What Are Annual Financial Reports?

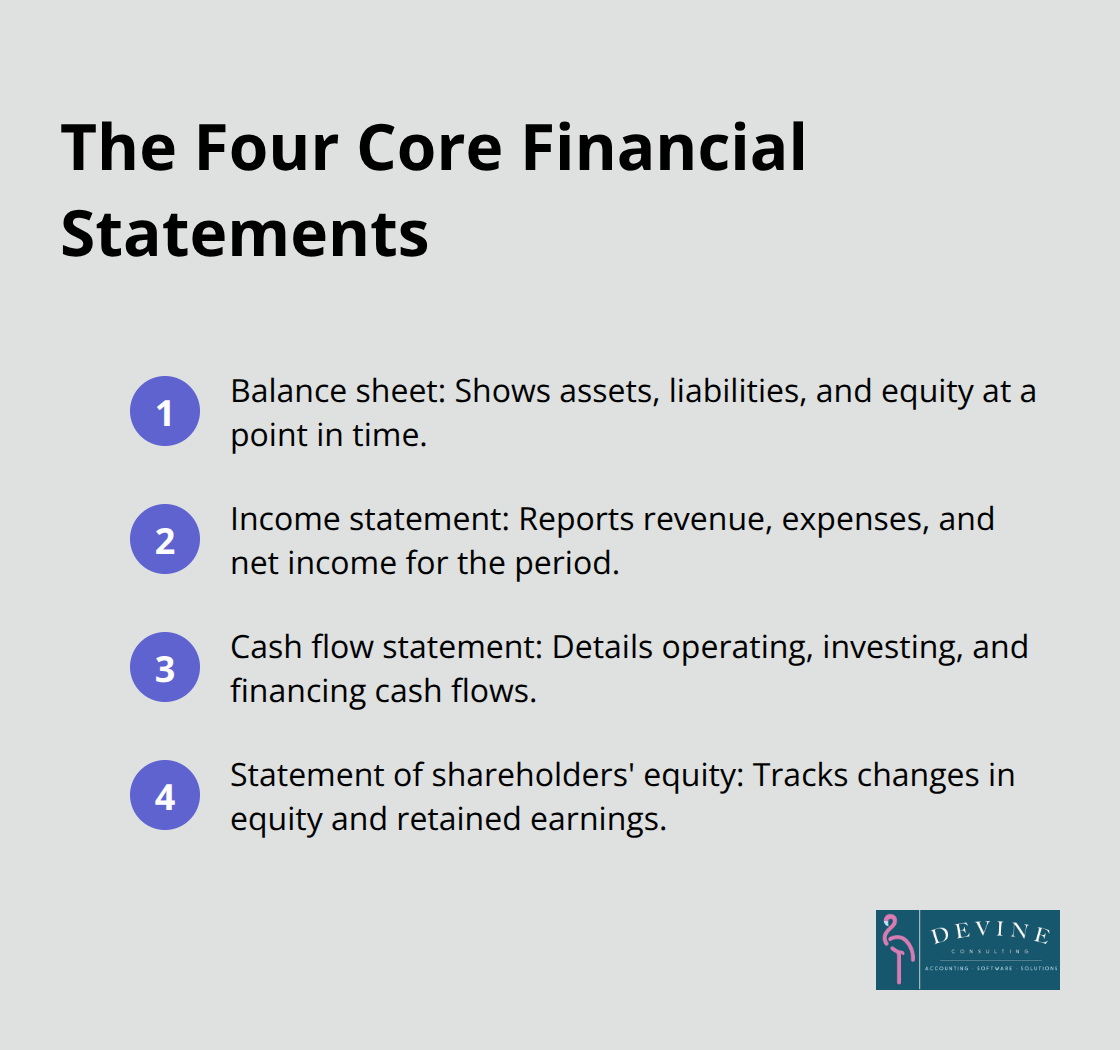

Annual financial reports covering a one-year period are known as comprehensive documents that showcase your company’s complete financial health. These reports contain four essential statements that tell the story of your business performance.

At Devine Consulting, we see businesses struggle with creating accurate financial reports that meet regulatory standards. Understanding these documents helps you make better strategic decisions and maintain investor confidence.

What Financial Statements Make Up Your Annual Report

Your annual financial report contains four interconnected statements that work together to present your complete financial picture. The balance sheet captures your company’s financial position on December 31st, showing assets worth $2.5 million against liabilities of $1.8 million and equity of $700,000. This snapshot follows the fundamental equation where assets equal liabilities plus equity, and it gives stakeholders immediate insight into your company’s net worth and liquidity position.

