How to Use Financial Statement Analysis for Internal Improvement

Financial statement analysis is a powerful tool for business improvement. It provides crucial information to internal users, helping them identify areas for growth and optimization.

At Devine Consulting, we’ve seen firsthand how companies can transform their operations by leveraging financial insights. This blog post will guide you through the process of using financial statement analysis to drive internal improvements and boost your business performance.

Key Financial Statements: The Foundation of Business Decision-Making

Financial statements form the cornerstone of informed business decisions. Let’s explore the three main financial statements and how they can propel your business performance.

The Balance Sheet: A Financial Health Snapshot

The balance sheet presents your company’s financial position at a specific moment. It lists assets (what you own), liabilities (what you owe), and equity (the difference between assets and liabilities). An analysis of your balance sheet allows you to evaluate your company’s liquidity, solvency, and overall financial strength.

Consider this scenario: You notice a trend of increasing liabilities without a corresponding rise in assets. This situation might signal the need to reassess your debt management strategy. Conversely, consistently growing equity could indicate robust financial health and potential for expansion.

The Income Statement: Profitability Under the Microscope

The income statement (also known as the profit and loss statement) displays your company’s revenues, expenses, and profits over a specific period. This statement proves essential for understanding your business’s profitability and operational efficiency.

A thorough examination of your income statement can uncover opportunities for cost reduction or revenue growth. For instance, if your cost of goods sold increases faster than your revenue, you might need to reconsider your pricing strategy or find ways to cut production costs.

The Cash Flow Statement: Tracking the Money Trail

The cash flow statement illustrates how cash moves in and out of your business through operating, investing, and financing activities. This statement plays a vital role in understanding your company’s liquidity and ability to generate cash.

Positive cash flow from operations generally indicates that your core business activities generate sufficient cash. However, consistent negative cash flow from operations might necessitate a reassessment of your business model or improvements in working capital management.

Leveraging Financial Statements for Business Growth

Regular analysis of these key financial statements provides valuable insights into your business’s financial health and performance. This analysis serves as the foundation for data-driven decision-making and strategic planning, helping you identify areas for improvement. Highly data-driven organizations are three times more likely to report significant improvements in decision-making compared to those who rely less on data.

For example, a construction company might use balance sheet analysis to optimize its equipment investments (assets) based on project needs and financial capacity. An oil and gas firm could use income statement analysis to adjust its pricing strategy in response to market fluctuations. A real estate company might leverage cash flow statement insights to time property acquisitions and sales more effectively.

While many businesses struggle with financial statement analysis, professional services like Devine Consulting offer expert guidance in interpreting these crucial documents. Their industry-specific knowledge ensures that businesses can extract maximum value from their financial data, driving growth and profitability.

As we move forward, we’ll explore how to use specific financial ratios derived from these statements to gain even deeper insights into your business performance.

Financial Ratios That Drive Business Success

Financial ratios provide powerful tools for internal analysis, offering a clear picture of a company’s financial health and performance. These ratios can transform decision-making processes and drive significant improvements across various industries.

Profitability: The Bottom Line

Profitability ratios indicate a business’s ability to generate earnings relative to its revenue, operating costs, balance sheet assets, or shareholders’ equity. The gross profit margin reveals the percentage of revenue retained after accounting for the cost of goods sold. A higher margin indicates better efficiency in turning raw materials into income.

Net profit margin considers all expenses, not just the cost of goods sold. It shows how much of each dollar earned translates into profits. Companies with higher net profit margins often have more flexibility to invest in growth or weather economic downturns.

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profits. The ROA ratio compares a company’s net income to its assets. A higher ROA suggests better asset utilization.

Liquidity: Staying Afloat

Liquidity ratios assess a company’s ability to meet short-term obligations. The current ratio (calculated by dividing current assets by current liabilities) indicates whether a company can cover its short-term debts with its short-term assets. A ratio below 1 might signal potential cash flow problems.

The quick ratio, also known as the acid-test ratio, provides a more stringent measure of liquidity. It is a metric used to see if a company is positioned to sell assets within 90 days to meet immediate expenses. This ratio holds particular importance for businesses with slow-moving inventory. Retailers can significantly improve their quick ratio by implementing just-in-time inventory systems, reducing carrying costs while maintaining sales levels.

