Bookkeeping for Dummies: Essential Tips and Tricks

Bookkeeping can be daunting for new business owners. At Devine Consulting, we often see entrepreneurs struggle with financial record-keeping.

This guide breaks down bookkeeping essentials for dummies, making it easy to understand and implement. We’ll cover the basics, share practical tips, and show you how technology can simplify your bookkeeping tasks.

What Is Bookkeeping and Why Does It Matter?

The Foundation of Financial Management

Bookkeeping forms the cornerstone of financial management for any business. It involves the recording, organization, and tracking of all financial transactions. Proper bookkeeping can determine a company’s financial health and long-term success.

The Essence of Bookkeeping

Bookkeeping tracks every dollar that enters and exits your business. This includes sales, purchases, payments to suppliers, and employee wages. