Outsourced Accounting: Is It Right for Your Business?

At Devine Consulting, we’ve seen businesses grapple with the decision to outsource their accounting functions.

Outsourced accounting services have become increasingly popular, offering a range of benefits for companies of all sizes.

This blog post will explore the pros and cons of outsourcing your accounting, helping you determine if it’s the right move for your business.

What Is Outsourced Accounting?

Definition and Core Components

Outsourced accounting represents a strategic business decision where companies entrust their financial management tasks to external experts. This approach allows businesses to tap into specialized knowledge for handling a wide range of financial responsibilities, from basic bookkeeping to complex financial analysis.

Scope of Outsourced Services

The scope of outsourced accounting services encompasses various financial tasks:

- Daily bookkeeping

- Payroll processing

- Tax preparation

- Financial reporting

- Cash flow management

- Budgeting and forecasting

In some cases, providers offer CFO-level strategic advice. Different industries often require specialized accounting services. For instance, construction firms might need job costing and progress billing, while real estate companies could benefit from property management accounting and investment analysis.

Types of Outsourced Accounting Services

Outsourced accounting services typically include:

- Bookkeeping: This involves recording daily transactions, reconciling bank statements, and maintaining the general ledger.

- Payroll: Accountants process employee payments, manage tax withholdings, and ensure compliance with labor laws.

- Accounts Payable/Receivable: This includes managing vendor payments and customer invoicing.

- Financial Reporting: Accountants prepare income statements, balance sheets, and cash flow statements.

- Tax Preparation: This service handles tax filings and ensures compliance with tax regulations.

- Financial Analysis: Outsourced accountants provide insights on financial performance and assist with strategic decision-making.

In-House vs. Outsourced Accounting

The primary distinction between in-house and outsourced accounting lies in the level of control and the breadth of expertise available. In-house teams offer more direct oversight but can prove costly to maintain and may lack specialized knowledge in certain areas.

Outsourced accounting, conversely, provides access to a team of experts with diverse industry experience. This approach can particularly benefit small to medium-sized businesses that cannot afford to hire a full in-house accounting department.