Balance Sheet Structure and Components

Current assets include cash, accounts receivable, and inventory that convert to cash within 12 months. Non-current assets encompass equipment, buildings, and intangible assets like patents. Current liabilities represent debts due within one year, while long-term liabilities include mortgages and bonds.

The Securities and Exchange Commission requires public companies to present comparative balance sheets that show two years of data, which helps investors track changes in financial position over time.

Income Statement Performance Indicators

Your income statement reveals operational efficiency through key metrics like gross profit margin and net profit margin. Revenue minus cost of goods sold equals gross profit, then you subtract operating expenses to reach operating income. Companies with gross margins above 40% typically demonstrate strong pricing power and operational control. The bottom line shows net income after taxes, which directly impacts your retained earnings on the balance sheet.

Cash Flow Analysis and Equity Movements

The cash flow statement categorizes money movement into operating, investing, and financing activities. A ratio above 1 means the company is converting more profits into cash than it earns, which is a positive indicator of financial health. The statement of shareholders’ equity tracks changes in ownership value, including retained earnings growth and dividend payments. These statements connect through net income that flows from the income statement to retained earnings, while cash changes link the income statement to the balance sheet.

Understanding these four statements provides the foundation you need to interpret your company’s financial health and make informed business decisions. The next step involves understanding why these reports matter beyond simple compliance requirements.

