Every business owner wonders at some point, “Are we doing better than others in our industry?” That’s not about being competitive for the sake of it. It’s about making smart decisions. Knowing how your business performs compared to similar businesses gives you context. It tells you whether you are spending too much, growing fast enough, or missing out on profits you didn’t even realize were possible.

That’s where comparative financial analysis, or benchmarking, comes in. It’s a powerful tool that helps you look at your numbers and measure them against others in your industry. Done right, it gives you direction, clarity, and confidence.

In this blog, we will help you understand what benchmarking means, why it’s important, and how Devine Consulting can help you make the most of it.

1. What Is Comparative Financial Analysis?

At its core, comparative financial analysis means comparing your financial metrics—things like revenue, expenses, and profit margins—with those of other companies in the same industry.

It’s not just about numbers; it’s about understanding the story they tell. Are your costs higher than they should be? Are your profits on par with your peers? Are your growth rates healthy?

Benchmarking looks at:

- Gross and net profit margins

- Operating expenses

- Revenue per employee

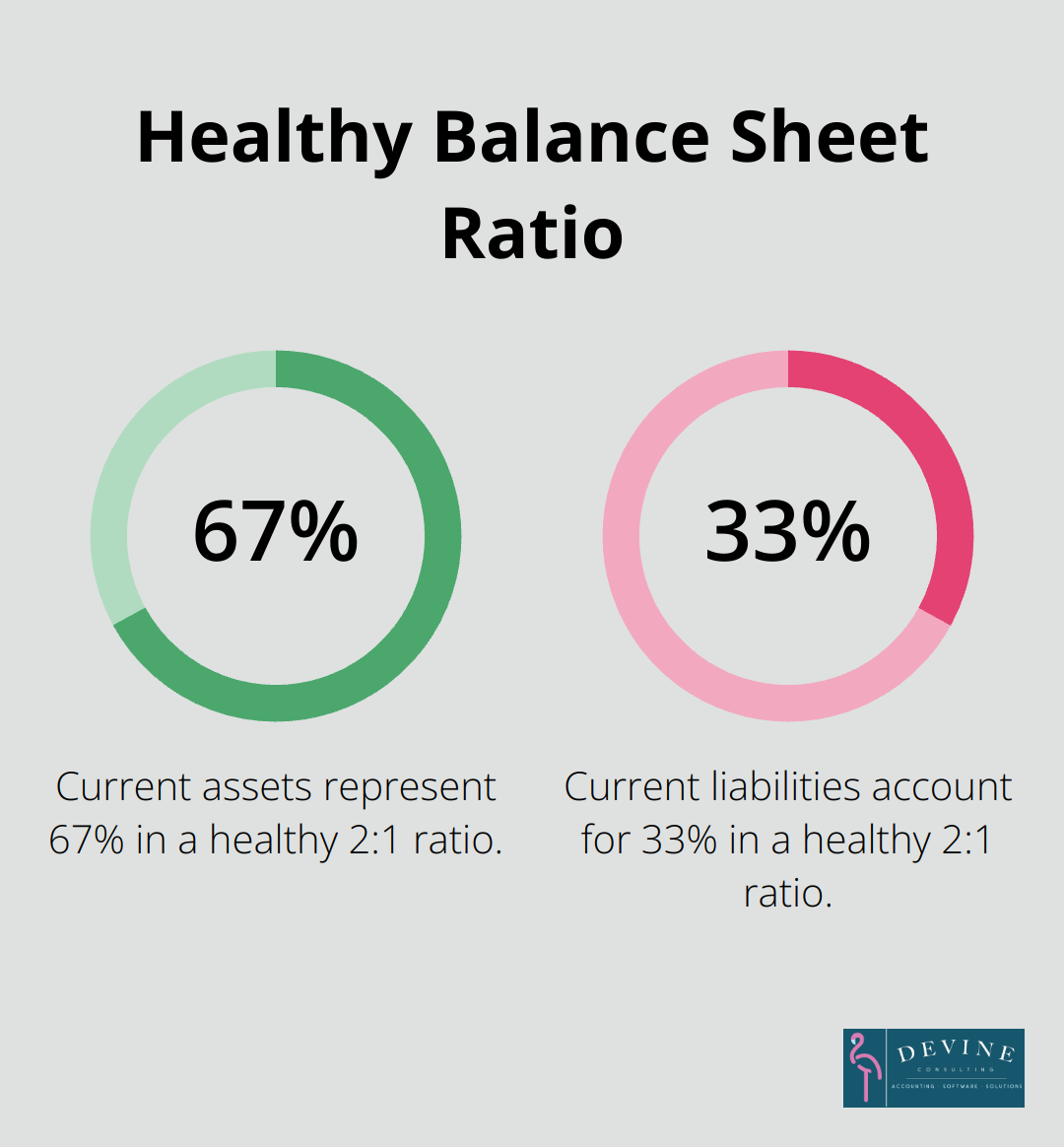

- Debt-to-equity ratios

- Cash flow performance

- And more

It’s a reality check and a roadmap all in one.

Do you want to know where your business stands in your industry? Let Devine Consulting guide your benchmarking process with detailed financial analysis.

