Nonprofit Accounting Services Explained

Nonprofit organizations face unique financial challenges that require specialized expertise. Standard business accounting practices don’t address fund restrictions, grant compliance, or specific reporting requirements.

We at Devine Consulting understand these complexities. Professional nonprofit accounting services help organizations maintain compliance while focusing on their mission-driven work.

What Makes Nonprofit Accounting Different

Nonprofit accounting operates under fundamentally different rules than standard business practices. The Financial Accounting Standards Board requires nonprofits to track funds according to donor restrictions, not just revenue and expenses. This means organizations must maintain separate records for restricted funds designated for specific programs and unrestricted funds available for general operations. IRS regulations mandate that nonprofits with over $200,000 in annual revenue file Form 990, which demands detailed breakdowns of functional expenses across program services, management, and fundraising activities.

Fund Restrictions Transform Financial Management

Fund accounting becomes the backbone of nonprofit financial operations. Donors contribute money for specific purposes, and organizations must track these restrictions throughout the entire financial cycle. Restricted funds cannot cover general operating expenses, regardless of cash flow challenges. Organizations need robust systems to monitor grant requirements, donor stipulations, and endowment restrictions (software like QuickBooks Nonprofit or Aplos maintains this separation automatically).

Financial Statements Focus on Accountability

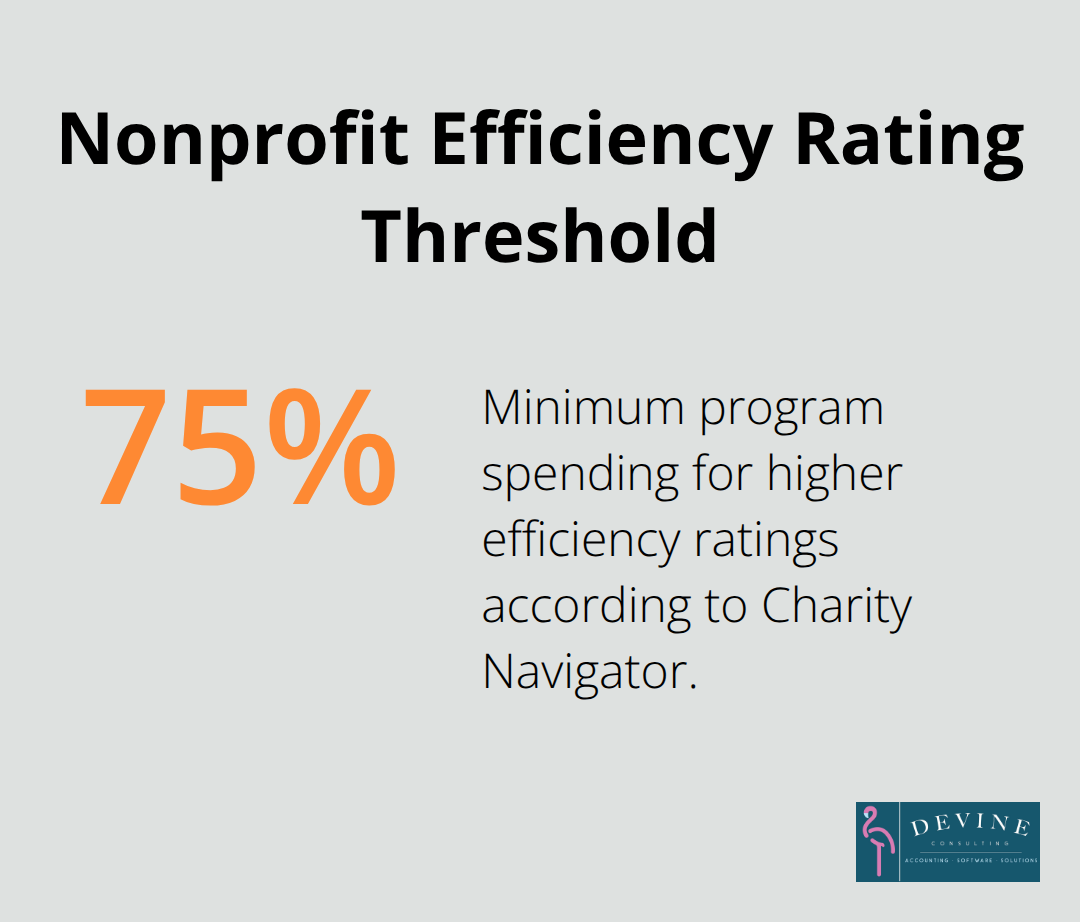

Nonprofit financial statements prioritize accountability over profitability. The Statement of Activities replaces income statements and shows changes in net assets rather than profits. The Statement of Functional Expenses breaks down costs into program services, administrative functions, and fundraising activities. Charity Navigator uses these ratios to evaluate nonprofit efficiency-organizations that spend less than 75% on programs receive lower ratings. Financial position statements must separate permanently restricted, temporarily restricted, and unrestricted net assets (these formats help stakeholders understand how effectively organizations use donated funds).

