Outsourced Accounting Services: Small Business Solutions

Small businesses face unique financial challenges. At Devine Consulting, we’ve seen how outsourced accounting services for small businesses can be a game-changer.

These services offer a cost-effective way to access expert knowledge and advanced technology, freeing up valuable time for business owners.

In this post, we’ll explore the benefits of outsourced accounting, key services available, and how to choose the right accounting partner for your small business.

Why Outsource Your Accounting?

Small businesses often face challenges in managing their finances effectively. Outsourcing accounting services can provide numerous advantages.

Cost Savings and Efficiency

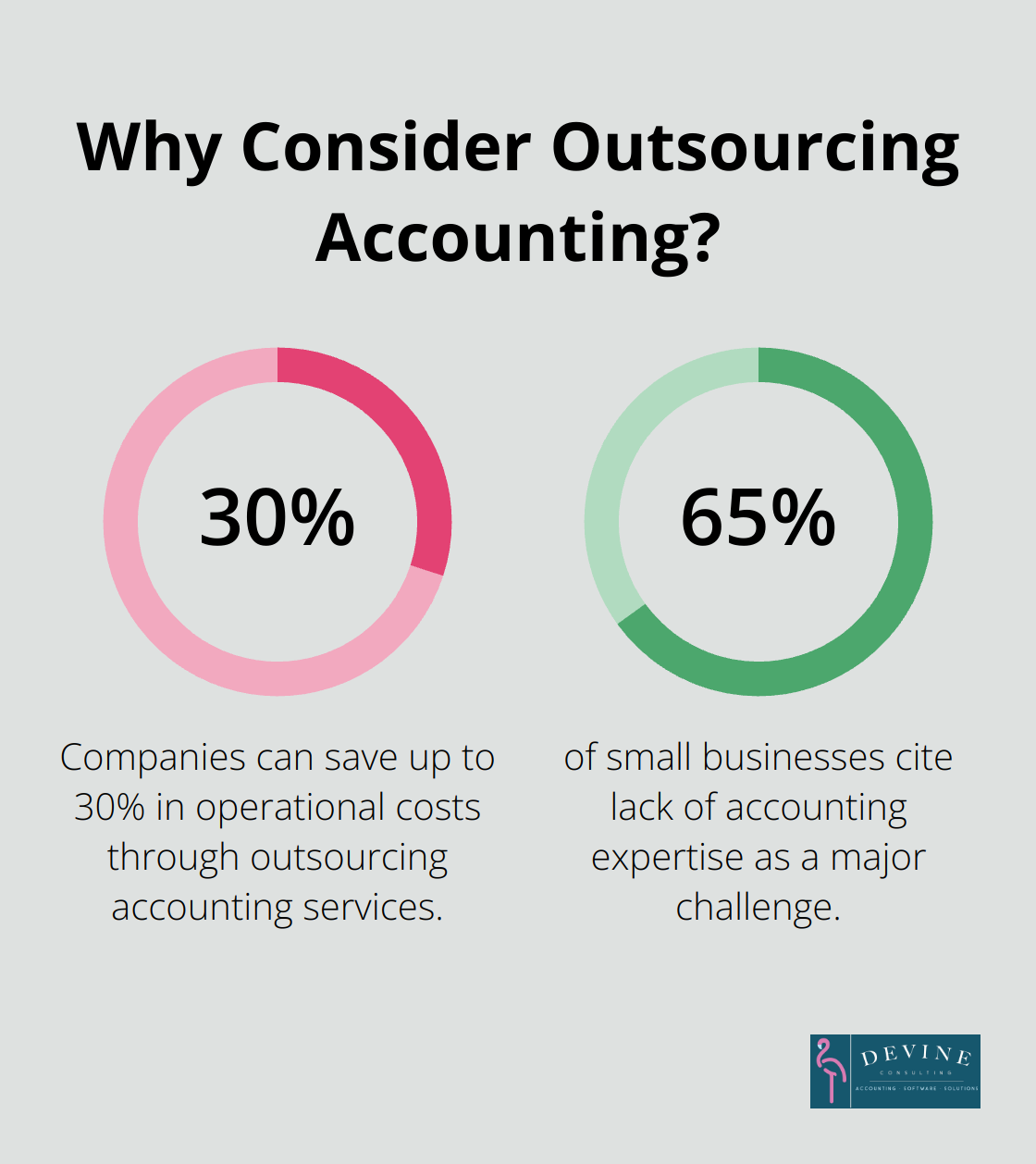

Outsourcing accounting tasks typically costs less than hiring a full-time accountant. A study by Deloitte found that companies can save up to 30% in operational costs through outsourcing. The financial savings come from multiple areas.

Expert Knowledge at Your Fingertips

Outsourced accounting firms employ professionals with diverse expertise. This means you get access to specialists in tax law, financial planning, and industry-specific accounting practices. The American Institute of CPAs reports that 65% of small businesses cite lack of accounting expertise as a major challenge. Outsourcing solves this problem instantly.

