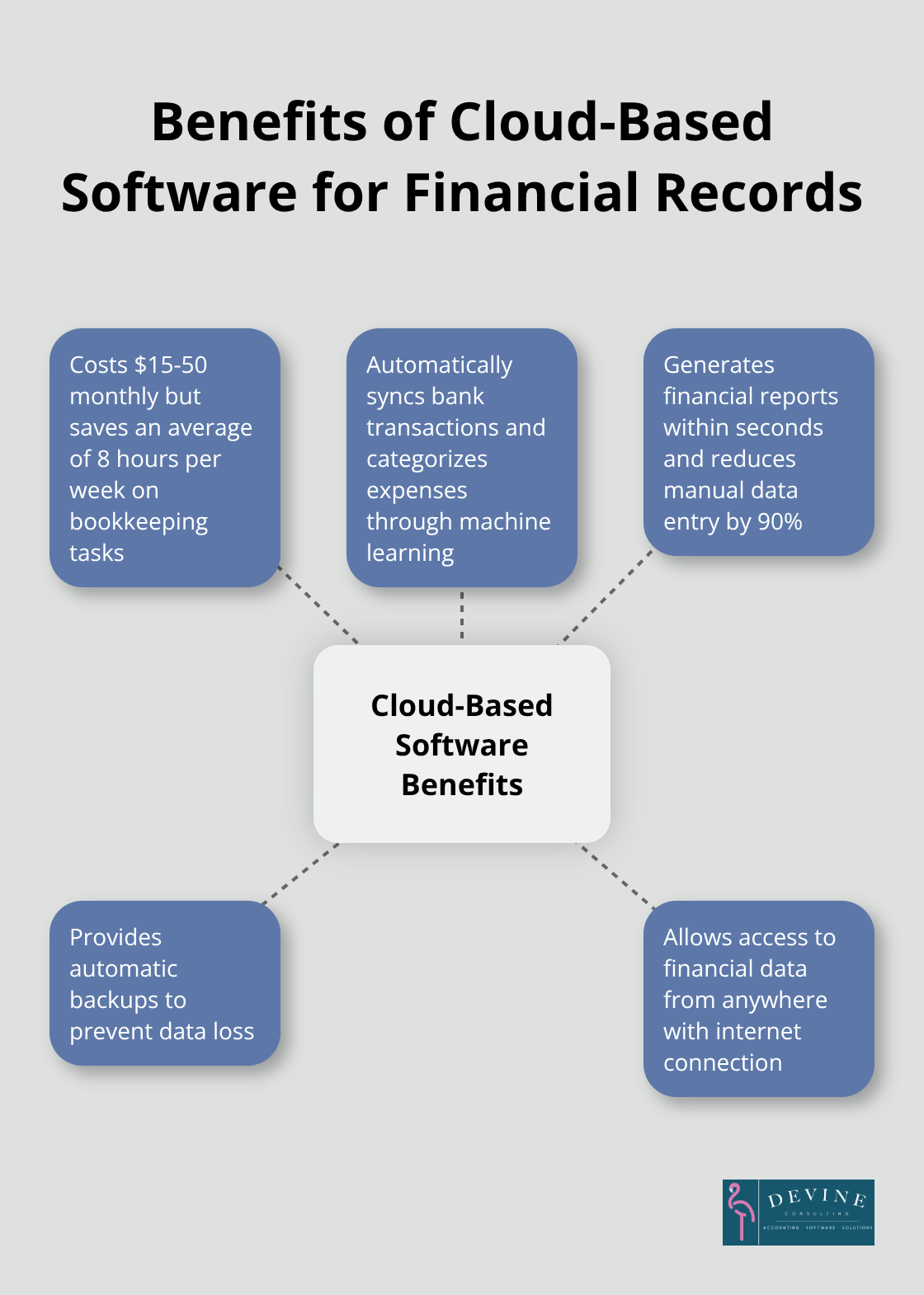

Cloud-Based Software Dominates Modern Businesses

QuickBooks Online amounted to 35% of Intuit’s revenues in the Small Business & Self-Employed segment between 2021 and 2023, while Xero and FreshBooks split most remaining market share. These platforms automatically sync bank transactions, categorize expenses through machine learning, and generate financial reports within seconds. QuickBooks processes over 4.5 million transactions daily and reduces manual data entry by 90% compared to spreadsheet-based systems.

