Unethical Financial Reporting: Risks and Consequences

Unethical financial reporting is a serious issue that can have far-reaching consequences for businesses and individuals alike. At Devine Consulting, we’ve seen firsthand the devastating impact of such practices on companies and their stakeholders.

This blog post will explore the common types of financial misconduct, the risks involved, and the steps organizations can take to prevent and detect these unethical practices. By understanding these crucial aspects, businesses can safeguard their financial integrity and maintain trust in the marketplace.

Unmasking Financial Deception

At Devine Consulting, we encounter various forms of unethical financial reporting practices that companies use to mislead investors and regulators. Let’s explore some of the most common types of financial deception we observe in our work.

Cooking the Books

Earnings management is the use of accounting techniques to produce financial statements that present an overly positive view of a company’s business activities. This can involve:

- Shifting revenues or expenses between accounting periods

- Creating fake transactions

- Misclassifying costs

For example, WorldCom (once the second-largest long-distance phone company in the U.S.) inflated its earnings by $3.8 billion over five quarters by classifying operating expenses as capital expenditures.

Playing the Revenue Recognition Game

Revenue recognition fraud occurs when companies record revenue before it’s actually earned. This can involve:

- Backdating sales contracts

- Shipping products to customers who haven’t ordered them

- Recording future sales as current revenue

In 2018, the SEC charged Theranos and its founder with raising more than $700 million from investors through an elaborate, years-long fraud. They exaggerated or made false statements about the company’s technology, business, and financial performance.

Inflating Asset Values

Improper asset valuation is another common form of financial deception. Companies may overstate the value of their assets to appear more financially stable than they actually are. This can involve:

- Manipulating inventory counts

- Failing to write down obsolete assets

- Overvaluing intangible assets like goodwill

Waste Management overstated its pre-tax income by $1.7 billion from 1992 to 1997 in a systematic scheme to falsify and misrepresent its financial results.

Hiding Liabilities and Expenses

Some companies attempt to improve their financial position by concealing liabilities and expenses. This can involve:

- Failing to record expenses when incurred

- Understating liabilities

- Moving debt off the balance sheet through complex financial structures

Enron, one of the most infamous accounting scandals in history, used special purpose entities to hide billions of dollars in debt from its balance sheet.

These unethical practices not only mislead investors and regulators but also erode trust in the financial markets. As financial experts, we must remain vigilant and help our clients maintain the highest standards of financial integrity. The next section will explore the risks and consequences of engaging in these deceptive practices.