2. Why Benchmarking Matters for Your Business

You might be thinking, “I already review my financial reports. Why do I need benchmarking?” The answer is simple: looking at your numbers without context can be misleading.

Benchmarking tells you:

- If your business is overpaying in certain areas

- Whether your pricing strategy is competitive

- How efficient your operations are

- Where you can cut costs or boost revenue

It helps you answer key questions like:

- Is my payroll too high?

- Are my margins healthy?

- Should I be reinvesting more?

And most importantly, it helps you confidently make better, faster decisions.

Take the guesswork out of business decisions. Devine Consulting can help you use benchmarking to make confident, informed choices.

3. Key Metrics You Should Be Benchmarking

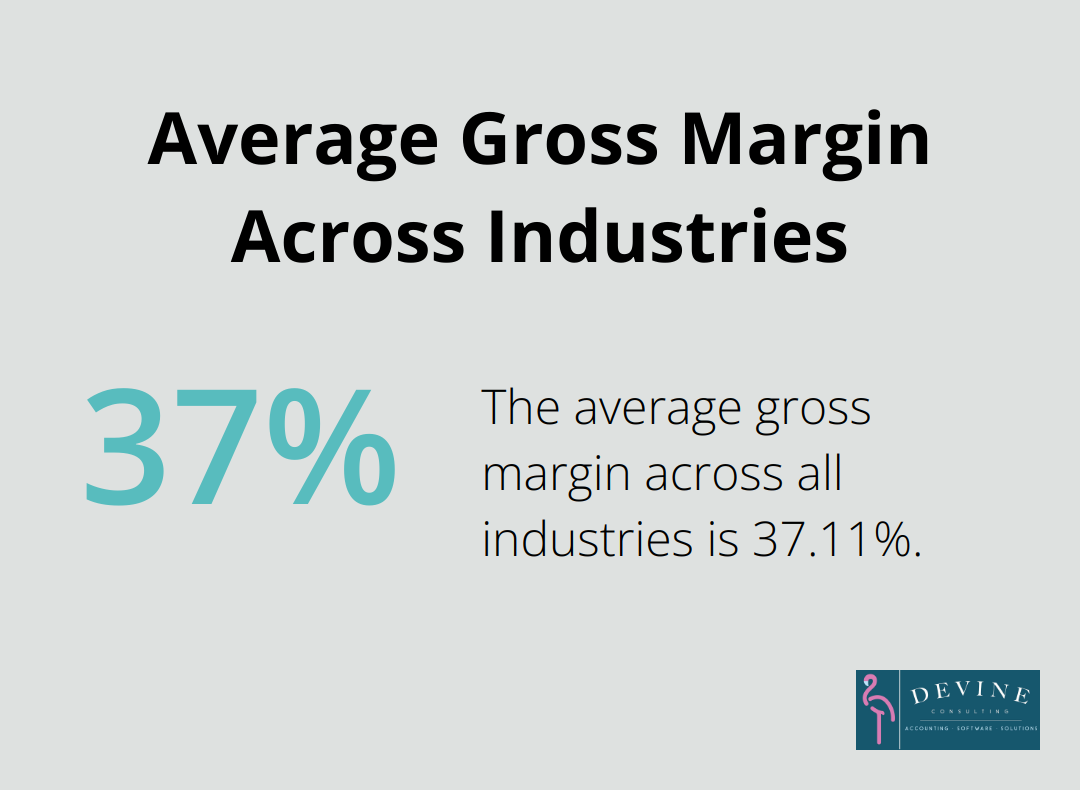

Gross Profit Margin

This tells you how much profit you make after the cost of goods sold. If your margin is lower than the industry average, it might be time to consider production costs or pricing.

Net Profit Margin

How much are you keeping after all expenses? Benchmarking this can show if your overhead is eating away at your profits.

Revenue Growth

Are you growing as fast as your competitors? If not, you might need to rethink your marketing or sales strategy.

Operating Expense Ratio

Too high? You may need to streamline operations. Too low? You might be under-investing in growth.

Return on Assets (ROA)

This shows how efficiently you are using your resources. A low ROA could mean it’s time to reassess your asset investments.

Not sure which metrics matter most for your industry? Devine Consulting can help you track the right KPIs and interpret them clearly.