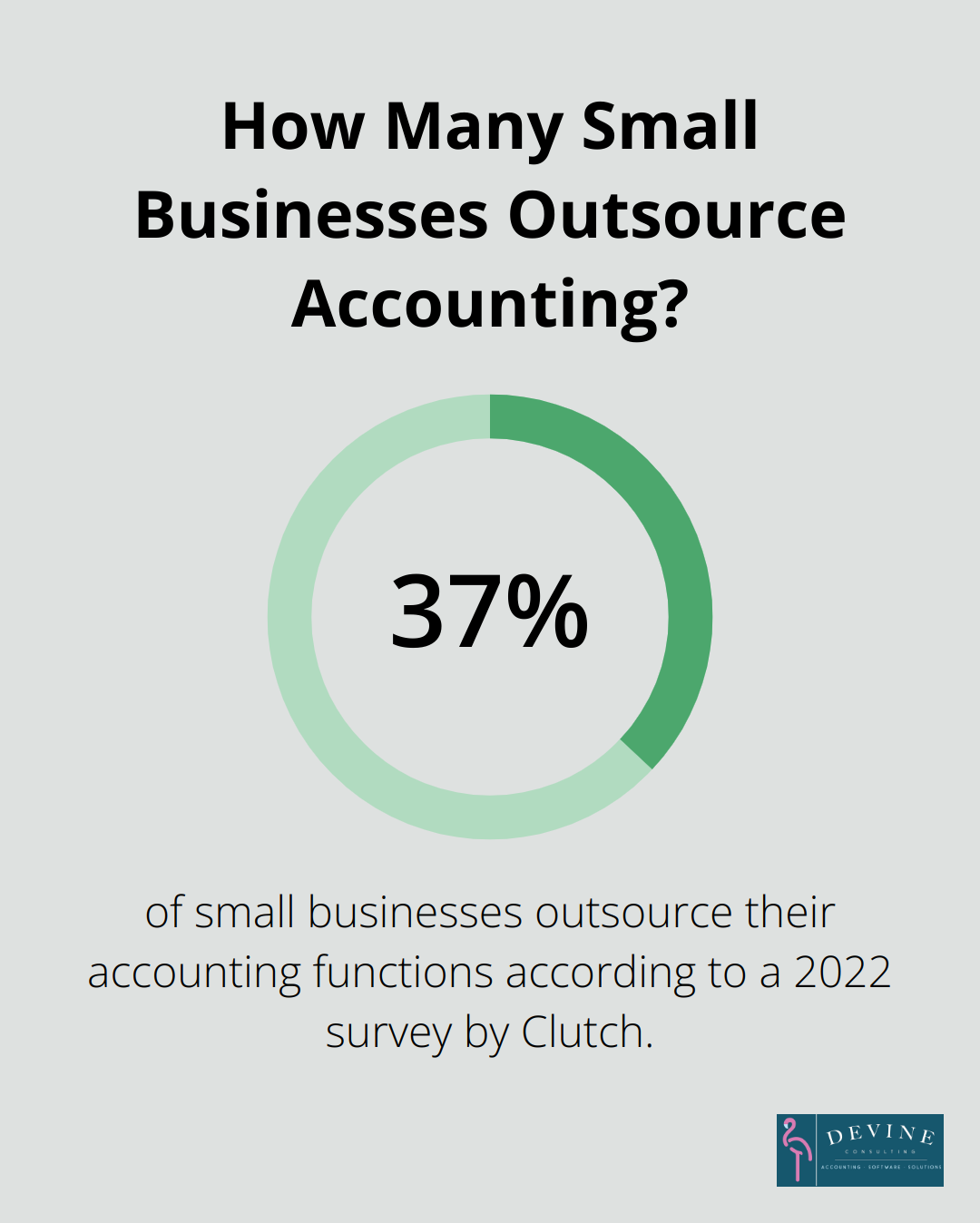

A 2022 survey by Clutch revealed that 37% of small businesses outsource their accounting functions. This trend continues to grow as many businesses recognize the cost-effectiveness and expertise that outsourcing can provide.

Tailored Solutions for Business Needs

It’s important to note that outsourcing doesn’t represent a one-size-fits-all solution. Each business must evaluate its specific needs, budget, and growth plans to determine the best approach. Companies like Devine Consulting offer tailored solutions that can scale as businesses grow, ensuring the right level of financial support at every stage.

As we explore the benefits of outsourced accounting in the next section, you’ll gain a clearer picture of how this approach can transform your financial management and drive business growth.

Why Outsource Your Accounting?

Outsourcing your accounting can transform your business operations. Let’s explore why outsourcing might be the game-changer your business needs.

