What Are Outsourced Financial Controller Services and Why You Need Them

Growing businesses often hit a wall when financial complexity outpaces their internal capabilities. Cash flow becomes harder to track, compliance requirements multiply, and strategic planning suffers.

We at Devine Consulting see this pattern repeatedly across mid-market companies. Outsourced financial controller services offer a proven solution that delivers expert oversight without the overhead of full-time hiring.

What Makes Outsourced Financial Controllers Different

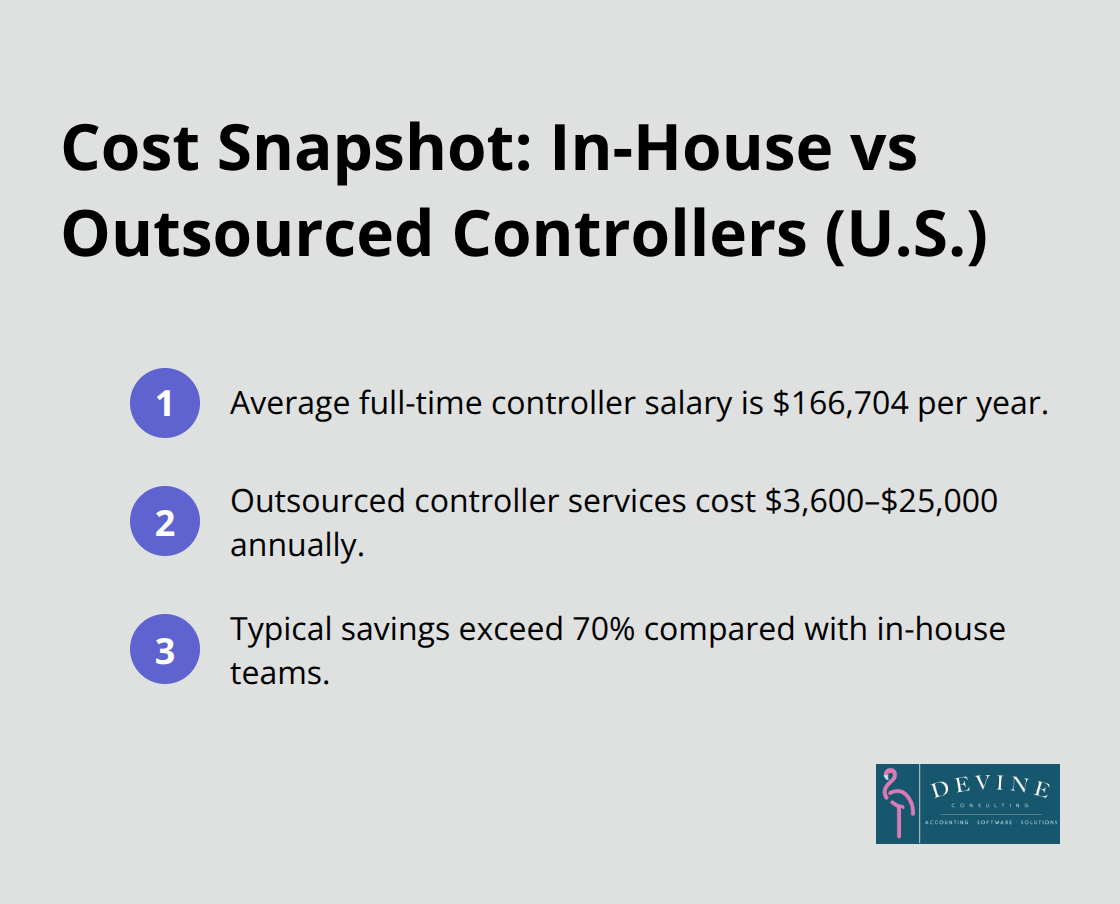

An outsourced financial controller manages your complete financial operations from an external location and handles everything from monthly financial statements to strategic budget planning. These professionals oversee your entire finance department, develop internal controls, and provide executive-level financial analysis (unlike traditional bookkeepers who simply record transactions). According to Glassdoor, full-time financial controllers earn an average of $166,704 annually.

Outsourced services typically cost $3,600 to $25,000 per year and deliver savings that exceed 70% compared to in-house teams.

How External Controllers Operate vs Internal Staff

External controllers work remotely and use cloud-based systems to provide the same oversight as on-site staff without physical presence requirements. They typically serve multiple clients and bring diverse industry experience that single-company controllers lack. Internal controllers focus solely on one organization but require full salaries, benefits, office space, and training costs that exceed $4,700 per new employee. External providers offer immediate expertise without recruitment delays or extended preparation periods.

