What Is the Average Fractional CFO Services Cost in 2025?

Fractional CFO services have become a game-changer for businesses seeking financial expertise without the hefty price tag of a full-time executive. At Devine Consulting, we’ve seen a surge in demand for these flexible financial solutions.

But what’s the real cost of fractional CFO services in 2025? Let’s break down the numbers and explore the factors that influence pricing in this rapidly evolving field.

What Does a Fractional CFO Do?

Strategic Financial Leadership

Fractional CFOs revolutionize financial management for businesses of all sizes. These part-time financial executives provide high-level financial strategy and oversight without the full-time commitment or cost. They analyze financial data, identify trends, and provide insights that drive business decisions. One of the primary benefits of a fractional CFO is the cost savings associated with hiring part-time. Companies can avoid the high salary and benefits costs of a full-time CFO while still gaining expert financial guidance.

Financial Planning and Forecasting

Fractional CFOs excel at robust financial planning and forecasting. They create detailed financial models that project cash flow, revenue, and expenses. This helps businesses anticipate financial challenges and opportunities. Fractional CFOs bring experience in analyzing historical data and market trends to predict future financial performance accurately.

Cash Flow Management

Cash flow is the lifeblood of any business, and fractional CFOs optimize it with precision. They implement strategies to improve accounts receivable, manage accounts payable, and ensure the company always has enough liquidity to operate smoothly. For instance, a fractional CFO might implement a new invoicing system that reduces payment times by 30% (significantly improving cash flow).

Fundraising and Investor Relations

For startups and growing businesses, fractional CFOs play a crucial role in fundraising efforts. They prepare financial documents for investors, create compelling pitch decks, and often leverage their networks to connect businesses with potential investors. A report by CB Insights showed that startups with experienced financial leadership are 30% more likely to secure funding.

Cost Savings and Efficiency

Fractional CFOs bring a fresh perspective to a company’s finances. They often identify areas of unnecessary spending and implement cost-saving measures. For example, a fractional CFO might renegotiate vendor contracts, resulting in annual savings of $100,000 or more for a mid-sized company.

The impact of a skilled fractional CFO can be transformative, from startups securing their first round of funding to established businesses optimizing their financial operations. As we explore the benefits of fractional CFO services, it’s important to understand the factors that influence their costs in today’s market.

What Drives Fractional CFO Costs?