Cost Savings That Matter

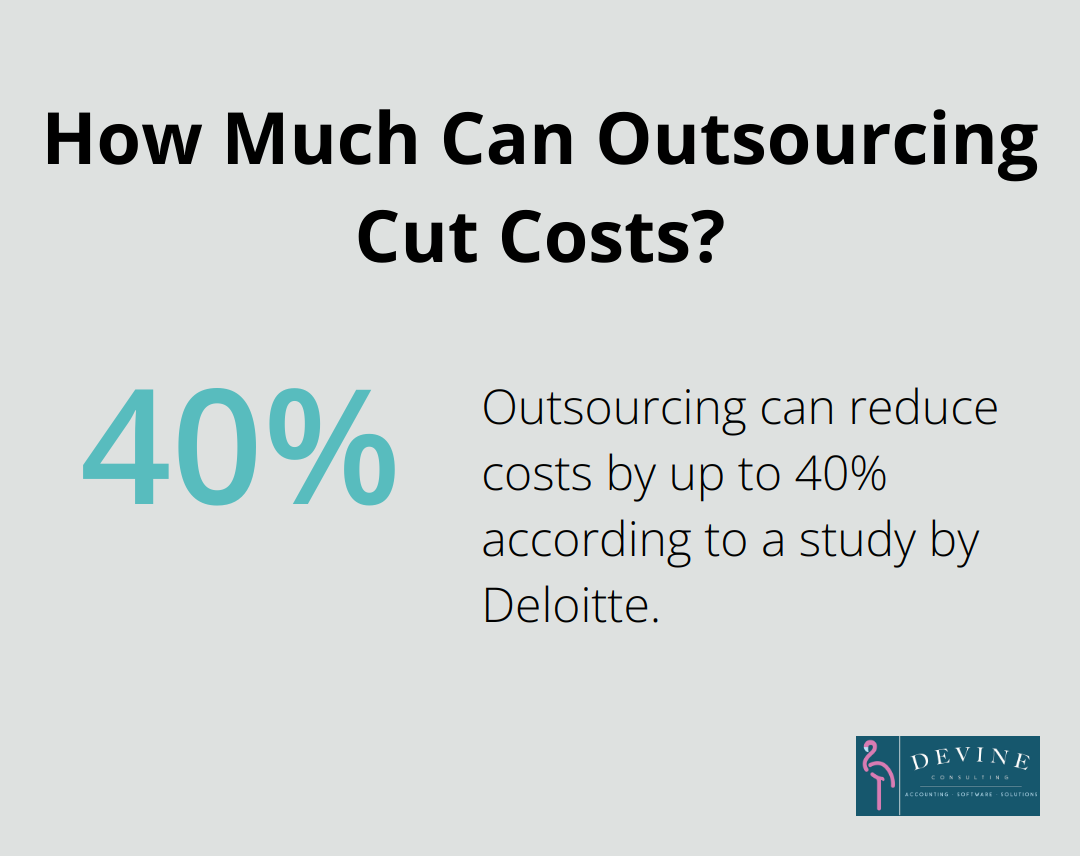

Outsourcing your accounting typically costs less than maintaining an in-house team. A study by Deloitte found that outsourcing can reduce costs by up to 40%. This isn’t just about cutting salaries. You’ll save on training, benefits, office space, and expensive accounting software. For example, a mid-sized construction company saved $150,000 annually by outsourcing their accounting to a specialized firm.

Top-Tier Expertise at Your Fingertips

When you outsource, you don’t just hire an accountant; you gain access to a team of financial experts who bring diverse skills and industry-specific knowledge. This team stays up-to-date with the latest tax laws, accounting standards, and industry-specific regulations. Oil and gas companies benefit from accountants who understand complex revenue recognition rules and joint interest billing. Real estate firms get experts in property management accounting and investment analysis.

Scalability for Your Growing Business

As your business grows, your accounting needs change. Outsourced accounting services can scale with you. During peak seasons (like tax time), you have extra support without the need to hire temporary staff. A retail business doubled in size over two years. Their outsourced accounting team seamlessly scaled up, handling the increased transaction volume without any disruption to the business.

Focus on What You Do Best

Accounting can consume time. By outsourcing, you free up valuable hours to focus on core business activities, leading to improved productivity and growth. According to Deloitte’s CFO Survey, CFOs expect labour costs to remain elevated, leading to a sustained investment in new technology.

Enhanced Financial Reporting and Insights

Outsourced accounting firms often use advanced software and technologies that might be too expensive for individual businesses. This leads to more accurate, timely, and insightful financial reports. Many firms provide real-time financial dashboards, allowing clients to make data-driven decisions quickly. One manufacturing client increased their profit margins by 15% after implementing these insights.

Outsourcing your accounting isn’t just about cutting costs. It’s about gaining a competitive edge through expert financial management. Whether you’re in construction, real estate, or any other industry, the right outsourced accounting partner can drive your business forward. However, while the benefits are clear, it’s important to consider potential drawbacks. In the next section, we’ll examine some challenges businesses might face when outsourcing their accounting functions.

Navigating Outsourced Accounting Challenges

Data Security: Protecting Your Financial Information

Data security stands as a primary concern when outsourcing accounting. To minimize risks, businesses must thoroughly evaluate potential accounting partners. Look for firms with robust security measures, including encryption, multi-factor authentication, and regular security audits. Ask about their data handling policies and ensure they comply with relevant regulations like GDPR or CCPA.