Which Companies Gain the Most

Mid-market companies face extremely high costs for in-house bookkeeping and accounting departments that meet their complex needs. Startups and rapidly expanding businesses need scalable financial management that adapts quickly to new requirements. Seasonal businesses benefit from flexible service levels that adjust during peak and slow periods (manufacturing companies, professional services firms, and technology startups particularly value this approach). These organizations face complex financial challenges like inventory management, project profitability analysis, and regulatory compliance across multiple jurisdictions.

The next consideration involves the specific financial benefits that make outsourced controller services attractive to growing businesses.

Why Outsourced Controllers Save Money and Deliver Better Results

The financial math behind outsourced controllers makes the decision straightforward for most companies. Gohar Rizvi research shows that in-house accounting teams cost up to $351,000 annually, while outsourced services range from $3,600 to $25,000 per year. This represents savings that exceed 70% compared to internal teams. When you hire an in-house controller, accountant, and billing clerk, costs total around $218,800 per year versus $57,600 for equivalent outsourced roles. Companies like Google and Slack use outsourced services to reduce operational costs while they improve efficiency, according to Forbes analysis.

Access to Senior-Level Financial Expertise Without Senior-Level Costs

Outsourced controllers bring extensive cross-industry experience that single-company employees rarely match. These professionals work with multiple clients across different sectors, which exposes them to diverse financial challenges and innovative solutions. They stay current with tax regulations, compliance requirements, and financial technologies through continuous professional development (that would cost individual companies over $4,700 per employee according to Gohar Rizvi data). External providers also offer immediate access to specialized knowledge in areas like budget planning, forecasting, and financial analysis without lengthy recruitment processes or training delays.

Enhanced Financial Reporting and Risk Management

Professional outsourced firms implement multiple review systems and strong internal controls that minimize errors and fraud risks significantly more than single-person internal departments. These providers use advanced financial software and tools, which spreads technology costs across multiple clients to deliver sophisticated systems at affordable rates. IT spending is expected to grow 7.9% in 2025, which reflects the trend toward external services for operational efficiency. The segregation of duties inherent in outsourced services provides additional security layers that protect company assets while they maintain accurate financial data integrity (a protection that internal single-person departments cannot match).

Immediate Implementation and Business Continuity

Outsourced controllers eliminate the productivity losses that typically occur during controller turnover within organizations. These services provide stable, top-tier financial expertise without recruitment delays or extended preparation periods. External teams offer backup resources that maintain continuity when staff members are unavailable, while in-house teams may face disruptions during absences or vacations. This stability becomes particularly valuable when businesses need consistent financial oversight during growth phases or seasonal fluctuations.

The next step involves recognizing the specific warning signs that indicate your business needs professional financial controller services.