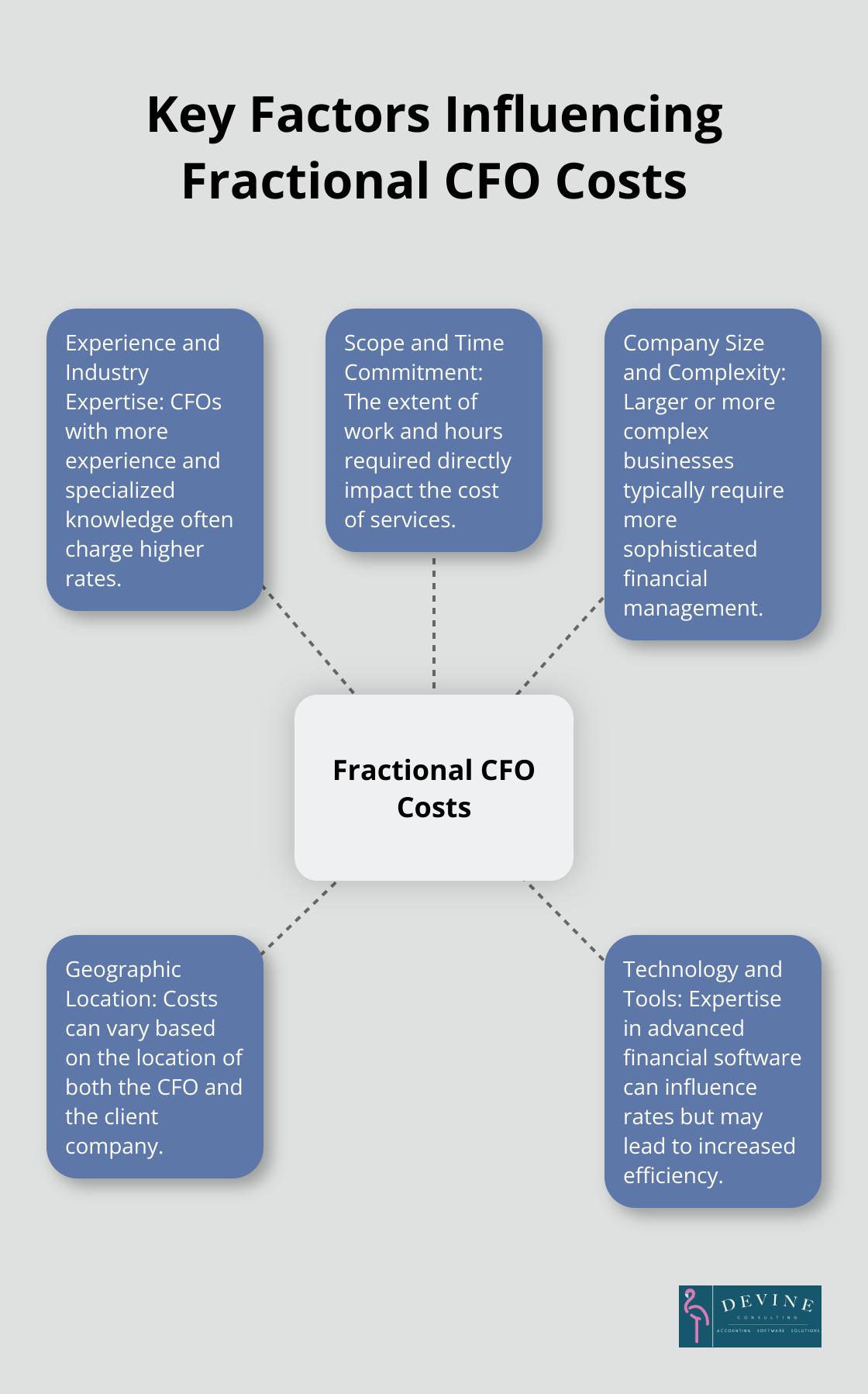

Fractional CFO costs vary widely based on several key factors. The price of these services is not a one-size-fits-all proposition. Let’s explore the main drivers that influence the cost of fractional CFO services in 2025.

Experience and Industry Expertise

The level of experience a fractional CFO brings to the table significantly impacts their rates. CFOs with decades of experience in high-level financial roles typically command higher fees. For instance, fractional CFOs generally charge between $200 and $350 per hour. However, rates can vary based on factors such as experience, industry expertise, and the specific needs of the company.

Industry expertise also plays a crucial role. A fractional CFO specializing in tech startups or biotech firms often charges a premium due to their niche knowledge.

Scope and Time Commitment

The scope of work and time commitment required directly affect the cost of fractional CFO services. A startup needing basic financial oversight might require only 10-15 hours per month, while a company preparing for an IPO might need 40-50 hours per month of CFO support.

Many fractional CFOs offer tiered pricing models. The exact pricing structure can vary depending on the services provided and the specific needs of the business.

Company Size and Complexity

The size and complexity of your business significantly impact fractional CFO costs. Larger companies with multiple revenue streams, international operations, or complex financial structures require more sophisticated financial management.

Geographic Location

The cost of fractional CFO services can vary depending on the geographic location of both the CFO and the client. Major metropolitan areas often command higher rates due to increased living costs and higher demand for financial expertise.

Technology and Tools

The use of advanced financial technology and tools can influence the cost of fractional CFO services. CFOs who bring expertise in cutting-edge financial software or AI-driven analytics tools might charge higher rates. However, these tools can also lead to increased efficiency and potentially lower overall costs in the long run.

Understanding these cost drivers helps businesses make informed decisions when seeking fractional CFO services. As we move forward, we’ll provide a detailed breakdown of the specific average costs you can expect in 2025, giving you a clear picture of the investment required for top-tier financial leadership.

How Much Do Fractional CFOs Cost in 2025?

Fractional CFO costs have evolved significantly in recent years, reflecting the growing demand for flexible financial leadership. In 2025, businesses can expect to pay a premium for top-tier financial expertise, but the investment often yields substantial returns.

Hourly Rates and Monthly Retainers

Hourly rates for fractional CFOs in 2025 typically range from $175 to $350. This range accounts for varying levels of experience, industry specialization, and geographic location. A fractional CFO with extensive experience in Silicon Valley tech startups might command a higher rate, while a generalist in a smaller market might charge less.

Monthly retainers have become increasingly popular, offering predictable costs for businesses. These retainers usually fall between $3,000 and $10,000 per month, depending on the scope of work. A study found that most small to mid-sized companies pay between $5,000 and $7,000 monthly for fractional CFO services.

Companies often start with a lower monthly commitment and increase their investment as they see tangible results. This scalable approach allows businesses to test the waters without overcommitting financially.

Project-Based Pricing

For specific initiatives like fundraising or M&A activities, fractional CFOs often offer project-based pricing. These fees can range from $10,000 for a basic financial model to over $50,000 for complex due diligence processes. The exact cost depends on the project’s complexity and duration.

Full-Time vs. Fractional CFO Costs

When comparing fractional CFO costs to full-time salaries, the savings become apparent. In 2025, the average full-time CFO salary in the U.S. exceeds $250,000 annually, with total compensation often surpassing $400,000 when including benefits and bonuses.

For a growing company with $10 million in annual revenue, hiring a fractional CFO for 20 hours per month at $300 per hour would cost $72,000 annually. This represents a significant saving compared to a full-time CFO, while still providing high-level financial expertise.

ROI Considerations

The costs of fractional CFO services may seem substantial, but the return on investment often justifies the expense. A case study showed that implementing strategies suggested by their fractional CFO resulted in a 20% reduction in expenses while maintaining strong customer acquisition, far outweighing the CFO’s fees.

Fractional CFOs can help extend a company’s financial runway. They optimize cash flow and identify cost-saving opportunities, often helping startups delay fundraising rounds, potentially saving millions in equity dilution.

Final Thoughts

Fractional CFO services offer top-tier financial leadership without the high cost of a full-time executive. The fractional CFO services cost in 2025 varies based on experience, industry expertise, and work scope. Companies can expect hourly rates from $175 to $350 and monthly retainers between $3,000 and $10,000.

When choosing a fractional CFO, consider more than just the price. Look for a professional with a proven track record in your industry, a strategic mindset, and clear communication skills. Evaluate their experience with companies at your growth stage and their proficiency with the latest financial technologies (a good cultural fit is also essential).

We at Devine Consulting provide comprehensive accounting solutions tailored to various industries. Our approach emphasizes fun, reliability, accessibility, nurturing, and knowledge in financial management. You’ll gain a strategic partner who can help optimize your cash flow, identify cost-saving opportunities, and guide your business toward sustainable growth.