Compliance Requirements Demand Specialized Knowledge

Tax compliance for nonprofits extends far beyond basic filing requirements. Organizations must maintain their 501(c)(3) status through proper documentation and operational practices. State registration requirements vary significantly, with some states requiring annual reports and fundraising permits. Professional accounting services become essential as these requirements grow more complex and the stakes for non-compliance increase. Creating comprehensive finance reports helps organizations maintain transparency and meet regulatory standards.

Essential Nonprofit Accounting Services

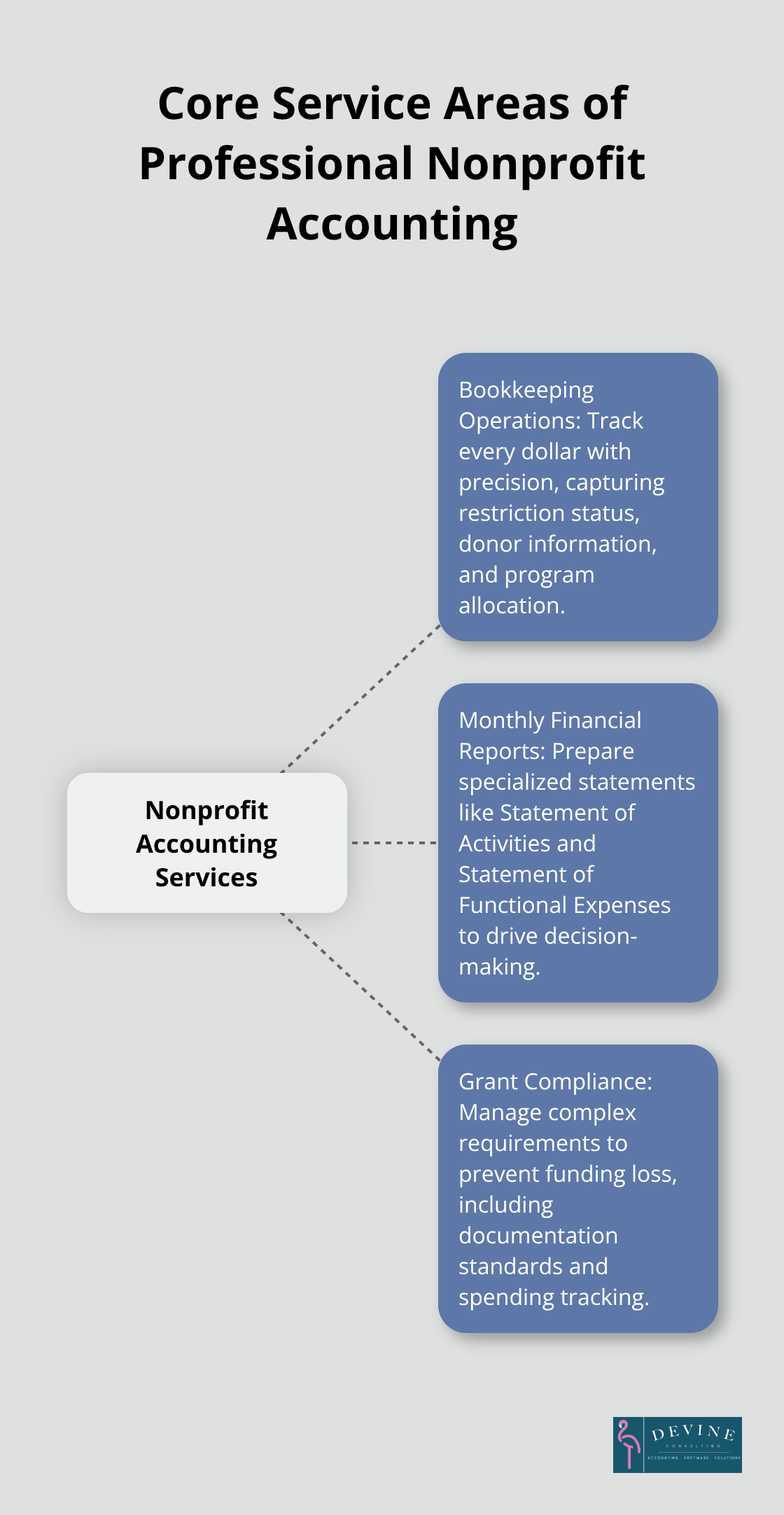

Professional nonprofit accounting involves three core service areas that directly impact organizational success. Daily bookkeeping operations require meticulous transaction recording that captures donor intent, grant restrictions, and program allocations. Accounting firms that specialize in nonprofits use software systems that automatically categorize restricted versus unrestricted funds and prevent accidental misuse of donor contributions. Monthly reconciliation processes become more complex because organizations must verify that restricted funds remain within designated accounts and track spending against specific grant requirements.

