How to Write an Effective Financial Report

Financial reports are the backbone of business decision-making. At Devine Consulting, we’ve seen how well-crafted reports can drive success and growth for organizations.

This guide will walk you through how to write finance reports that are clear, comprehensive, and compliant with regulatory standards. We’ll cover everything from understanding your audience to mastering key components and best practices.

Why Financial Reports Are Essential

Financial reports serve as the foundation for strategic decision-making in businesses of all sizes. Through financial reporting, businesses can monitor their financial health, ensure compliance with regulatory requirements, and provide critical insights that drive success and growth for organizations.

Tailoring Reports to Your Audience

The creation of an effective financial report starts with a clear understanding of its readers. Investors, board members, and internal management have different needs and levels of financial literacy. Investors often focus on profitability and growth metrics, while operations managers require detailed cost breakdowns.

A study by the Financial Executives Research Foundation revealed that 72% of CFOs believe audience-specific financial reports improve decision-making. This underscores the importance of using language and metrics that resonate with each group (e.g., ROI for investors, operational efficiency for managers).

Setting Clear Financial Objectives

Every financial report should have a specific purpose. The objectives shape the content and structure of your report. For example:

- Investment seeking reports highlight growth potential and market opportunities

- Internal management reports focus on operational efficiency and cost control measures

- Quarterly result reports emphasize performance metrics and year-over-year comparisons

Navigating Regulatory Requirements

Compliance is non-negotiable in financial reporting. Different industries and company sizes face varying regulatory requirements. The Securities and Exchange Commission (SEC) mandates specific disclosures for public companies, while private companies may adhere to different standards.

Companies must ensure their reports meet all relevant standards, whether it’s GAAP for U.S. companies or IFRS for international operations. This attention to detail prevents costly compliance issues and maintains trust with stakeholders.

The Power of Well-Crafted Reports

Financial reports, when created correctly, become powerful tools. They:

- Provide actionable insights

- Guide strategic decisions

- Ensure regulatory compliance

Understanding your audience, setting clear objectives, and navigating regulatory requirements form the foundation of effective financial reporting. These elements work together to create reports that drive businesses forward and support informed decision-making at all levels of an organization.

As we move forward, we’ll explore the key components that make up a comprehensive financial report, ensuring you have all the tools necessary to create impactful financial documents.