Cloud software costs between $15-50 monthly but saves businesses an average of 8 hours per week on bookkeeping tasks. Automatic backups prevent data loss that affects companies using local storage solutions, as comprehensive data protection platforms help reduce the high cost and disruptive effects of data loss and downtime.

Physical Filing Systems Still Matter for Compliance

Physical documents require fireproof safes rated for 1,700°F temperatures and water damage protection. SentrySafe models cost $200-800 but protect original contracts, signed agreements, and legal documents that courts often require in physical form. The IRS accepts digital copies for most audits, yet original receipts over $75 and international transaction records need physical retention per Treasury regulations.

Filing cabinets with locks secure sensitive payroll information and employee records that face strict privacy requirements under state employment laws. Smart businesses scan physical documents immediately after receipt, then store originals in organized filing systems with monthly purging schedules that prevent overwhelming accumulation.

Hybrid Systems Provide Maximum Protection

Successful companies combine cloud software for daily operations with physical storage for legal compliance and disaster recovery. This approach costs 60% less than pure physical systems while maintains 99.9% data availability that pure cloud solutions cannot guarantee during internet outages.

Hybrid systems automatically upload scanned receipts to accounting software while maintain physical copies in organized filing systems that auditors can access within 24 hours. Companies that implement these dual systems report 35% fewer compliance issues during tax season (particularly when auditors request specific documentation on short notice).

The foundation of any effective record system depends on consistent organization practices that prevent chaos from accumulating over time.

Best Practices for Financial Record Organization

Review Schedules That Prevent Disasters

Successful financial organization demands rigid review schedules that prevent small problems from major disasters. Companies that conduct monthly reviews help detect fraud early, as organizations lost an average of more than $1.5M per fraud case according to recent data. Monthly sessions should focus on bank reconciliations, expense categorizations, and cash flow projections that take exactly 2-3 hours for most small businesses. Quarterly reviews require deeper analysis of profit margins, debt ratios, and tax preparation status that typically consume 6-8 hours but save thousands in professional fees.

Smart Categorization Prevents Chaos

Financial categories must follow IRS Chart of Accounts standards with specific subcategories that match your industry requirements. Restaurant businesses need separate categories for food costs, labor expenses, and equipment maintenance, while construction companies require material costs, subcontractor payments, and equipment depreciation. Consistent codes like 5100-Office Supplies eliminate confusion when multiple team members access records rather than vague descriptions that create duplicate entries. Software like QuickBooks automatically suggests categories based on vendor names, but manual verification prevents miscategorizations that cause tax preparation delays.