Efficiency: Maximizing Resources

Efficiency ratios measure how well a company uses its assets and manages its liabilities. Inventory turnover ratio shows how many times a company’s inventory sells and replaces over a period. A higher ratio generally indicates better inventory management. However, companies must balance this with maintaining sufficient stock to meet customer demand.

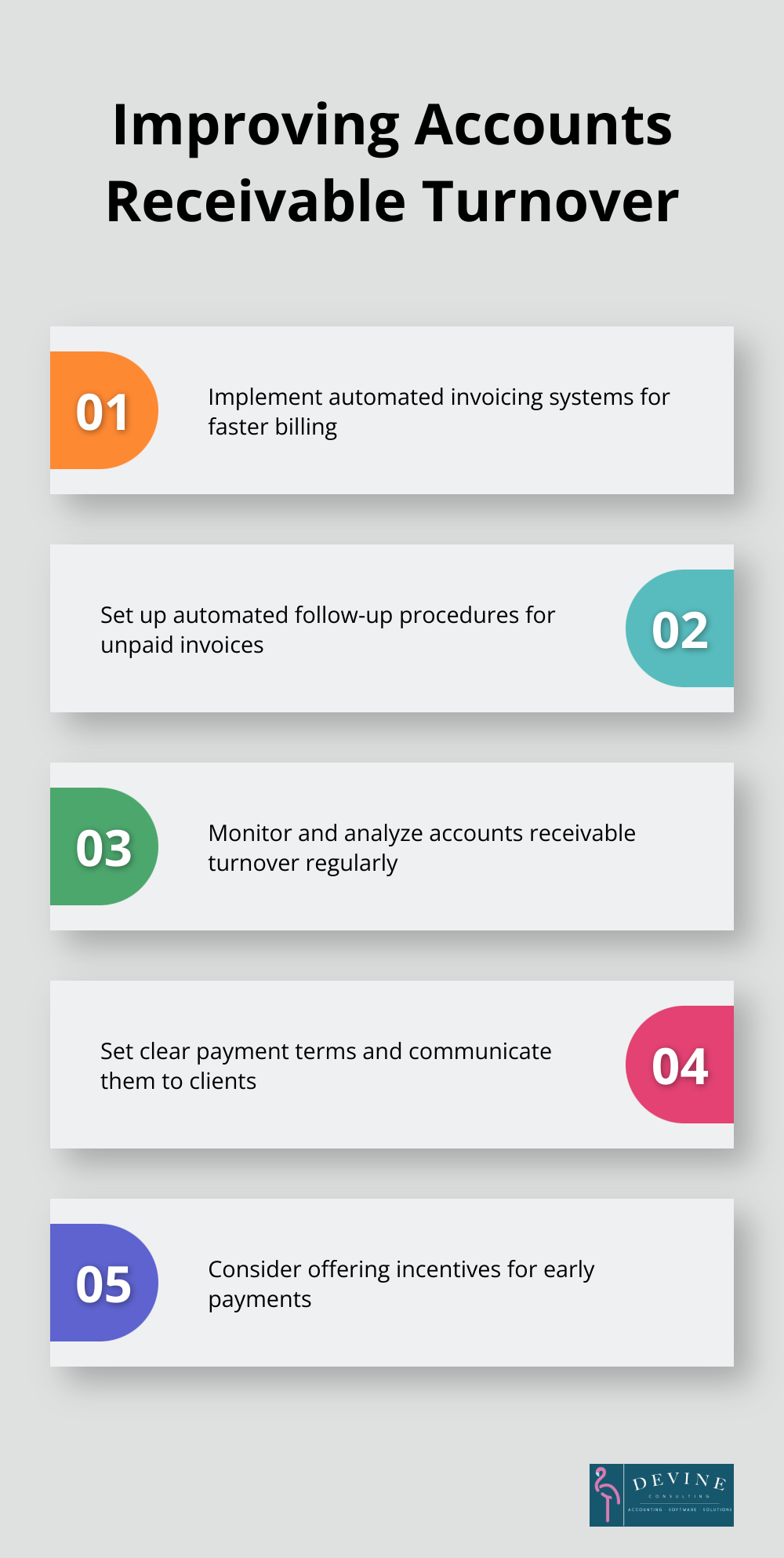

Accounts receivable turnover measures how quickly a company collects payments. A higher ratio suggests more efficient collection practices. A construction company improved their accounts receivable turnover from 6 to 9 times per year by implementing automated invoicing and follow-up systems, significantly boosting their cash flow.