When Does Your Business Need Financial Controller Services

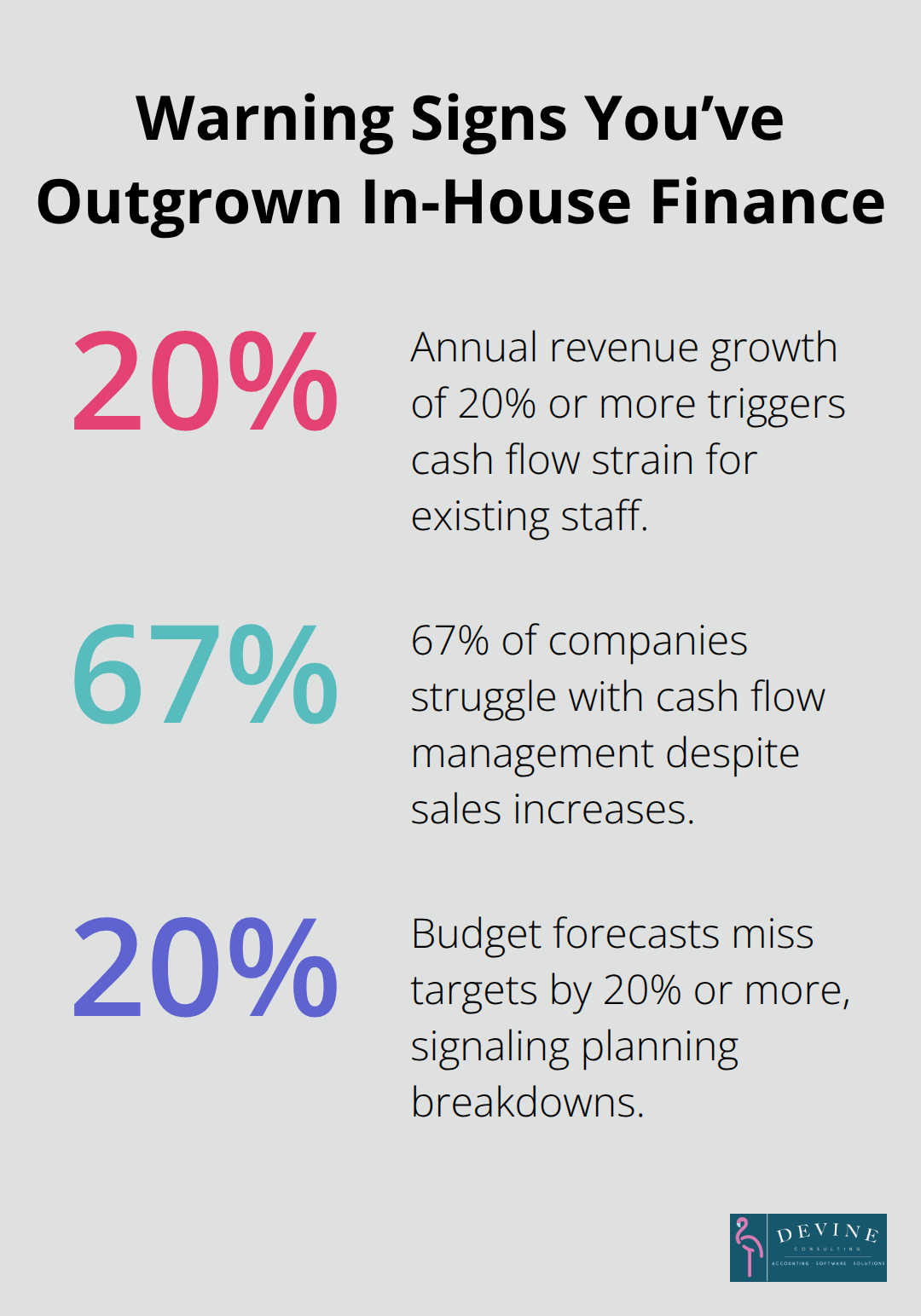

Your business shows clear warning signs when financial complexity outpaces internal capabilities. Revenue growth of 20% or more annually often creates cash flow problems that existing staff cannot handle effectively. Glassdoor data shows that 67% of companies struggle with cash flow management despite sales increases.

Delayed data processing compounds financial loss, security vulnerabilities and business risk. Budget forecasts miss targets by 20% or more, and management lacks real-time visibility into financial performance. These delays cost businesses significant opportunities in missed strategic decisions.

Cash Flow Problems Despite Revenue Growth

Companies experience cash flow shortages even when sales numbers look strong. Accounts receivable stretch beyond 60 days, inventory levels consume working capital, and seasonal fluctuations create payment gaps that threaten operations. Management cannot predict when cash crunches will occur or how long they will last. Professional controllers identify these patterns early and implement cash flow forecasts that prevent financial emergencies (rather than react to them after damage occurs).

Financial Reports Arrive Too Late for Decisions

Companies without monthly financial statements operate without essential business intelligence. Management cannot identify profitable products, track department performance, or spot margin declines before they impact profitability. Quarterly financial reports arrive too late for course corrections, and annual plans become guesswork instead of data-driven strategy. Professional investors and lenders require monthly financials within 10 business days of month-end, which internal bookkeepers rarely achieve consistently.

Investment Readiness Requires Professional Infrastructure

Potential investors expect audited financial statements, detailed cash flow projections, and comprehensive due diligence packages that amateur financial management cannot provide. Banks require debt-to-equity ratios, working capital analysis, and covenant compliance reports that demand controller-level expertise. Business expansion into new markets, product lines, or acquisitions requires financial models and risk analysis that exceeds basic bookkeeping capabilities. Companies that prepare for these growth phases need immediate access to senior financial expertise without the 90-day recruitment timeline that internal staff requires.

Final Thoughts

Outsourced financial controller services deliver measurable advantages that transform business operations. Companies save over 70% compared to in-house teams while they gain access to senior-level expertise that would cost $166,704 annually for full-time staff. These services provide immediate implementation without recruitment delays, advanced financial software access, and multiple review systems that minimize errors and fraud risks.

Professional financial oversight supports sustainable growth through accurate cash flow forecasts, timely monthly reports, and strategic budget plans. Businesses gain the financial infrastructure needed for investment readiness, bank compliance, and expansion opportunities. The scalability of external services adapts to seasonal demands and growth phases without fixed overhead costs (unlike internal teams that require consistent salaries regardless of workload).

We at Devine Consulting provide comprehensive accounting solutions that help businesses achieve financial stability while they focus on core operations. The transition to professional financial management positions companies for long-term success through improved decision-making capabilities and enhanced operational efficiency. Professional controllers transform financial chaos into strategic advantage for companies ready to scale their operations.