Profit Maximization: A Comprehensive Explanation

Profit maximization is the cornerstone of business success. At Devine Consulting, we’ve seen firsthand how companies that master this concept outperform their competitors.

This comprehensive profit maximization explanation will equip you with strategies to boost your bottom line. We’ll explore key components, effective techniques, and potential challenges to help you make informed decisions for your business’s financial growth.

What Is Profit Maximization?

The Core Concept

Profit maximization stands as the ultimate goal for business success. It transcends mere profit-making; it involves generating the highest possible profit given available resources and market conditions. At its essence, profit maximization is the process of identifying the optimal point where the gap between total revenue and total costs reaches its peak.

Key Components: Revenue, Costs, and Profit

The foundation of profit maximization rests on three pillars: revenue, costs, and profit. Revenue represents the total income a business generates from sales. Costs encompass all expenses incurred in producing and selling products or services. Profit emerges as the remainder after subtracting costs from revenue.

To maximize profit, businesses must increase revenue, decrease costs, or ideally, achieve both. While this concept appears straightforward, its execution proves complex. For instance, overzealous cost-cutting might compromise product quality, potentially harming long-term revenue (a risk that savvy companies like Devine Consulting help their clients avoid).

Short-Term vs. Long-Term Strategies

A critical distinction exists between short-term and long-term profit maximization strategies. Short-term approaches often involve quick fixes such as quality reduction or aggressive price cuts to boost immediate sales. These tactics might provide a temporary profit surge but can prove detrimental in the long run.

Long-term profit maximization focuses on sustainable growth. This approach might include investments in new technology, improvements in production processes, or expansion into new markets. While these strategies often require initial capital outlays, they can yield substantially higher profits over time.

The Profit Maximization Formula

The basic formula for profit maximization is straightforward: Profit = Total Revenue – Total Cost. However, true profit maximization occurs at the point where marginal revenue equals marginal cost (the point at which each additional unit sold contributes equally to costs and revenue).

In practice, this requires constant analysis of sales data and cost structures to uncover improvement opportunities. Activity-based costing (ABC) is a system that tallies the costs of overhead activities and assigns those costs to products, providing insights into expenditure patterns and highlighting areas for potential cost reduction without sacrificing quality.

Profit maximization is not solely about today’s earnings; it’s about positioning a business for enduring success. The next section will explore specific strategies businesses can employ to maximize their profits effectively.

How Businesses Can Maximize Profits

Smart Pricing Strategies

Intelligent pricing stands as one of the most effective ways to maximize profits. Dynamic pricing plays a crucial role in boosting both consumer price perception and retailer profitability. Many retailers sell about one-fifth of their products using this strategy.

Value-based pricing focuses on setting prices based on the perceived value to the customer rather than just covering costs. Apple exemplifies this strategy by consistently pricing its products at a premium, reflecting the high value consumers place on their brand and technology.

Expanding Market Reach

Expanding into new markets can significantly increase revenue and profits. This expansion doesn’t necessarily mean entering new geographical areas. It could involve targeting new customer segments or introducing existing products to new industries.

Netflix’s transition from DVD rentals to streaming services illustrates this concept. They not only tapped into a new market but also revolutionized how people consume entertainment. This move led to significant growth, with Netflix’s net profit amounting to 5.4 billion USD in 2023, an increase of around 1 billion USD from 2022.

Efficiency Improvements

Improving operational efficiency reduces costs and maximizes profits. Lean manufacturing principles, originally developed by Toyota, have found application across industries to eliminate waste and improve productivity. Companies that implement lean principles report productivity increases of up to 25% (according to the Lean Enterprise Institute).