The High Cost of Financial Deception

Legal and Financial Fallout

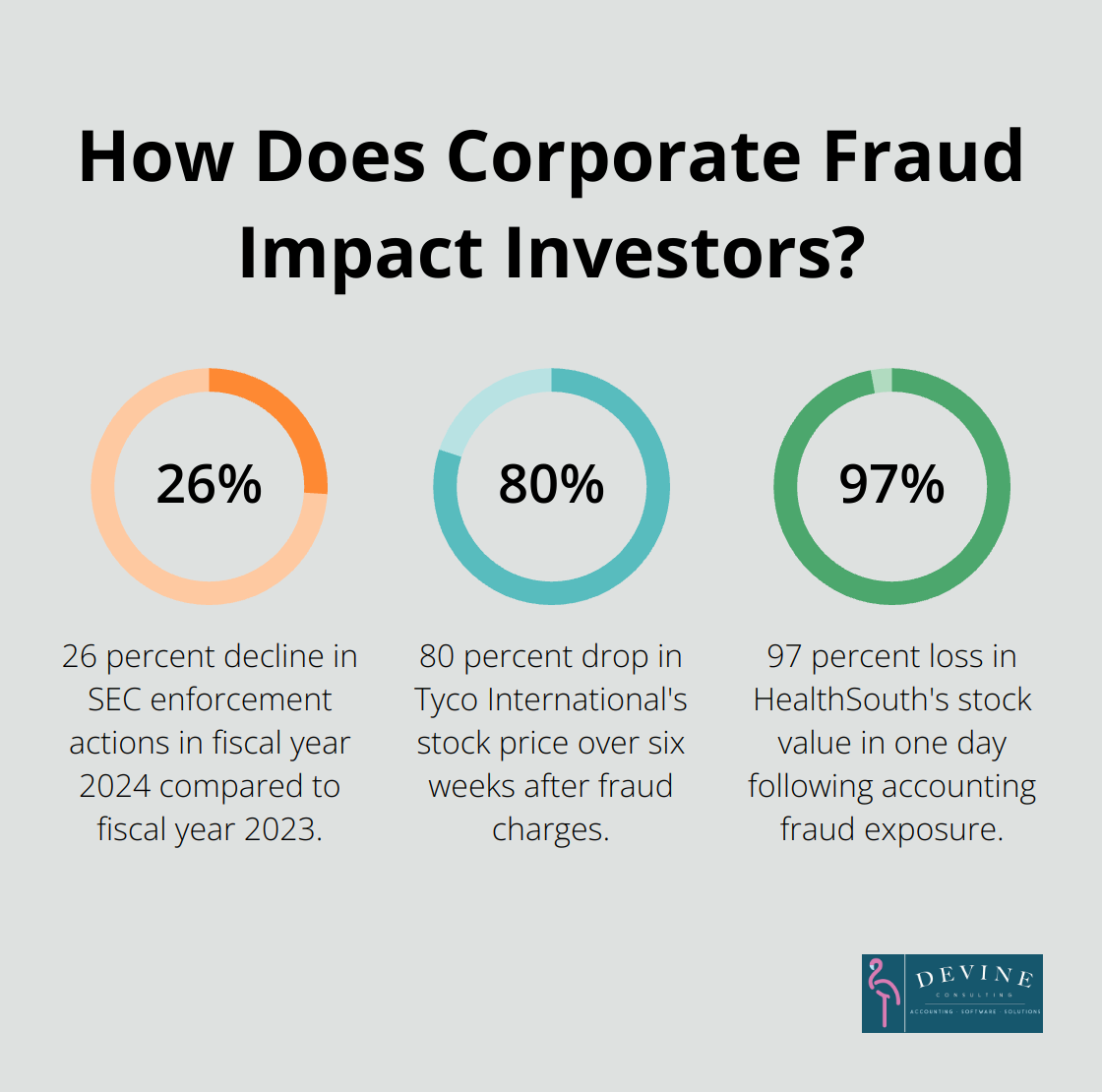

Unethical financial reporting carries severe consequences. The Securities and Exchange Commission (SEC) takes a hard stance on these matters. In fiscal year 2024, the SEC initiated 583 enforcement actions, which represents a 26 percent decline compared to fiscal year 2023. These actions often result in crippling fines and penalties.

WorldCom’s $3.8 billion fraud led to a $750 million fine, one of the largest in corporate history. Waste Management’s financial misrepresentation incurred a $26.8 million penalty. These aren’t mere slaps on the wrist-they’re financial body blows that can knock a company out of business.

Reputation in Ruins

The damage to a company’s reputation often surpasses legal penalties in severity. When stakeholders lose trust, the effects permeate every aspect of the business. Customers may abandon ship, partners may cut ties, and attracting top talent becomes a Herculean task.

Enron’s case exemplifies this. Once hailed as “America’s Most Innovative Company” by Fortune magazine for six consecutive years, its name now stands as a synonym for corporate fraud. The fallout transcended finances-it led to a complete erosion of trust, the company’s collapse, and affected the entire energy trading sector.

Market Reaction: Swift and Merciless

The stock market responds to unethical financial reporting with immediate and severe consequences. When authorities charged Tyco International’s CEO and CFO with stealing $600 million through fraudulent stock sales and falsified loans, the company’s stock price nosedived by 80% in six weeks. Similarly, HealthSouth’s $3.8 billion accounting fraud exposure caused its stock to lose 97% of its value in a single day.

These figures represent real losses for investors, including pension funds and individual shareholders who entrusted these companies with their financial futures.

