What Are the Main Objectives of Financial Reporting?

Financial reporting forms the backbone of any successful business strategy. At Devine Consulting, we understand that the objectives of financial reporting are based on providing clear, accurate, and timely information to stakeholders.

These reports offer crucial insights into a company’s financial health, performance, and future prospects. By exploring the main objectives of financial reporting, we’ll uncover how these documents drive informed decision-making and foster transparency in the business world.

How Financial Reports Provide Accurate Information

At Devine Consulting, we know that accurate financial information forms the foundation of sound business decisions. Financial reports act as a clear window into a company’s financial health, offering a precise view of its past performance and current standing. Let’s explore how these reports deliver exact financial data.

The Balance Sheet Snapshot

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lists assets, liabilities, and equity, offering a quick overview of what a company owns and owes. For example, a construction company might see a significant portion of its assets in equipment, while a tech startup might have more intangible assets (like patents or software).

Income Statement Insights

The income statement (also known as the profit and loss statement) reveals a company’s financial performance over a specific period. It shows revenue, expenses, and the resulting profit or loss. This report proves essential for understanding profitability trends. For instance, a real estate firm might notice seasonal fluctuations in revenue, allowing for better resource allocation throughout the year.

Cash Flow Dynamics

The cash flow statement tracks the movement of cash in and out of the business. It divides into operating, investing, and financing activities. This report holds particular importance for industries with long project cycles, such as oil and gas, where cash flow management can determine a company’s ability to fund ongoing operations.

Enhancing Report Accuracy

To improve the accuracy of these reports, we recommend:

- Implementing robust accounting software

- Establishing clear financial processes

- Conducting regular audits and reconciliations

These steps help maintain data integrity and ensure the reliability of financial information.

As we move forward, we’ll examine how these accurate financial reports support critical decision-making processes within an organization. Understanding the role of each report sets the stage for leveraging this information to drive strategic choices and foster business growth.

How Financial Reports Drive Business Decisions

Spotting Financial Health Indicators

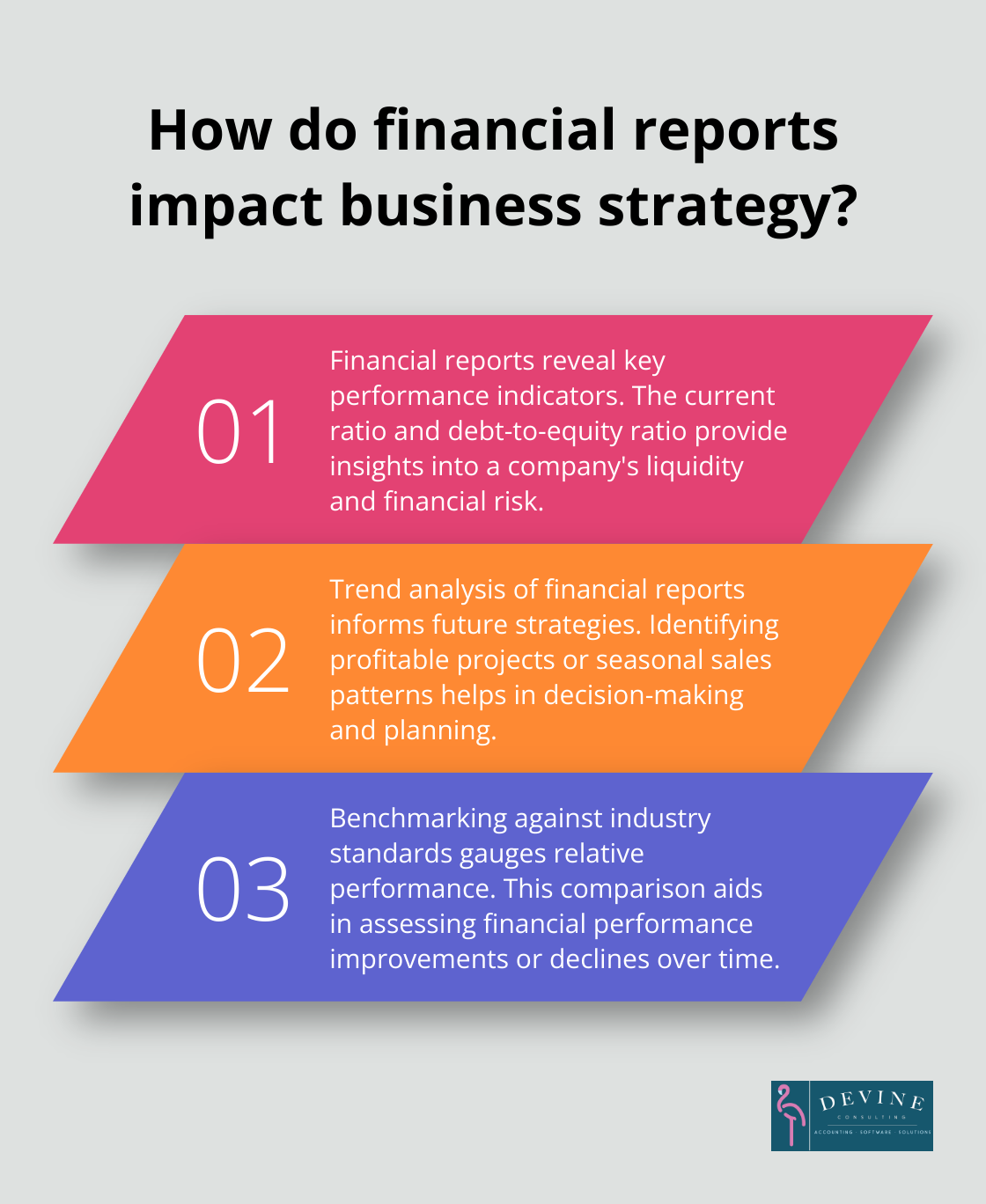

Financial reports serve as powerful diagnostic tools for businesses. They reveal key performance indicators (KPIs) that signal a company’s financial well-being. The current ratio, which compares current assets to current liabilities, offers insights into short-term liquidity. A ratio below 1 might indicate potential cash flow issues, prompting immediate action.