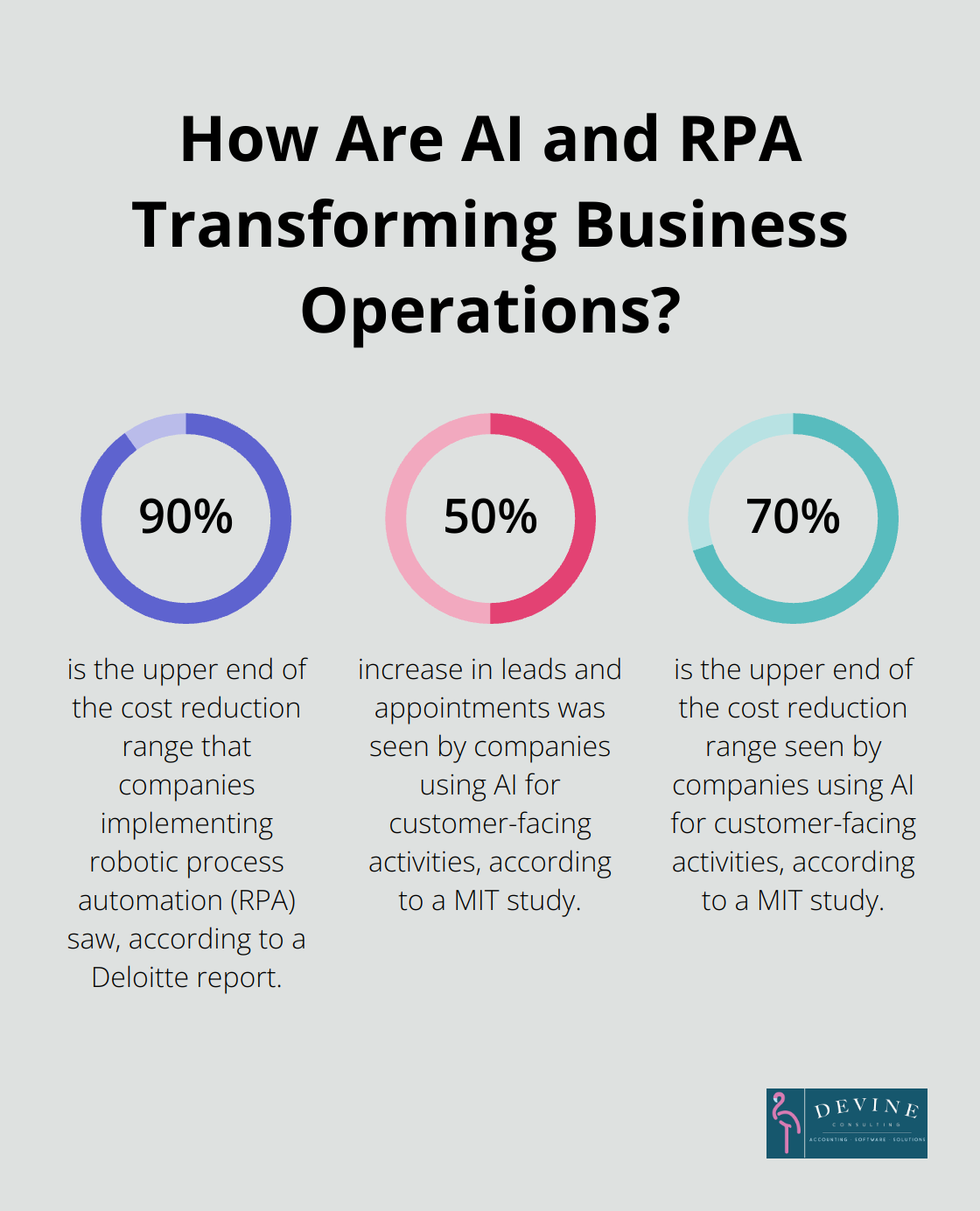

Automation serves as another key efficiency driver. A report by Deloitte found that companies implementing robotic process automation (RPA) saw cost reductions of 15-90%, depending on the process automated.

Leveraging Data and Technology

In today’s digital age, data-driven decision making proves essential for profit maximization. Advanced analytics tools provide insights into customer behavior, market trends, and operational inefficiencies.

Amazon uses predictive analytics to optimize its inventory management, reducing storage costs and improving delivery times. This data-driven approach has contributed to Amazon’s impressive profit growth, with net income increasing from $3 billion in 2017 to $33.4 billion in 2022.

Artificial Intelligence (AI) and Machine Learning (ML) are also proving to be game-changers. These technologies optimize pricing, personalize marketing efforts, and improve customer service. A study by MIT found that companies using AI for customer-facing activities saw a 50% increase in leads and appointments, 60-70% cost reduction, and 40-60% increase in call deflection.