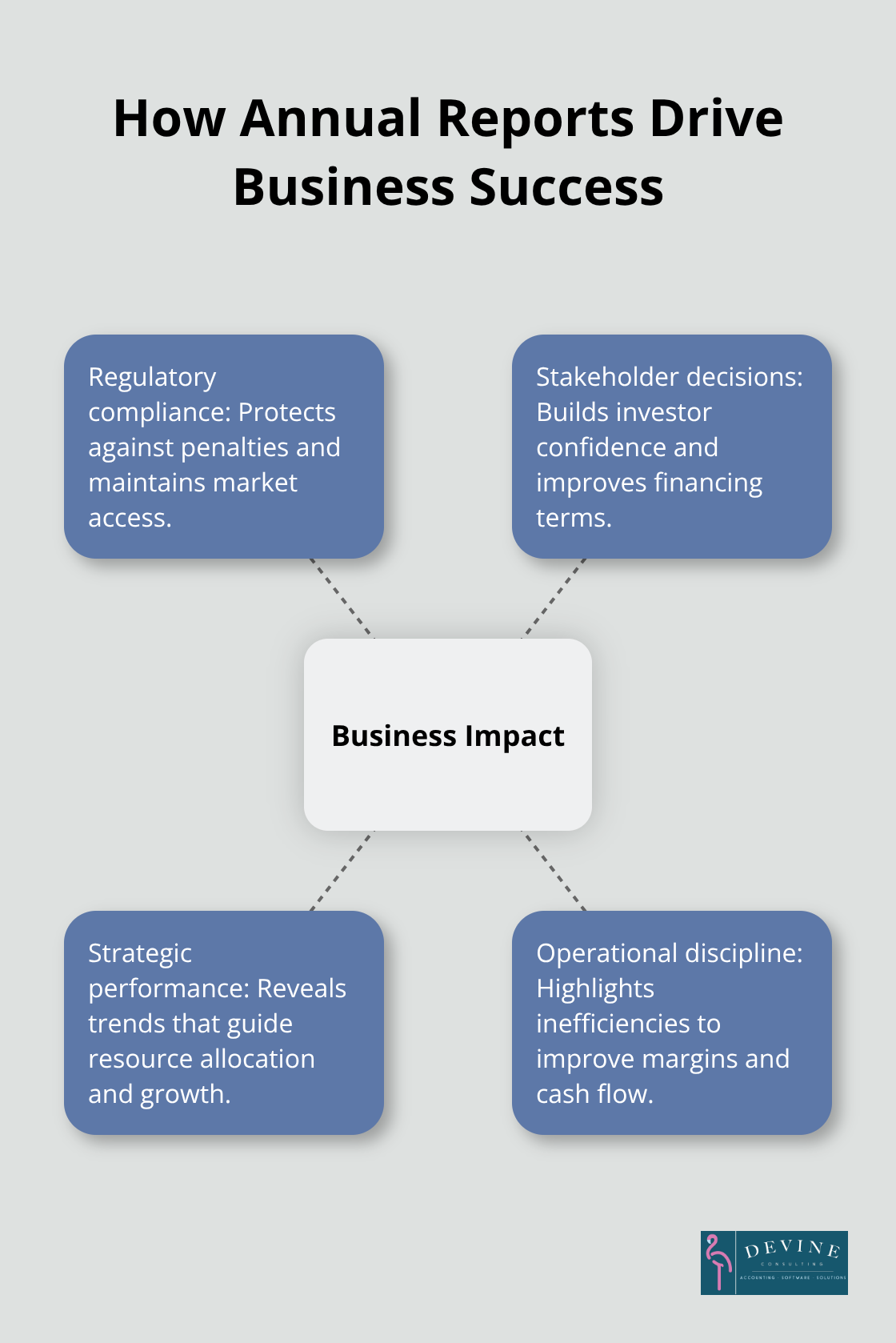

Why Annual Financial Reports Drive Business Success

Annual financial reports form your business foundation for legal protection, stakeholder trust, and strategic growth. The Securities and Exchange Commission mandates that public companies file Form 10-K with deadlines of 60 days for large-accelerated filers, 75 days for accelerated filers, and 90 days for non-accelerated filers, with penalties reaching $775,000 for late filings. Private companies face state-level requirements that vary significantly, but compliance protects you from regulatory scrutiny and potential lawsuits from investors or creditors.

Regulatory Compliance Protects Your Business Future

Financial Accounting Standards Board regulations require companies to follow Generally Accepted Accounting Principles, and non-compliance triggers SEC investigations that can result in trading suspensions. EU rules require large companies and listed companies to publish regular reports on the social and environmental risks they face, affecting businesses with European operations. Companies that fail to meet reporting deadlines face immediate consequences including delisted stock status, frozen bank accounts, and restricted access to capital markets that can destroy business operations within months.

Stakeholder Communication Drives Investment Decisions

Investors analyze annual reports to make funding decisions worth millions of dollars, and companies with transparent reporting attract 23% more investment according to recent market analysis. Your financial statements directly influence stock prices, with quarterly earnings surprises moving share values by an average of 4.2% within 24 hours of publication. Creditors use your debt-to-equity ratios and cash flow patterns to determine loan terms, interest rates, and credit limits that affect your operational capacity for the entire following year.

Performance Assessment Enables Strategic Growth

Annual reports reveal operational inefficiencies through metrics like inventory turnover ratios and accounts receivable cycles that highlight cash flow problems before they become critical. Companies with gross margins below 20% typically struggle with pricing power and operational control, while those above 40% demonstrate strong market positioning. Your year-over-year comparisons identify trends in revenue growth, cost management, and profitability that guide resource allocation, expansion decisions, and operational improvements for maximum competitive advantage.

The foundation of legal compliance and stakeholder trust requires meticulous preparation processes that transform raw financial data into accurate, professional reports that meet all regulatory standards.

How Do You Build Bulletproof Financial Reports

Accurate annual financial reports demand systematic data collection that starts January 1st, not December 31st. Document every transaction with receipts, invoices, and bank statements stored in monthly folders that auditors can access within 24 hours. Companies that maintain organized financial records can benefit from streamlined audit processes and reduced professional fees. Your chart of accounts should contain no more than 200 line items to prevent confusion, and monthly reconciliations must happen within 10 days of month-end to catch errors before they compound into major discrepancies that require expensive corrections.

Professional Audit Teams Protect Your Business Reputation

Certified Public Accountants who specialize in your industry understand specific regulations that general practitioners miss. Schedule your audit engagement by September for December year-end reports because qualified audit firms book their calendar months in advance. Companies that wait until January settle for less experienced teams or pay premium rush fees. Your auditor needs complete access to financial systems, employee interviews, and documentation, so companies that provide organized audit trails complete the process faster than those with scattered records.

Technology Solutions Eliminate Manual Errors

Cloud-based software like QuickBooks Enterprise or NetSuite automatically generates the four required financial statements with real-time accuracy that manual bookkeeping cannot match. Automated bank feeds eliminate data entry errors that cause many small business financial mistakes, while integrated payroll systems prevent wage and tax discrepancies that trigger IRS audits. Companies that use automated financial software reduce month-end closures significantly while improving accuracy rates. The software investment typically pays for itself within months through reduced labor costs and eliminated correction expenses.

Final Thoughts

Financial reports covering a one-year period are known as the foundation of business transparency and regulatory compliance. These comprehensive documents protect your company from SEC penalties while they build investor confidence through accurate performance data. The four interconnected statements work together to reveal operational efficiency, cash flow patterns, and strategic opportunities that drive growth decisions.

Professional preparation eliminates costly errors that trigger audits and regulatory scrutiny. Companies that invest in systematic data collection, qualified audit teams, and automated software solutions reduce month-end closures while they improve accuracy rates. The upfront investment in proper financial reports (annual documents) pays dividends through streamlined operations and enhanced stakeholder trust.

Your next step involves evaluation of your current processes against regulatory requirements and industry standards. Devine Consulting provides comprehensive solutions that transform complex financial data into accurate annual reports. We allow you to focus on core business operations while you maintain compliance and build investor confidence through transparent financial communication.