Maintaining Financial Control

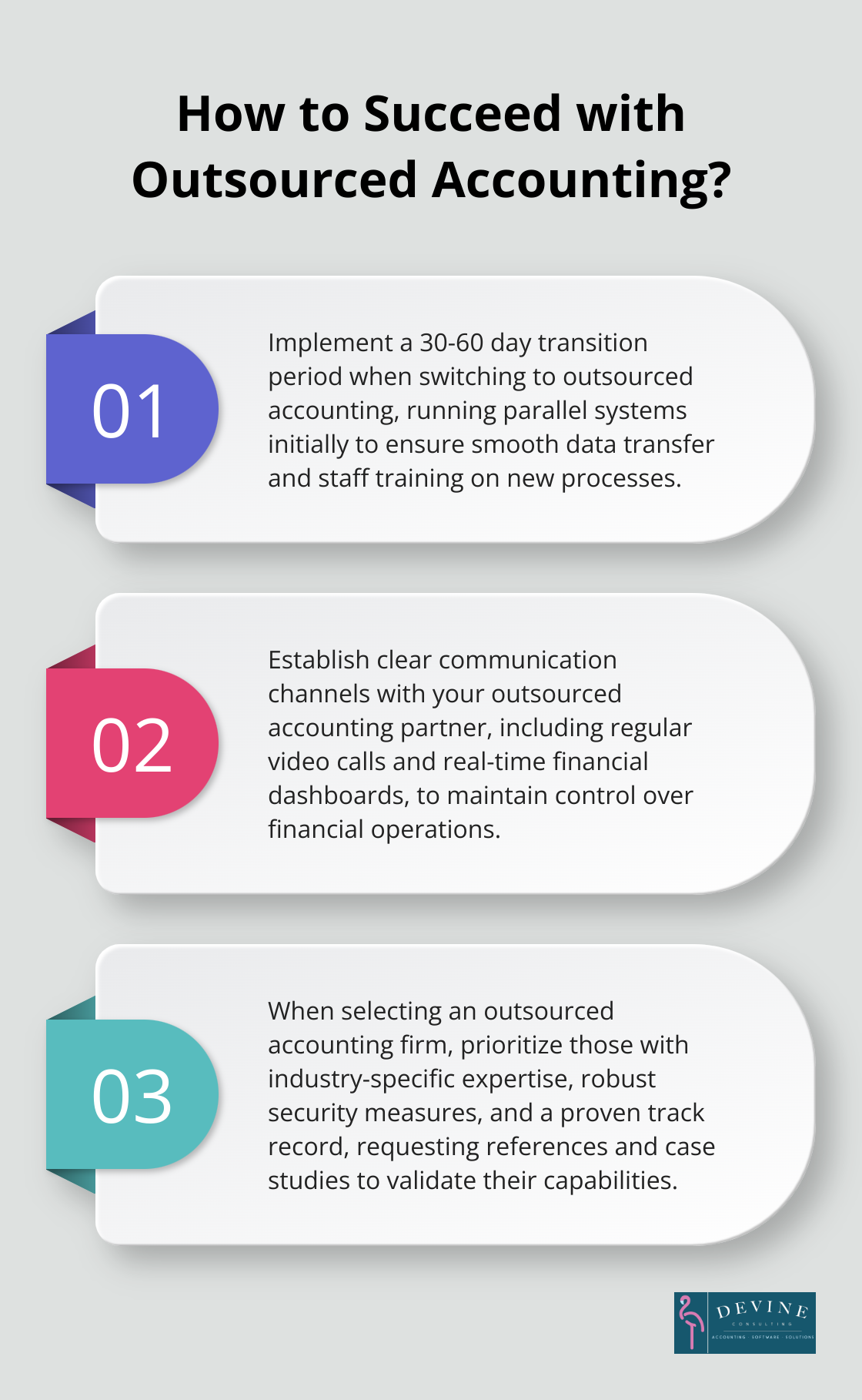

Some businesses worry about losing control over their financial operations when outsourcing. This concern is valid but manageable. Establish clear communication channels and reporting schedules with your accounting partner. Request regular financial updates and set up a system for approving major financial decisions. Many outsourced accounting firms offer real-time dashboards, allowing you to monitor your financial health at any time.

Effective Communication Strategies

Effective collaboration proves crucial for successful outsourced accounting. Time zone differences and cultural nuances can sometimes lead to misunderstandings. To address this, set up regular video calls with your accounting team. Use project management tools to track tasks and deadlines. Be clear about your expectations and encourage open dialogue. A good outsourced accounting partner should feel like an extension of your in-house team.

Smooth Transition to Outsourced Accounting

Switching to outsourced accounting can disrupt operations if not managed properly. Plan for a transition period of at least 30-60 days, depending on the complexity of your financial operations. During this time, ensure all financial data transfers accurately to the new system. Train your staff on new processes and communication protocols. Consider running parallel systems for a short period to ensure a smooth handover.

Choosing the Right Outsourced Accounting Partner

Selecting the right outsourced accounting partner proves critical in overcoming these challenges. Look for a provider with a proven track record in your industry. Ask for references and case studies demonstrating their ability to handle similar businesses. Consider factors such as their technology stack, communication protocols, and scalability. Devine Consulting, for example, offers comprehensive accounting solutions tailored for various industries (including construction, oil and gas, and real estate), ensuring businesses can focus on core operations while achieving financial stability and growth.

Final Thoughts

Outsourced accounting services offer powerful solutions for businesses to optimize their financial operations. Companies can benefit from cost savings, expert knowledge, enhanced reporting, and increased focus on core activities. These advantages lead to improved decision-making and accelerated growth for many organizations.

Businesses must consider data security, financial control, and communication when outsourcing accounting functions. To mitigate these concerns, companies should choose the right partner and implement proper protocols. Analyzing current financial processes, identifying areas for improvement, and assessing growth trajectories will help determine if outsourcing aligns with specific business needs.

Research potential providers with industry experience and a proven track record of success. Devine Consulting offers comprehensive accounting solutions for various industries (including construction, oil and gas, and real estate). When selecting a provider, evaluate their technology, security measures, and communication protocols to ensure a good fit for your company’s goals and values.