While these strategies can significantly boost profits, businesses must implement them thoughtfully and ethically. Companies like Devine Consulting help businesses navigate these strategies while maintaining a balance between profit maximization and long-term sustainability. This approach ensures that businesses not only increase their profits but also build a strong foundation for future growth.

The implementation of these profit maximization strategies requires careful planning and execution. The next section will explore the challenges and limitations businesses may face in their pursuit of maximum profits.

Navigating Profit Maximization Pitfalls

The Short-Term Trap

Many businesses prioritize short-term gains over long-term sustainability. This myopic approach leads to decisions that boost immediate profits but harm future growth. For instance, cutting corners on product quality might increase profits temporarily, but it often results in inferior products, inflated prices, and damaged brand reputation.

A study by McKinsey & Company found that companies focusing on long-term strategies outperformed their short-term focused peers on several financial metrics. These long-term oriented companies saw 47% higher revenue growth and 36% higher earnings growth over a 15-year period.

To avoid this pitfall, businesses should implement a balanced scorecard approach. This method, developed by Robert Kaplan and David Norton, helps companies align their short-term actions with long-term objectives by considering financial, customer, internal process, and learning and growth perspectives.

Ethical Considerations in Profit Pursuit

In the race for profits, ethical considerations can sometimes take a backseat. However, ignoring corporate social responsibility (CSR) can backfire spectacularly. Neglecting corporate responsibility risks damaging a company’s reputation, leading to negative publicity and public perception that can result in a loss of business.

Companies that prioritize ethical practices often see long-term benefits. Unilever’s Sustainable Living Plan, which aims to decouple the company’s growth from its environmental footprint, has not only reduced costs but also driven innovation and growth in sustainable product lines.

To navigate this challenge, businesses should integrate CSR into their core strategy rather than treating it as an afterthought. The UN Global Compact provides a framework for companies to align their operations with universal principles on human rights, labor, environment, and anti-corruption.

Market Constraints and Competitive Pressures

Market saturation and intense competition can severely limit a company’s ability to maximize profits. In mature markets, businesses often find themselves in a race to the bottom, slashing prices to maintain market share at the expense of profitability.

To overcome this challenge, companies need to focus on differentiation and innovation. Apple’s success in the highly competitive smartphone market exemplifies this. Despite not having the largest market share, Apple consistently captures the majority of the industry’s profits through premium pricing and a strong brand identity.

Businesses can also explore blue ocean strategies, a concept developed by W. Chan Kim and Renée Mauborgne. This approach involves creating uncontested market space rather than competing in existing markets. Cirque du Soleil exemplifies this strategy, creating a new market space between traditional circus and theater.

Regulatory Compliance: A Necessary Evil?

Regulatory compliance often feels like a burden on profitability. However, non-compliance can lead to hefty fines and reputational damage that far outweigh the costs of adherence. The 2018 Facebook-Cambridge Analytica data scandal resulted in a $5 billion fine for Facebook and a significant blow to its reputation.

Smart businesses view regulatory compliance not as a hindrance but as an opportunity for innovation and competitive advantage. For instance, when the EU introduced GDPR, many companies used it as an opportunity to overhaul their data management systems, leading to improved efficiency and customer trust.

To effectively manage regulatory challenges, businesses should stay proactive. Regular reviews and updates of compliance strategies, investments in compliance technology, and fostering a culture of compliance throughout the organization can help turn this challenge into a strength.

Final Thoughts

Profit maximization requires a balanced approach that considers short-term gains and long-term sustainability. Companies must weigh immediate financial returns against their impact on stakeholders, brand reputation, and future growth potential. This comprehensive profit maximization explanation highlights the importance of adapting to trends like data analytics, artificial intelligence, and sustainability in shaping effective strategies.

The digital economy and globalization present opportunities and challenges for profit maximization. Companies need to quickly adapt to changing consumer behaviors, emerging technologies, and new competitive landscapes to maintain profitability. These factors underscore the complexity of profit maximization in today’s dynamic business environment.

We at Devine Consulting offer comprehensive accounting solutions and strategic financial planning services to help businesses navigate profit maximization challenges. Our expertise allows companies to focus on core operations while achieving financial stability and growth. Partnering with professionals who understand profit maximization nuances positions businesses for sustained success in an evolving marketplace.