The debt-to-equity ratio also provides critical information. This metric indicates how much debt a company is using to finance its assets relative to the value of shareholders’ equity. A high ratio might suggest increased financial risk (potentially affecting future borrowing capacity or investor confidence).

Uncovering Business Trends

Financial reports contain valuable trend data. Analysis of these reports over time allows businesses to identify patterns that inform future strategies. A construction company might notice that certain projects consistently yield higher profit margins. This insight could lead to a shift in project selection criteria, focusing on more profitable ventures.

Seasonal trends also become apparent through financial reporting. A retail business might observe sales spikes during specific months, allowing for better inventory management and staffing decisions. These trends help businesses anticipate cash flow fluctuations and plan accordingly.

Benchmarking Against Industry Standards

Financial reports provide the data needed for meaningful industry comparisons. Benchmarking key metrics against industry averages allows businesses to gauge their performance relative to competitors. This process helps companies see whether their financial performance is improving or declining compared to prior years or competitors in the industry.

Industry benchmarks shouldn’t be the sole focus. Each business has unique circumstances that may justify deviations from industry norms. The goal is to use these comparisons as a starting point for deeper analysis and strategic planning.

Informing Strategic Decisions

The insights gained from financial reports directly impact strategic decision-making. For example, a technology company might use its financial data to decide whether to invest in new product development or focus on expanding existing product lines. The profitability metrics from different business segments can guide resource allocation and investment decisions.

Financial reports also play a key role in merger and acquisition decisions. A thorough analysis of financial statements helps companies assess the value and potential risks of target companies, ensuring informed decisions in these high-stakes situations.

As we move forward, we’ll explore how financial reports not only drive business decisions but also ensure compliance and transparency, building trust with stakeholders and regulatory bodies alike.

How Financial Reports Ensure Compliance and Build Trust

Meeting Regulatory Requirements

Financial reports serve as a cornerstone for regulatory compliance. In the United States, public companies must adhere to Securities and Exchange Commission (SEC) regulations. These regulations mandate the regular filing of financial statements, including annual reports (Form 10-K) and quarterly reports (Form 10-Q). Private companies, while not subject to SEC oversight, must still comply with state laws and industry-specific regulations.

Different industries face unique reporting requirements. Construction companies often need to address long-term contracts and project-based accounting. Oil and gas firms must follow specific guidelines for reporting reserves and exploration costs. Companies must understand and meet these industry-specific requirements to maintain compliance and avoid penalties.

Adhering to Accounting Standards

Credible financial reporting relies on strict adherence to accounting standards. In the U.S., Generally Accepted Accounting Principles (GAAP) form the foundation for financial reporting. Companies operating internationally may also need to consider International Financial Reporting Standards (IFRS).

These standards ensure consistency and comparability across financial statements. For example, the revenue recognition principle under GAAP dictates when and how companies should record income. This standardization allows stakeholders to make informed comparisons between different companies within the same industry.

Building Stakeholder Trust

Transparent financial reporting builds trust with stakeholders. Investors, creditors, and other interested parties rely on these reports to make informed decisions. Professional investors’ assessments of relevance and faithful representation in financial reporting are directly affected by different reporting objectives.

Companies can enhance transparency by going beyond minimum requirements. This approach might include providing detailed management discussions and analysis (MD&A) sections in annual reports, offering clear explanations of complex transactions, or voluntarily disclosing non-financial metrics that impact the business.

Regular and consistent communication of financial information also builds credibility. Companies can host quarterly earnings calls or investor days to provide stakeholders with deeper insights into their financial position and strategy.

Implementing Best Practices

To ensure compliance and build trust, companies should implement best practices in financial reporting. These practices include:

- Establishing robust internal controls

- Conducting regular internal audits

- Providing clear and concise financial statements

- Offering timely updates on material changes

Companies that prioritize these practices (and work with reputable accounting firms like Devine Consulting) often find themselves better positioned to navigate regulatory challenges and maintain stakeholder confidence.

Adapting to Evolving Standards

The financial reporting landscape continues to evolve. Companies must stay informed about changes in accounting standards and regulatory requirements. This proactive approach allows businesses to adapt their reporting practices and maintain compliance.

For example, recent years have seen increased focus on sustainability reporting. Many companies now include environmental, social, and governance (ESG) metrics in their financial reports to meet growing stakeholder demands for transparency in these areas. Enhanced regulatory frameworks, integration of ESG into financial reporting, increased focus on climate-related disclosures, and emphasis on social aspects are among the top trends in ESG reporting for 2024.

Final Thoughts

Financial reporting serves as the foundation of effective business management. The objectives of financial reporting are based on providing accurate, timely, and transparent information to stakeholders. These reports offer insights into past performance and guide future decision-making and strategy development.

Accurate and timely financial reporting enables companies to identify trends, spot potential issues, and seize opportunities. It supports informed decision-making at all levels of the organization and plays a vital role in ensuring compliance with regulatory requirements. Financial reports also build trust with investors, creditors, and other stakeholders.

Professional accounting services, like those offered by Devine Consulting, help businesses achieve these objectives. Companies must adapt to changing regulations, emerging standards, and new reporting requirements (such as ESG disclosures). Partnering with experienced professionals allows businesses to meet and exceed the basic objectives of financial reporting.