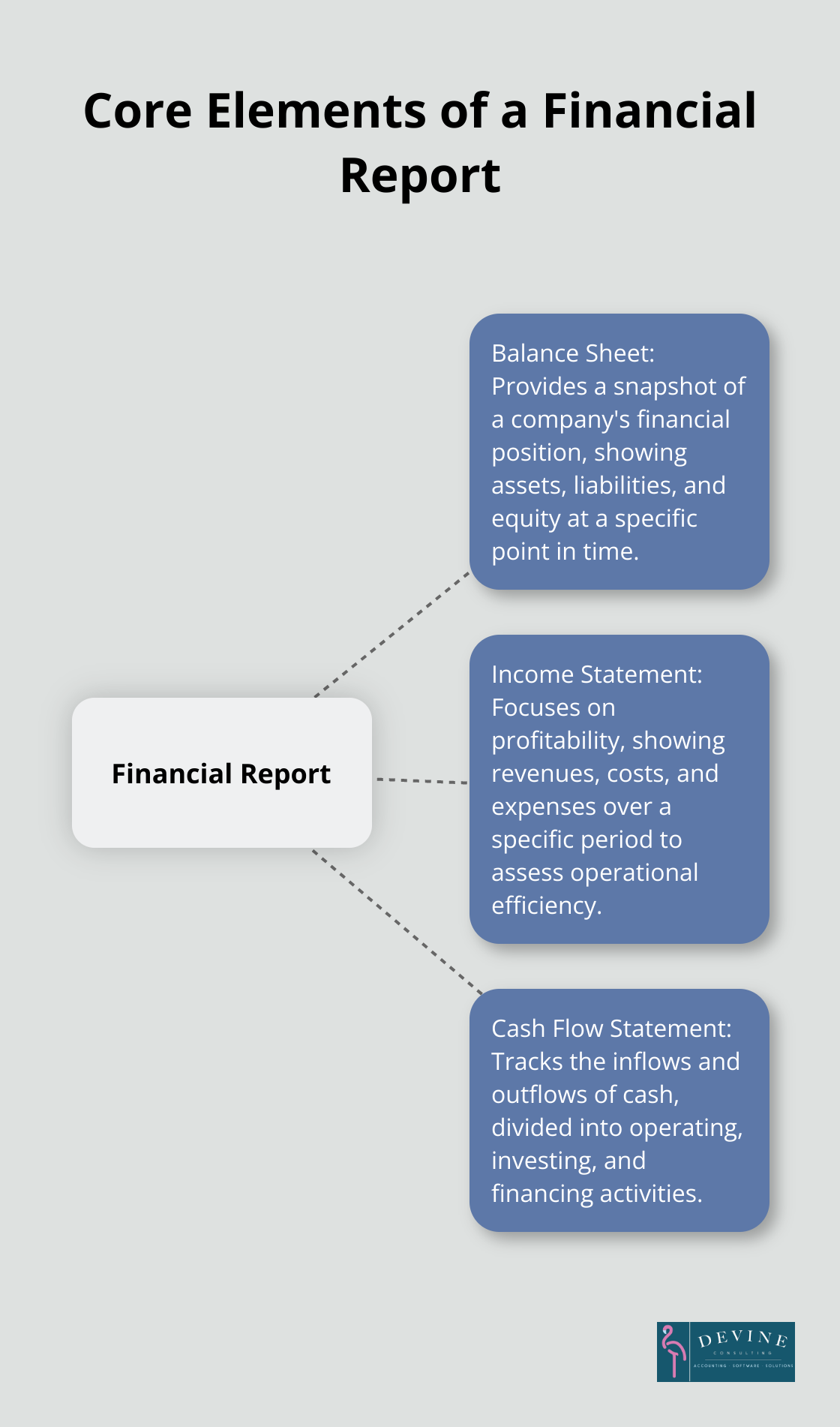

Core Elements of a Financial Report

Financial statements can be used by managers to track performance, budgets, and other metrics, and as tools to make decisions, motivate teams, and maintain a focus on organizational goals. They offer a comprehensive view of a company’s financial health, performance, and future prospects. Let’s examine the essential components that constitute a robust financial report.

Balance Sheet: Financial Position Snapshot

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the difference between the two (equity).

Key elements to focus on in the balance sheet include:

- Current ratio: This measures a company’s ability to pay short-term obligations. A ratio below 1 might indicate liquidity issues.

- Debt-to-equity ratio: This shows how much a company finances its operations through debt versus wholly-owned funds. A high ratio could signal higher risk.

- Working capital: This is the difference between current assets and current liabilities, indicating operational efficiency and short-term financial health.

Income Statement: Profitability Focus

The income statement (also known as the profit and loss statement) shows a company’s revenues, costs, and expenses over a specific period. It’s essential for assessing profitability and operational efficiency.

When analyzing the income statement, pay attention to:

- Gross profit margin: This shows the percentage of revenue retained after accounting for the cost of goods sold. Higher margins often indicate better efficiency.

- Operating expenses: These are the costs associated with running the business. Look for trends and areas where costs might be reduced.

- Net profit margin: This is the percentage of revenue that translates into profit after all expenses are deducted. It’s a key indicator of overall profitability.

Cash Flow Statement: Money Trail

The cash flow statement tracks the inflows and outflows of cash during a specific period. It’s divided into three sections: operating activities, investing activities, and financing activities.

Key aspects to consider in the cash flow statement include:

- Operating cash flow: This shows cash generated from core business operations. A positive and growing operating cash flow is generally a good sign.