Bookkeeping Operations Track Every Dollar

Transaction recording for nonprofits demands precision that exceeds standard business practices. Each donation entry must capture restriction status, donor information, and intended program allocation. Professional bookkeepers maintain separate ledgers for restricted and unrestricted funds while documenting the source and purpose of every contribution. QuickBooks Nonprofit and Aplos provide automated categorization features that reduce manual errors and maintain compliance with fund accounting principles.

Monthly Financial Reports Drive Decision Making

Financial reports for nonprofits demand specialized knowledge beyond standard business statements. The Statement of Activities must show revenue and expenses by restriction category, while the Statement of Functional Expenses breaks costs into program services, management, and fundraising categories. Organizations that maintain proper expense allocation ratios perform better in charity evaluations. The program expense ratio measures the percentage of expenses that a nonprofit organization is spending on its core mission. Professional accounting services prepare these monthly reports with precise categorization and help boards make informed decisions about program expansion or cost reduction strategies.

Grant Compliance Prevents Funding Loss

Grant management represents the most technical aspect of nonprofit accounting services. Federal grants require specific documentation standards to ensure compliance with government regulations and evaluate financial information, including expenses paid for with federal award funds. Professional services maintain grant tracking systems that monitor spending rates, match requirements, and allowable cost categories. Organizations that miss compliance deadlines risk future funding opportunities, which makes this service area essential for grant-dependent nonprofits.

The complexity of these services raises important questions about implementation. Organizations must evaluate whether to handle these functions internally or partner with specialized providers who understand nonprofit requirements.

How Do You Select the Right Nonprofit Accounting Partner

Nonprofit accounting firms vary dramatically in their capabilities and sector knowledge. Organizations that choose generalist accounting firms often face compliance issues because standard business accountants lack experience with fund restrictions and Form 990 requirements. Specialized nonprofit accounting firms understand the complexities of donor restrictions, grant compliance, and functional expense allocation. These firms maintain current knowledge of regulations and use software systems designed specifically for nonprofit operations. Organizations with specialized providers experience fewer compliance issues compared to those with general business accounting firms.

Software Integration Determines Operational Efficiency

Modern nonprofit accounting requires sophisticated technology platforms that integrate donor management, grant tracking, and financial reporting functions. Leading firms use systems like Aplos, QuickBooks Nonprofit, or Sage Intacct that automatically separate restricted and unrestricted funds while they generate compliant financial statements. The technology platform determines reporting speed and accuracy levels. Firms that offer cloud-based solutions provide real-time access to financial data and enable board members to review reports remotely. Organizations should evaluate whether potential partners can integrate with existing donor management systems and provide automated grant tracking capabilities that prevent compliance violations.

Service Models Impact Long-Term Costs

Nonprofit accounting services operate under three primary models: full-service outsourcing, fractional CFO arrangements, and project-based consulting. Full-service providers handle all bookkeeping, reporting, and compliance functions for organizations with limited internal capacity. Fractional CFO services combine monthly accounting with strategic financial planning for organizations that need executive-level guidance. Project-based consulting works best for organizations with internal accounting staff who need specialized assistance with audits, Form 990 preparation, or grant compliance. Pricing structures vary significantly, with full-service arrangements typically costing $2,000-$8,000 monthly (depending on transaction volume and complexity levels). Organizations must evaluate their internal capacity and growth projections when they select service levels that balance cost control with operational needs.

Experience Validates Technical Competence

Nonprofit accounting partners must demonstrate proven experience with organizations of similar size and complexity. Firms that work exclusively with nonprofits understand the nuances of restricted fund management and can navigate complex grant requirements without delays. Ask potential partners for references from current nonprofit clients and verify their experience with your specific funding sources. Organizations should request examples of financial statements and Form 990 returns the firm has prepared to assess quality standards. Partners with deep nonprofit experience can anticipate compliance challenges and provide proactive solutions that prevent costly mistakes.

Final Thoughts

Professional nonprofit accounting services deliver measurable benefits that extend far beyond basic compliance. Organizations that partner with specialized providers reduce their risk of regulatory violations while they gain access to sophisticated financial systems. These services enable nonprofits to demonstrate accountability to donors through accurate fund tracking and transparent expense allocation.

The impact on organizational growth becomes evident through improved financial decision-making capabilities. Professional accounting partners provide monthly reports that help boards identify funding trends, optimize program spending, and plan strategic expansions. Organizations with proper financial management systems attract larger grants and retain donors at higher rates because they can demonstrate effective stewardship of contributed funds.

Nonprofits ready to strengthen their financial operations should evaluate current accounting practices and identify gaps in compliance or reporting capabilities. Organizations must assess whether their existing systems adequately track restricted funds and generate required financial statements (this evaluation reveals areas that need immediate attention). Devine Consulting offers comprehensive accounting solutions that help nonprofits achieve financial stability while they focus on their core mission work.