Profit Maximization vs Optimization: Which Is Better?

At Devine Consulting, we often encounter businesses grappling with the choice between profit maximization and profit optimization.

These two strategies, while similar in their goal of improving financial performance, differ significantly in their approach and outcomes.

This blog post will explore the key differences between profit maximization vs profit optimization, their impacts on businesses, and provide real-world examples to help you make informed decisions.

We’ll also look at future trends in profit strategies to keep your business ahead of the curve.

What Is Profit Maximization?

The Core Concept of Profit Maximization

Profit maximization is a strategy many businesses use to boost their bottom line. It focuses on increasing revenue and cutting costs to achieve the highest possible profit in the short term. This approach can lead to quick financial gains, but it often comes with significant drawbacks.

Strategies for Maximizing Profits

Companies that pursue profit maximization typically focus on:

- Aggressive pricing strategies

- Cost-cutting measures

- Rapid expansion

For instance, a business might raise prices across the board, lay off employees to reduce labor costs, or push for rapid market expansion without considering long-term sustainability.

The Impact on Customer Satisfaction

Harvard Business Review suggests that the fastest and most effective way for a company to realize its maximum profit is to get its pricing right. However, this approach may not always lead to long-term customer satisfaction.

Short-Term Gains vs. Long-Term Consequences

While profit maximization can lead to impressive short-term financial reports, it often lacks sustainability. Companies investing less than 5% of their revenue in R&D saw an average market share decline of 0.8% annually over ten years (according to a PwC report). This underscores the importance of reinvesting profits for long-term growth rather than maximizing short-term gains.