Focus on Core Business Activities

Time equals money for small business owners. Outsourcing accounting frees up valuable hours. A survey found that the majority of small-business owners spend more than 20 hours per year dealing with federal taxes. Think about what you could accomplish with that time back in your schedule.

Improved Accuracy and Compliance

Accounting errors can prove costly. The IRS penalizes millions of small businesses each year for payroll mistakes. Professional accounting services use advanced software and have rigorous quality control processes. This significantly reduces the risk of errors and ensures compliance with ever-changing regulations.

Competitive Edge Through Expert Financial Management

Outsourcing your accounting isn’t just about cutting costs. It provides a competitive edge through expert financial management. Whether you operate in construction, real estate, or any other industry, partnering with a specialized firm can transform your financial operations and set you up for long-term success.

As we explore the specific services available through outsourced accounting, you’ll see how these benefits can directly impact your small business’s financial health and growth potential.

What Services Do Outsourced Accountants Offer?

Outsourced accounting services provide a wide range of financial management solutions for small businesses. These services extend far beyond basic bookkeeping, offering comprehensive support that can transform your financial operations.

Comprehensive Bookkeeping and Financial Management

At the core of outsourced accounting lies meticulous bookkeeping. This includes tracking all financial transactions, reconciling bank statements, and maintaining accurate ledgers. A survey revealed that 60% of small business owners feel they aren’t knowledgeable when it comes to accounting. Outsourcing this task ensures your financial records remain up-to-date and accurate.

Tax Preparation and Compliance

Tax season often becomes a nightmare for small business owners. Outsourced accountants stay current with ever-changing tax laws and regulations. They handle everything from quarterly estimated tax payments to year-end tax return preparation.

Financial Reporting and Analysis

Outsourced accountants provide regular financial reports that offer insights into your business’s financial health. These reports include profit and loss statements, balance sheets, and cash flow statements. They analyze these reports to help you understand your financial position and make informed business decisions.

Payroll Processing and Management

Payroll involves complex and time-consuming tasks. Outsourced accounting services handle all aspects of payroll, including wage calculations, tax withholdings, and labor law compliance.

Accounts Payable and Receivable Management

Effective management of accounts payable and receivable proves crucial for maintaining healthy cash flow. Outsourced accountants can streamline these processes, ensuring timely bill payments and prompt collection of outstanding invoices.

With such a comprehensive range of services available, the next question becomes: how do you choose the right outsourced accounting partner for your small business?

How to Select the Perfect Outsourced Accounting Partner

Choosing the right outsourced accounting partner is a critical decision for small businesses. The right partnership can transform a company’s financial operations. Here’s what you need to consider when making this important choice.

Expertise in Small Business Accounting

Look for a firm with a proven track record in small business accounting. Accounting statistics illuminate the significance of accounting in small businesses and the role of accounting professionals. An experienced outsourced accounting partner can significantly reduce the time burden while ensuring accuracy.

Ask potential partners about their experience with businesses similar to yours in size and industry. Request case studies or client testimonials that demonstrate their ability to handle small business accounting challenges effectively.

Technology and Security Measures

Your accounting partner should use state-of-the-art technology. Ask about their software solutions for bookkeeping, payroll, and financial reporting. Ensure they use cloud-based systems that allow you real-time access to your financial data.

Security is paramount when it comes to financial information. Inquire about their data protection measures, including encryption protocols and backup procedures. Robust security measures are non-negotiable.

Industry-Specific Experience

Different industries have unique accounting needs and regulatory requirements. For instance, construction companies often deal with complex job costing, while real estate firms need expertise in property management accounting.

Ask potential partners about their experience in your specific industry. This industry-specific knowledge can prove invaluable in navigating sector-specific financial challenges.

Communication and Accessibility

Clear, regular communication is key to a successful outsourced accounting relationship. Ask about their communication protocols. How often will you receive financial reports? Will you have a dedicated point of contact? What’s their average response time to queries?

Ensure your potential partner has a solid track record of responsive, clear communication.

Pricing Structure and Service Packages

Understand the pricing structure and what services are included. Some firms offer tiered packages, while others provide customized solutions. Be wary of hidden fees or charges for additional services.

Don’t hesitate to negotiate or ask for a package that fits your specific needs and budget.

The cheapest option isn’t always the best. Consider the value you’re getting for your investment. A slightly higher-priced service that offers comprehensive solutions and expert advice could save you money in the long run through improved financial management and strategic planning.

Final Thoughts

Outsourced accounting services for small businesses offer powerful solutions to common financial challenges. Expert accountants provide advanced technology, reduce costs, and free up valuable time for growth. These benefits extend beyond cost savings, delivering improved accuracy, compliance, and strategic financial insights.

Selecting the right accounting partner maximizes these advantages. Firms with proven expertise in small business accounting, industry-specific experience, and clear communication stand out. Their technology offerings, security measures, and pricing structures should align with your unique needs.

Devine Consulting understands the transformative impact of outsourced accounting on small businesses. Our comprehensive solutions go beyond basic bookkeeping, providing strategic financial planning and reporting. We invite you to explore how outsourced accounting can benefit your business today.