Personal Price: Careers and Freedom at Stake

Unethical financial reporting exacts a heavy toll on individuals involved. The Sarbanes-Oxley Act of 2002, enacted in response to major corporate scandals, significantly increased penalties for financial fraud. Employees who report fraudulent activities or noncompliance within their organizations are protected under SOX.

Bernard Ebbers, former CEO of WorldCom, received a 25-year prison sentence. Jeffrey Skilling, Enron’s former CEO, initially received a 24-year sentence (later reduced to 14 years). These cases serve as stark reminders that the personal cost of unethical financial reporting can be one’s freedom.

The risks of unethical financial reporting clearly outweigh any perceived short-term gains. Companies must prioritize financial integrity not just as a legal obligation, but as a fundamental business strategy. The next section will explore proactive measures to prevent and detect unethical practices, ensuring businesses stay on the right side of both the law and public trust.

How to Prevent Financial Fraud

At Devine Consulting, we’ve witnessed the devastating impact of financial fraud. We’ve also observed the effectiveness of proactive measures in preventing unethical practices. Let’s explore some strategies to protect your company’s financial integrity.

Build Strong Internal Controls

Strong internal controls serve as your primary defense against financial fraud. Implement a robust segregation of duties. No single employee should control all aspects of financial transactions. For example, separate the roles of purchase approval and bank statement reconciliation.