The Human Cost of Profit Maximization

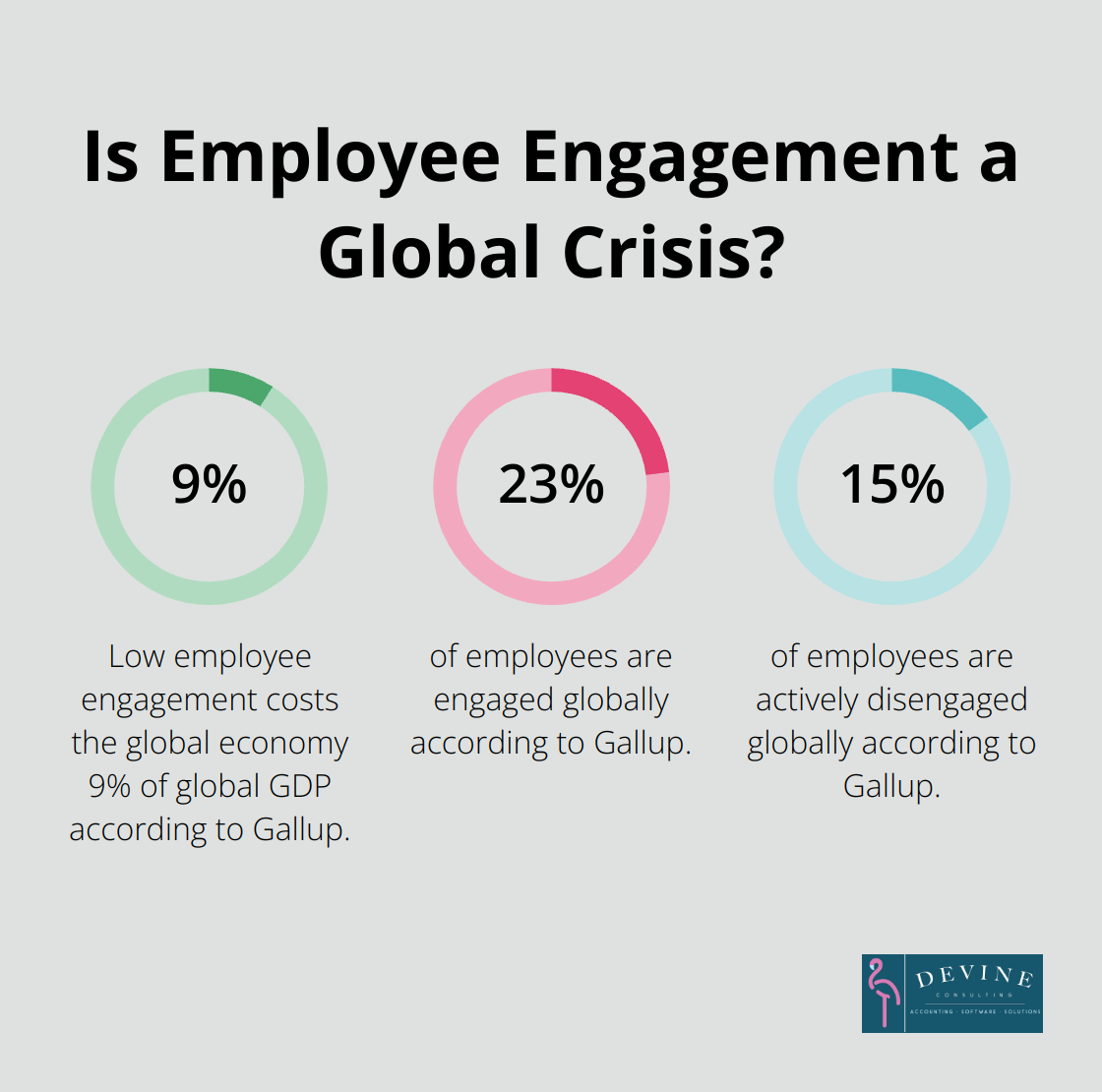

Employees often bear the brunt of profit maximization strategies. Gallup reports that only 23% of employees are engaged globally, with 62% not engaged and 15% actively disengaged. This disengagement can lead to higher turnover rates, decreased productivity, and ultimately, lower profits. Gallup estimates that low engagement costs the global economy US$8.9 trillion, or 9% of global GDP.

As we explore the concept of profit maximization, it becomes clear that a more balanced approach might yield better results. In the next section, we’ll examine profit optimization as an alternative strategy that balances short-term gains with long-term sustainability.

How Can Profit Optimization Drive Sustainable Growth?

The Power of Data-Driven Decision Making

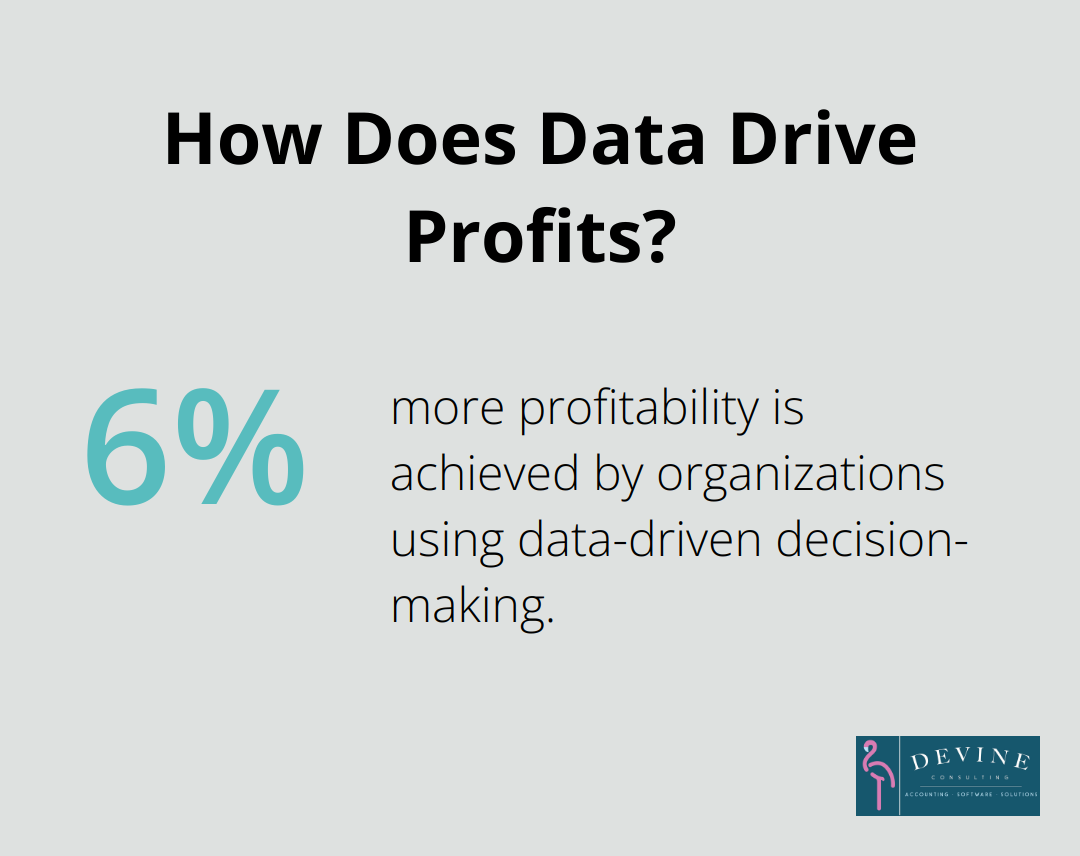

Profit optimization transforms businesses through strategic data analysis and market insights. Companies that adopt this approach use advanced analytics to understand customer behavior, market trends, and operational efficiencies. A study by MIT Sloan Management Review found that organizations using data-driven decision-making are 5% more productive and 6% more profitable than their competitors.