- Free cash flow: This is the cash left over after a company pays for its operating expenses and capital expenditures. It’s a good indicator of financial health and the ability to generate shareholder value.

- Cash conversion cycle: This metric shows how quickly a company can convert its investments in inventory and other resources into cash flows from sales.

Notes to Financial Statements: Detail Insights

The notes to financial statements provide additional information that’s essential for a full understanding of a company’s financial position. They offer context and explanations for the numbers presented in the main financial statements.

Key areas to focus on in the notes include:

- Accounting policies: These explain the methods used to prepare the financial statements.

- Debt details: Look for information on interest rates, maturity dates, and any covenants attached to the company’s debt.

- Contingent liabilities: These are potential future obligations that may or may not occur (such as pending lawsuits or government investigations).

Creating comprehensive and accurate financial reports is important for informed decision-making and stakeholder trust. Companies like Devine Consulting specialize in crafting tailored financial reports that provide clear insights and drive strategic planning. Their expertise spans various industries, ensuring that financial reporting meets both industry standards and specific business needs.

As we move forward, we’ll explore best practices for writing financial reports that are clear, concise, and impactful. These techniques will help you transform raw financial data into powerful tools for decision-making and communication.

Crafting Clear and Impactful Financial Reports

Simplify Complex Concepts

Financial reports must transform complex data into understandable insights. Use plain language to explain financial concepts. For example, replace “accounts receivable turnover ratio” with “how quickly customers pay their bills.” This approach makes reports accessible to non-financial stakeholders.

Leverage Visual Elements

While visual elements can be helpful in financial reports, it’s important to note that the claim about visual information processing being 60,000 times faster than text processing is a myth. However, well-designed charts, graphs, and infographics can still be valuable tools for presenting financial data effectively. Use a pie chart to show expense breakdowns or a line graph to illustrate revenue trends over time.

Tools like Tableau or Microsoft Power BI help create compelling visualizations. Ensure that your visuals add real value to the report (not just decorative elements).

Provide Context and Analysis

Numbers alone don’t tell the full story. Contextualize your data by explaining what the numbers mean for the business. If revenue increases by 15%, explain the factors behind this growth. Was it due to a new product launch, expanded market reach, or improved sales strategies?

Don’t just report what happened; analyze why it happened and what it means for the future. This forward-looking approach transforms your financial report from a mere record of past events into a strategic planning tool.

Ensure Accuracy and Consistency

Accuracy is paramount in financial reporting. Implement rigorous checks and balances to ensure all data is correct. Use automated systems where possible to reduce human error. Accounting software (such as QuickBooks) helps maintain accuracy across various financial statements.

Consistency is equally important. Use the same terminology, metrics, and presentation style across all reports. This practice makes it easier for readers to compare data over time and across different reports.

Tailor Reports to Your Audience

Create reports that cater to the specific needs of your audience. Investors often focus on profitability and growth metrics, while operations managers require detailed cost breakdowns. Use language and metrics that resonate with each group (e.g., ROI for investors, operational efficiency for managers).

The goal of a financial report is to present numbers and tell a story about your company’s financial health and future prospects. These practices will help you create reports that are accurate, compliant, insightful, and actionable.

Final Thoughts

Financial report writing requires a deep understanding of key elements and best practices. Effective reports provide a comprehensive view of a company’s financial health, inform strategic decisions, and build trust with stakeholders. Clear language, visual elements, and contextual analysis transform complex data into actionable insights for various audiences.

Accuracy and consistency in financial reporting build credibility and trust. We at Devine Consulting specialize in delivering tailored accounting solutions for various industries. Our team can help you create impactful financial reports that drive growth and success for your business.

The journey to master how to write finance reports is ongoing. With the right approach and resources, you can transform your financial reporting into a strategic asset. Devine Consulting offers valuable insights and support to enhance your financial report writing skills (and overall financial management).