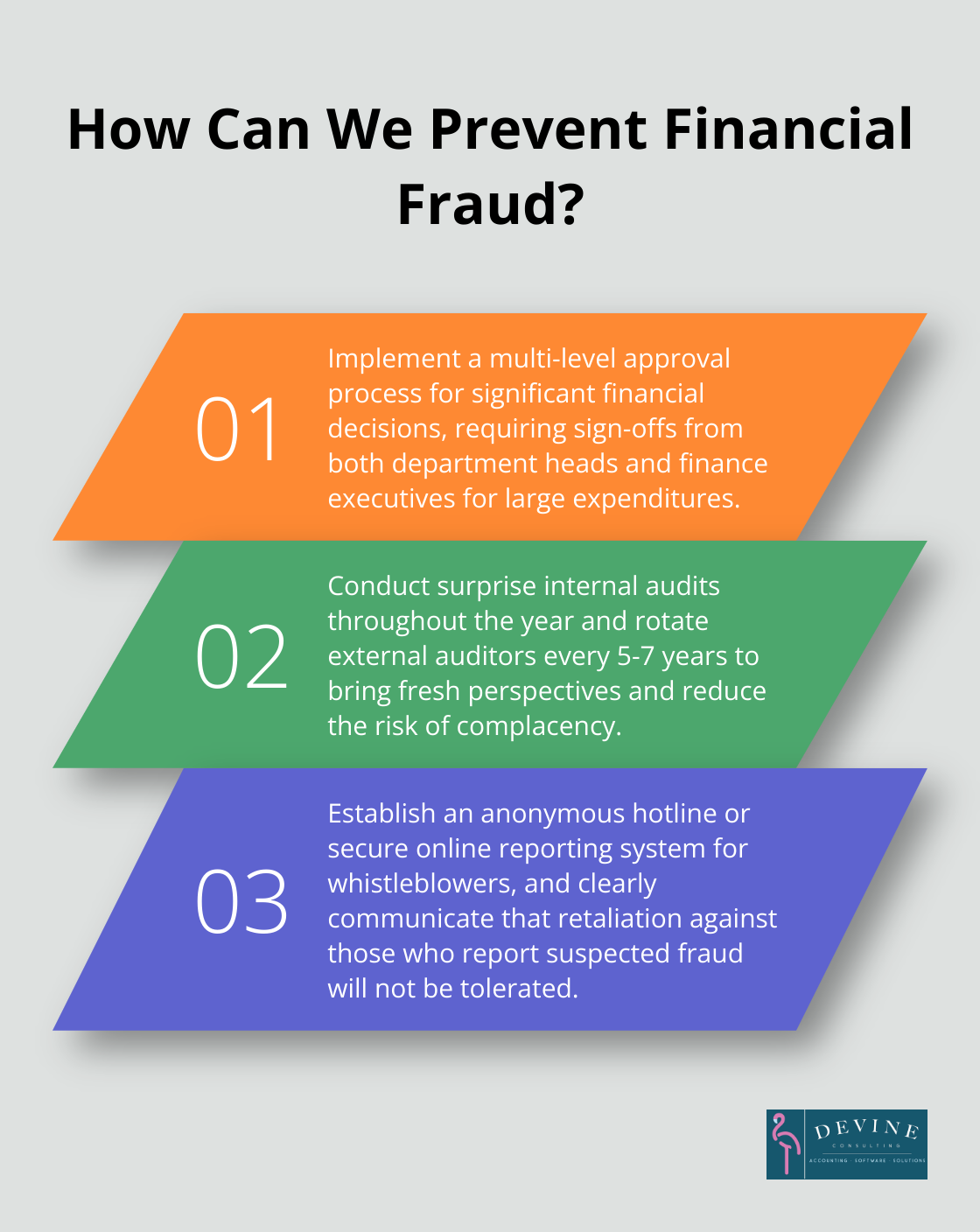

Establish multi-level approval processes for significant financial decisions. This could involve requiring sign-offs from both department heads and finance executives for large expenditures. The Association of Certified Fraud Examiners (ACFE) reported that the presence of anti-fraud controls was associated with both faster detection and lower losses.

Foster a Culture of Transparency

Creating an ethical culture starts at the top. Leadership must consistently demonstrate ethical behavior and openly discuss the importance of financial integrity.

Provide regular ethics training for all employees. Ensure everyone understands not just the rules, but the reasoning behind them.

Promote open communication about financial matters. Establish channels for employees to ask questions or raise concerns without fear of reprisal. This openness can help identify potential issues before they escalate.

Conduct Regular Audits

External audits serve as a powerful tool for detecting and deterring financial fraud. Don’t wait for your annual audit to check your books. Implement a system of regular internal reviews.

Consider conducting surprise audits.

Rotate your external auditors periodically. This brings fresh perspectives to your financial statements and reduces the risk of complacency. The Public Company Accounting Oversight Board (PCAOB) recommends considering auditor rotation every 5-7 years.

Empower Whistleblowers

Whistleblowers play a vital role in uncovering financial fraud. The SEC’s whistleblower program has awarded over $1.3 billion to individuals who provided information leading to successful enforcement actions since its inception in 2012.

Establish clear, confidential channels for reporting suspected fraud. This could include an anonymous hotline or a secure online reporting system. Inform employees about these channels and how to use them.

Most importantly, create a culture where whistleblowers receive protection and value. The fear of retaliation often deters fraud reporting. Make it clear that retaliation against whistleblowers will not be tolerated.

Leverage Technology

Try to use advanced financial software and data analytics tools to detect anomalies and patterns that might indicate fraud. These technologies can analyze large volumes of data quickly and flag suspicious activities for further investigation.

Implement automated controls within your financial systems to prevent unauthorized transactions or changes to financial records. This can include features like automatic notifications for unusual transactions or restrictions on who can access sensitive financial information.

Final Thoughts

Unethical financial reporting poses significant risks to businesses, stakeholders, and the broader economy. The consequences extend far beyond monetary penalties, potentially leading to irreparable damage to a company’s reputation, loss of investor trust, and severe personal repercussions for those involved. Companies must prioritize financial integrity as a fundamental aspect of responsible business management to build long-term sustainability and foster trust with stakeholders.

Devine Consulting urges businesses to take proactive steps to prevent unethical financial reporting. This includes implementing robust internal controls, fostering a culture of transparency, and conducting regular audits. Companies can significantly reduce the risk of financial fraud and its associated consequences through vigilance and the use of technology.

Financial integrity supports long-term success and is not just about avoiding penalties. Devine Consulting offers comprehensive solutions tailored to various industries for those seeking support in maintaining financial integrity and optimizing their accounting processes. Our team of experts can help implement best practices, ensure accurate reporting, and develop strategies for sustainable financial growth.