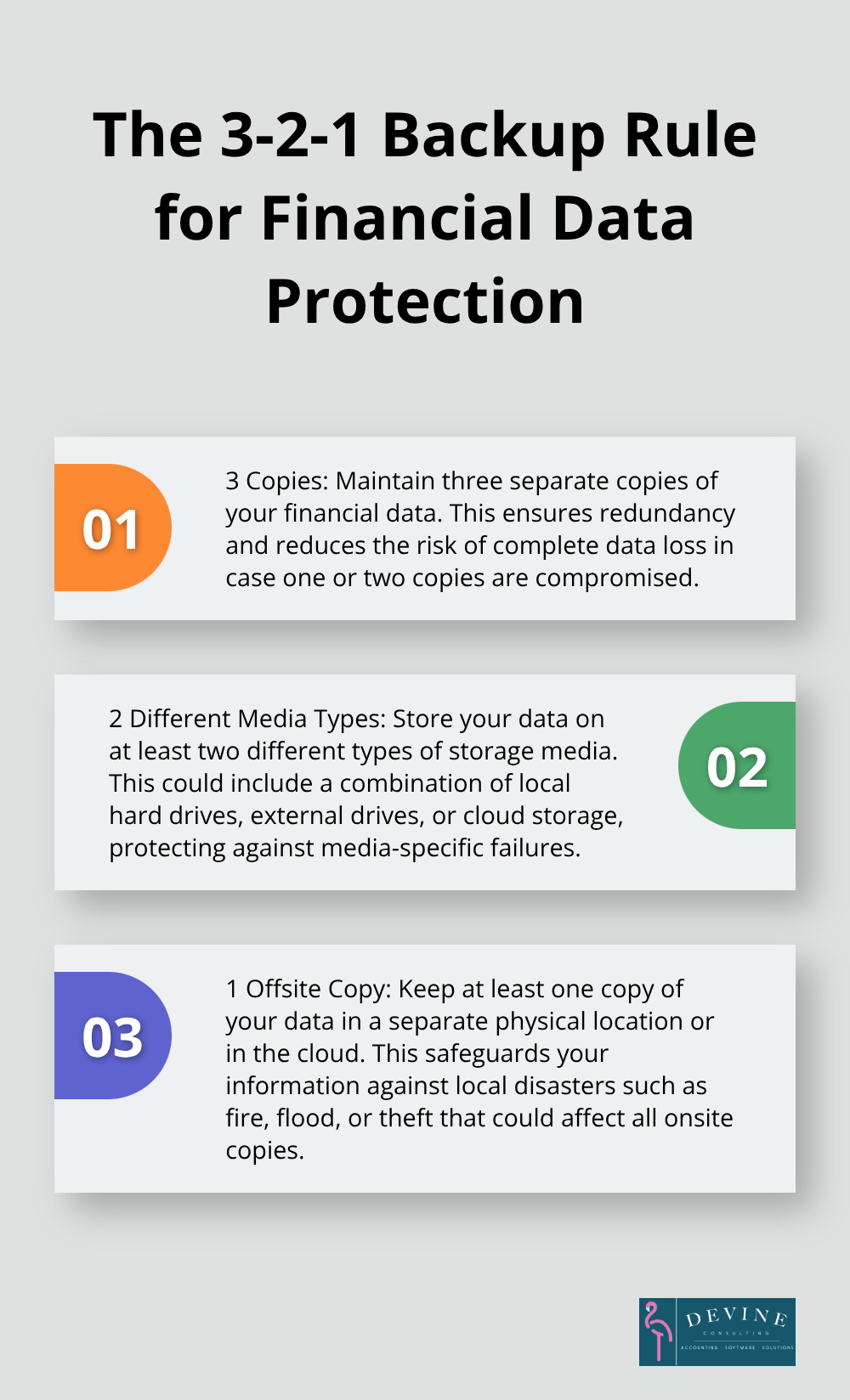

Backup Systems Save Businesses From Disaster

The 3-2-1 backup rule protects financial data through three copies stored on two different media types with one copy maintained offsite. Cloud-based accounting software costs $10-20 monthly but prevents significant losses that businesses face when hard drives fail without backups. Weekly automated backups capture all transactions, while daily backups protect companies that process over 100 transactions daily from data corruption. Test backup restoration quarterly to verify that files remain accessible and uncorrupted as many businesses discover backup failures only when disasters strike and recovery becomes impossible.

Final Thoughts

Organized financial records deliver measurable returns that transform business operations. Companies save $12,000 annually through reduced penalties and improved deduction tracking, while they cut document search time by 21%. These systems enable faster fraud detection, better cash flow management, and streamlined tax preparation that reduces professional fees by $2,400 yearly.

Strategic decision makers access accurate financial data within seconds rather than days when they implement proper systems. Monthly profit margin analysis reveals cost inefficiencies before they damage quarterly results. Cash flow projections prevent vendor payment delays and support better credit negotiations with suppliers (particularly during seasonal fluctuations).

Businesses start with cloud-based software like QuickBooks or hybrid systems that combine digital efficiency with physical compliance storage. They establish monthly review schedules, create consistent categorization systems, and implement 3-2-1 backup protocols that protect against data loss disasters. Devine Consulting provides comprehensive accounting solutions that handle bookkeeping and financial reporting, which allows businesses to focus on core operations while they master how to organize financial records through professional management systems.