Pricing Strategies That Boost Profits

Dynamic pricing stands out as a key technique in profit optimization. This strategy adjusts prices based on real-time market demand, competitor actions, and customer willingness to pay. Amazon exemplifies this approach, with prices changing millions of times per day across their product range.

Operational Efficiency: The Hidden Profit Booster

Profit optimization often involves streamlining operations. This can include process automation, waste reduction, and supply chain management improvements. A McKinsey & Company report shows that companies which focus on operational efficiency can increase their profit margins by 3-5% within a year.

The Customer-Centric Approach

Unlike profit maximization (which can sometimes neglect customer satisfaction), profit optimization places a strong emphasis on customer value. This focus on customer needs often leads to higher retention rates and increased lifetime value. Marketing to existing customers is now exceeding that to new ones, according to a report from 2006.

Balancing Short-Term and Long-Term Goals

Profit optimization requires a delicate balance between immediate financial needs and future growth. This can sometimes lead to difficult decisions, such as investing in new technologies or markets at the expense of short-term profits. However, the long-term benefits often outweigh these short-term sacrifices. Companies that successfully implement profit optimization strategies typically see more sustainable growth, improved market positioning, and better resilience to economic fluctuations.

As we move forward, we’ll explore how profit maximization and optimization compare in real-world scenarios, providing you with the insights needed to choose the best approach for your business.

How Do Profit Maximization and Optimization Compare?

The Execution Gap

Profit maximization often results in short-sighted decisions. A retail chain might slash inventory to cut costs, which leads to stockouts and lost sales. Profit optimization takes a more nuanced approach. A company might use data analytics to predict demand and optimize inventory levels, which reduces costs while maintaining customer satisfaction.

The Customer Experience Divide

Maximization strategies can negatively impact customer experience. A study found that companies adopting profit optimization strategies reported a 14% increase in customer satisfaction and a 9% boost in employee engagement over three years. This occurs because optimization focuses on creating value for customers, not just extracting it.

The Innovation Factor

Profit maximization can stifle innovation. Companies investing less than 5% of their revenue in R&D saw an average market share decline of 0.8% annually over ten years (according to PwC). Optimization, however, encourages reinvestment in growth areas. Amazon exemplifies this approach, consistently reinvesting profits into new technologies and services, which leads to long-term market dominance.

Real-World Results

Let’s examine two contrasting examples:

Company A, a software firm, pursued aggressive profit maximization. They raised prices by 20% and cut their customer support team by half. Short-term profits soared, but within a year, customer churn increased by 35%, and new customer acquisition dropped by 40%.

Company B, a similar software firm, took an optimization approach. They invested in AI-driven customer support, which reduced response times by 60% while maintaining staff levels. They also implemented dynamic pricing, adjusting rates based on usage patterns. The result? A 15% increase in customer retention and a 25% growth in new customers over 18 months.

These examples highlight the long-term benefits of profit optimization over short-term maximization. While maximization might boost immediate profits, optimization builds a foundation for sustainable growth.

The Strategic Choice

The choice between profit maximization and optimization isn’t just about numbers-it impacts the future of your business. Companies must consider their long-term goals, market position, and industry dynamics when deciding which approach to adopt. Profit optimization often provides a more balanced and sustainable path to growth, but it requires a commitment to data-driven decision-making and customer-centric policies.

Final Thoughts

Profit maximization vs profit optimization presents a clear choice for businesses. Maximization focuses on short-term gains through aggressive pricing and cost-cutting, often sacrificing long-term sustainability and customer satisfaction. Optimization balances short-term financial goals with long-term objectives, creating a more resilient and adaptable organization.

Data-driven insights, dynamic pricing strategies, and operational efficiency form the core of profit optimization. This approach allows companies to achieve sustainable growth while maintaining customer loyalty. As data analytics tools become more sophisticated, businesses of all sizes will make more informed decisions about pricing, inventory management, and customer engagement.

Devine Consulting offers comprehensive accounting solutions to help businesses navigate profit optimization challenges. Our services provide the insights and support needed to make informed decisions about your profit strategy. We handle the intricacies of financial management, allowing you to focus on your core operations and build lasting value for customers and stakeholders.