4. Benchmarking as a Tool for Decision-Making

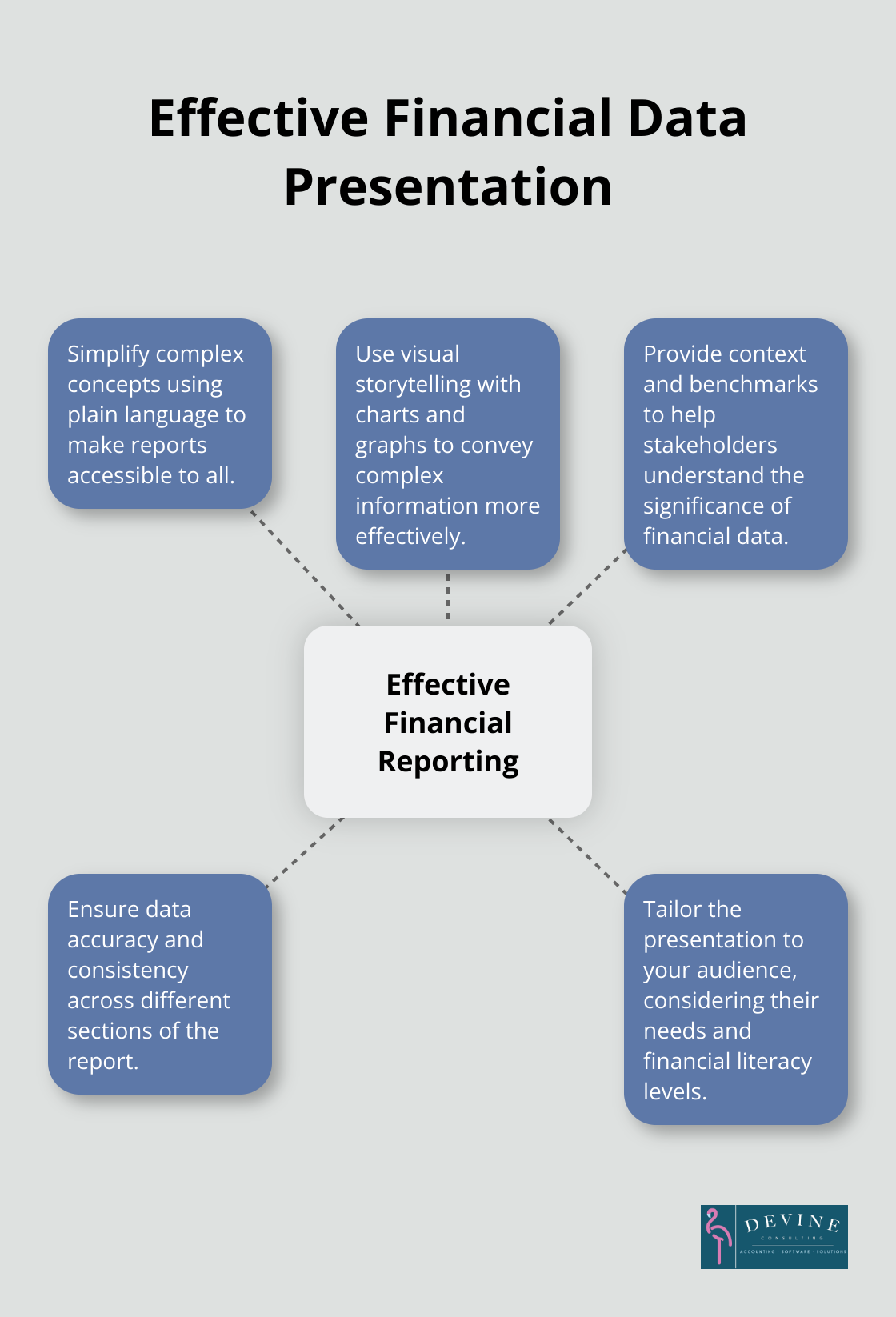

The beauty of comparative analysis is that it doesn’t just tell you where you are, it tells you what to do next.

You can use it to:

- Set realistic sales goals

- Justify hiring decisions

- Determine if you’re ready to expand

- See where you can reduce waste

- Rework underperforming areas

And because Devine Consulting combines benchmarking with financial planning, the numbers come with expert guidance on what to do about them.

Need to make smarter decisions without second-guessing? Devine Consulting uses benchmarking to guide every step of your growth strategy.

5. Common Benchmarking Mistakes to Avoid

Benchmarking is powerful, but only when done right. Here are a few pitfalls that Devine helps you avoid:

Comparing with the wrong businesses

You need apples-to-apples comparisons, i.e., comparing businesses that are similar in size, region, and business model.

Relying on outdated data

A snapshot from two years ago doesn’t help today’s decisions. You must use current data sources to get relevant information.

Focusing only on financials

While numbers are key, you must also consider operational metrics and business context.

Worried about misinterpreting your benchmarks? Devine Consulting ensures your analysis is accurate, relevant, and always up to date.

6. Benchmarking + Financial Planning = Growth

Here’s the magic combo: benchmarking + financial planning.

When Devine Consulting brings these two together, you don’t just know how you compare; you know how to improve.

They’ll work with you to:

- Build annual budgets based on industry averages

- Forecast revenue using your unique business trends

- Prepare for growth using targeted goals and models

- Track performance month over month

You’re not just reacting to your numbers—you’re using them to plan, lead, and grow.

Want more than just financial reports? Devine Consulting offers complete financial planning built on solid benchmarking data.

Comparative financial analysis isn’t about copying competitors, it’s about understanding your business in context. It’s about knowing your strengths, spotting weaknesses, and creating a plan that actually works.

With the right data and a trusted partner like Devine Consulting, you don’t have to wonder if you’re doing well. You’ll know. And you’ll have the tools to get even better.

Want to understand your performance, make better decisions, and confidently grow your business? Contact Devine Consulting today and start benchmarking your way to success!