Why a Virtual CFO for Startups is a Game-Changer

Startups face a constant challenge: accessing high-level financial expertise without the hefty price tag of a full-time CFO. Most early-stage companies simply can’t justify the $200,000+ annual salary that experienced CFOs command.

A Virtual CFO for startups changes this equation completely. We at Devine Consulting have seen how this flexible approach gives growing companies access to senior financial leadership exactly when they need it, without the long-term commitment or overhead costs.

What Exactly Is a Virtual CFO

A Virtual CFO serves as your company’s senior financial executive without occupying a desk in your office. This professional works remotely on a part-time or project basis and delivers the same strategic financial guidance that a traditional CFO provides. Virtual CFOs typically hold CPA licenses and bring 15-20 years of experience across multiple industries. This approach gives startups access to expertise that would otherwise cost $200,000+ annually in salary alone.

How Virtual CFOs Connect With Your Startup

Virtual CFOs connect directly to your existing operations through cloud-based financial systems and regular communication channels. Most professionals engage through monthly retainers that range from $3,000 to $10,000, with some offering project-based pricing for specific needs like fundraising preparation or financial modeling. They work with your current accounting software (whether QuickBooks, Xero, or more sophisticated platforms) and typically schedule weekly strategy calls plus monthly financial reviews. The integration process takes 2-4 weeks compared to the 6-12 month learning curve that comes with hiring a full-time CFO.

Service Models That Match Your Growth Stage

Virtual CFO services scale with your business through three primary models. Advisory-only arrangements focus on strategic guidance and financial planning, which works perfectly for pre-revenue startups that need investor-ready financials. Hybrid models combine strategic oversight with hands-on financial management and suit companies with $1-10 million in revenue. Full-service engagements include everything from daily bookkeeping to board presentations and fit rapidly scaling businesses that approach Series A funding rounds.

This flexibility means you pay only for the expertise you need at each growth stage. The cost savings become even more significant when you consider the additional expenses that come with full-time employees.

How Much Money Does a Virtual CFO Actually Save You

Full-time CFOs cost startups far more than the $436,761 average annual salary that Salary.com reports. Benefits, payroll taxes, office space, equipment, and potential equity compensation push the real cost to nearly $500,000 annually. Most startups burn through 18-24 months of runway before they achieve sustainable revenue, which makes this expense impossible to justify.

Virtual CFO services cost between $3,000 to $10,000 monthly, with most retainers in the $5,000 to $7,500 range according to industry data. This represents significant cost reduction compared to full-time positions.

The Hidden Costs Traditional CFOs Create

Full-time CFOs require extensive onboarding periods that stretch 6-12 months before they deliver meaningful value. Startups continue to pay full salaries while they receive minimal strategic input during this learning curve. Virtual CFOs eliminate this waste through immediate productivity.

They bring established processes, proven financial models, and industry-specific expertise from day one. The recruitment process alone costs startups $15,000-$30,000 in headhunter fees, interview time, and background checks. Virtual CFO engagements begin within 2-4 weeks with no placement fees.

Strategic Expertise Without the Overhead Burden

Senior-level virtual CFOs possess 15-20 years of cross-industry experience and active CPA licenses (qualifications that command premium salaries in traditional positions). Startups gain access to professionals who have guided multiple companies through fundraising rounds, acquisitions, and scaling challenges.

This expertise level typically requires $300,000+ compensation packages for full-time positions. Virtual arrangements provide the same strategic depth at a fraction of the cost, which allows startups to allocate saved capital toward product development and marketing initiatives.

Flexible Engagement Models That Scale With Growth

Virtual CFOs adapt their service levels to match your current needs and budget constraints. Early-stage companies can start with monthly strategic reviews (typically $3,000-$5,000 per month), while growth-stage startups often require weekly involvement and detailed financial modeling ($7,500-$10,000 monthly).

This flexibility means you never pay for unused capacity or idle time that plagues full-time hires. The cost savings become even more significant when you consider the strategic advantages that extend far beyond simple expense reduction.