Solvency: Long-Term Stability

Solvency ratios assess a company’s long-term financial stability and its ability to meet long-term obligations. The debt-to-equity ratio compares a company’s total liabilities to its shareholder equity, indicating the degree to which the company finances its operations through debt versus wholly-owned funds. A lower ratio generally means less risk, though the optimal ratio varies by industry.

The interest coverage ratio measures how easily a company can pay interest on its outstanding debt. Companies calculate it by dividing earnings before interest and taxes (EBIT) by interest expenses. A higher ratio indicates a better ability to meet interest payments. Companies can improve this ratio by restructuring debt and optimizing operations to increase EBIT.

Understanding and regularly monitoring these financial ratios can provide valuable insights for internal improvement. They serve as early warning systems for potential issues and highlight areas of strength that companies can leverage for growth. However, companies should analyze these ratios in context, considering industry standards and company-specific factors.

As we move forward, we’ll explore how to apply these financial insights to drive concrete business improvements and develop effective action plans.

How Financial Analysis Drives Business Improvement

Financial statement analysis serves as a practical tool for driving real business improvements. Companies can transform their operations by effectively applying financial insights. This chapter explores how to use financial analysis to boost business performance.

Identify Strengths and Weaknesses

The first step in leveraging financial analysis involves the identification of a company’s strengths and weaknesses. Ratio analysis can examine a company’s balance sheet and income statement to learn about its liquidity, operational efficiency, and profitability.

For example, strong profitability ratios coupled with lagging efficiency ratios might indicate effective product pricing but struggles with inventory management. A construction company discovered through ratio analysis that their equipment utilization was suboptimal, leading to unnecessary costs. The implementation of a more efficient equipment scheduling system improved their asset turnover ratio by 20% within six months.

Benchmark Against Industry Standards

After identifying a company’s financial profile, the next step involves benchmarking against industry standards. This comparison provides context for performance and helps set realistic improvement goals.

Industry associations often publish benchmark data. The Construction Financial Management Association, for instance, releases annual financial benchmarks for the construction industry. A mid-sized construction firm used these standards and realized their accounts receivable turnover fell significantly below the industry average. They implemented stricter credit policies and more aggressive collection procedures, which brought their ratio in line with industry standards within a year.

Develop Targeted Action Plans

A clear understanding of financial position and industry comparisons allows for the development of targeted action plans. These plans should address weaknesses, capitalize on strengths, and align with overall business strategy.

An oil and gas company found their debt-to-equity ratio exceeded the industry average, indicating potential long-term financial risk. Their action plan included gradual debt reduction, exploration of equity financing options, and improved cash flow management. Within 18 months, they reduced their debt-to-equity ratio by 15%, significantly improving their financial stability.

Monitor and Adjust Continuously

Financial improvement requires an ongoing process. Regular monitoring of financial metrics allows for progress tracking and necessary strategy adjustments.

We recommend monthly reviews of key financial ratios and quarterly comprehensive analyses. This frequency allows for timely interventions while providing enough data to identify meaningful trends.

A real estate firm implemented a monthly financial review process. They discovered a gradual decline in their gross profit margin over several months, which prompted an investigation into rising costs. The identification and addressing of inefficiencies in their property management processes reversed the trend and improved their gross profit margin by 3 percentage points over the following year.

Seek Expert Guidance

While many businesses struggle with financial statement analysis, professional services (such as Devine Consulting) offer expert guidance in interpreting these crucial documents. Industry-specific knowledge ensures that businesses can extract maximum value from their financial data, driving growth and profitability.

Final Thoughts

Financial statement analysis provides information to internal users to improve business performance. Companies can make data-driven decisions that lead to tangible improvements across various aspects of their operations by leveraging insights from balance sheets, income statements, and cash flow statements. The power of financial ratios reveals efficiency in revenue generation, cost management, and asset utilization.

Companies should start by regularly reviewing their financial statements to implement effective financial analysis. They need to identify strengths and weaknesses through ratio analysis and benchmark performance against industry standards to gain context and set realistic goals. Developing targeted action plans based on these insights will address weaknesses and capitalize on strengths.

Financial improvement requires an ongoing process of continuous monitoring and adjustment. Professional accounting services offer expert guidance in financial statement analysis and interpretation. Their industry-specific knowledge helps businesses extract maximum value from financial data, which can drive growth and profitability.