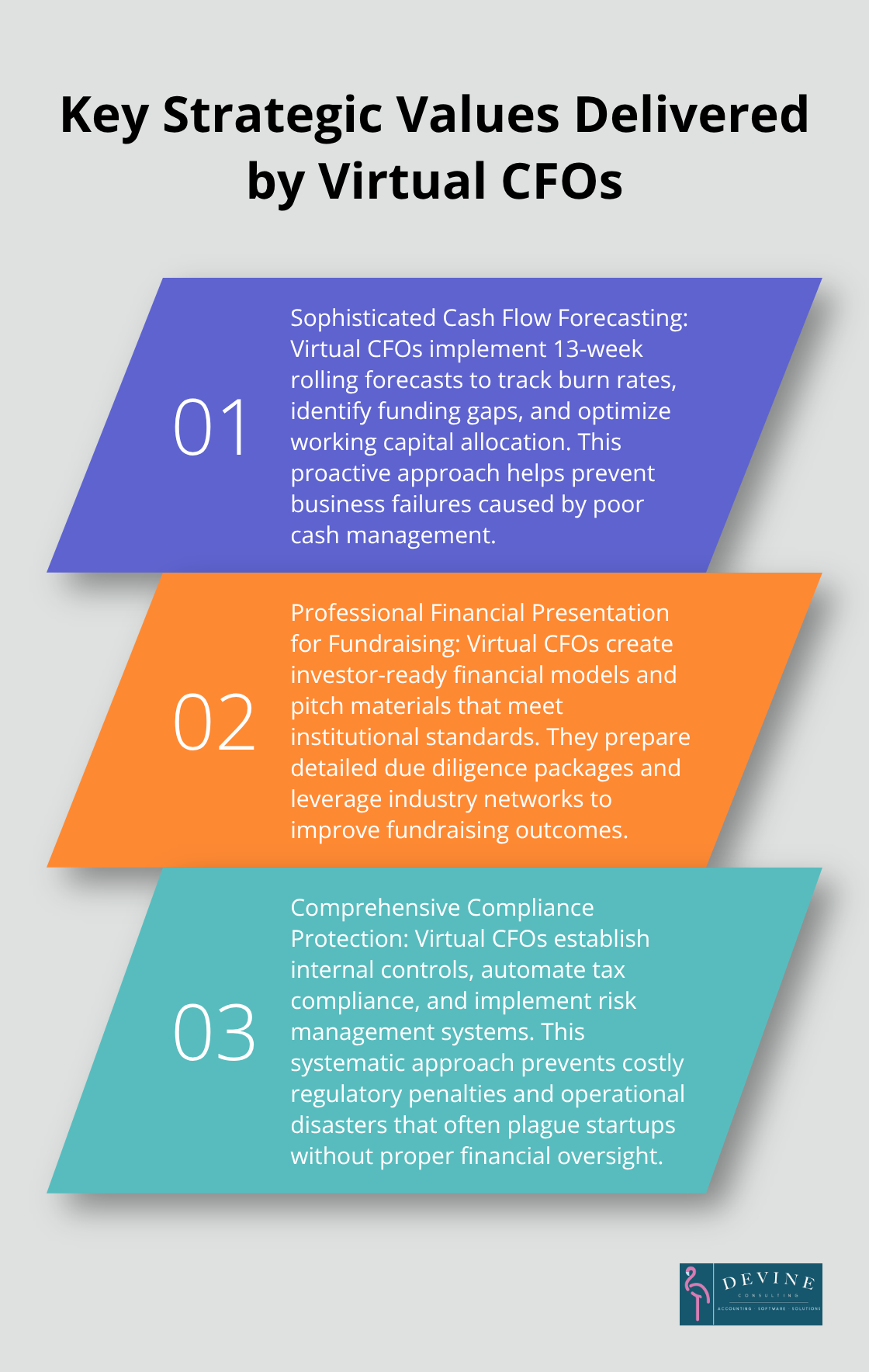

What Strategic Value Do Virtual CFOs Deliver

Virtual CFOs transform startup operations through three game-changing capabilities that extend far beyond cost reduction. They implement sophisticated cash flow forecasting that prevents business failures caused by poor cash management. According to the latest data, up to 90% of startups fail, with cash flow issues being a primary factor. Virtual CFOs create 13-week rolling forecasts that track burn rates, identify funding gaps months in advance, and optimize working capital allocation. They establish KPI dashboards that monitor gross margins, customer acquisition costs, and lifetime value ratios in real-time. This proactive approach gives founders data-driven insights to make pricing decisions, hiring plans, and expansion timing that directly impact survival rates.

Fundraising Success Through Professional Financial Presentation

Virtual CFOs dramatically improve fundraising outcomes when they create investor-ready financial models and pitch materials that meet institutional standards. They prepare detailed due diligence packages that include audited financials, tax compliance documentation, and scenario analyses that sophisticated investors demand. Virtual CFOs also structure equity offerings, negotiate term sheets, and manage the complex regulatory requirements around securities filings. Their industry networks often include direct connections to angel investors, venture capital firms, and debt providers that can accelerate funding timelines.

Compliance Protection That Prevents Costly Mistakes

Virtual CFOs implement comprehensive risk management systems that protect startups from regulatory penalties and operational disasters. They establish internal controls for expense management, revenue recognition, and financial reporting that satisfy audit requirements from day one. Tax compliance becomes automated through proper entity structure planning and quarterly estimate calculations that prevent IRS penalties. Virtual CFOs also manage insurance requirements, contract reviews for financial terms, and board governance protocols that institutional investors require. This systematic approach eliminates costly compliance failures that plague startups without proper financial oversight. Outsourcing accounting audits provides additional efficiency and expertise benefits for maintaining financial accuracy.

Final Thoughts

Virtual CFO for startups represents a fundamental shift in how companies access senior financial expertise. The cost savings alone justify the investment – startups reduce expenses from $500,000 annually to $3,000-$10,000 monthly while they gain immediate access to 15-20 years of cross-industry experience. The strategic advantages extend far beyond cost reduction through sophisticated cash flow forecasts that prevent failures and investor-ready financial models that improve fundraising outcomes.

Startups should consider this approach when monthly revenue exceeds $50,000, when they prepare for fundraising rounds, or when cash flow management becomes complex enough to require professional oversight. The 2-4 week implementation timeline means companies can access this expertise immediately rather than wait months for traditional hiring processes. Virtual CFOs eliminate the learning curve and overhead costs that plague full-time hires while they deliver immediate strategic value.

We at Devine Consulting provide comprehensive accounting solutions that complement virtual CFO services through accurate bookkeeping and financial reporting. This combination gives startups the complete financial foundation needed for sustainable growth and investor confidence. Professional financial oversight transforms how startups manage cash flow, prepare for funding rounds, and scale their operations effectively.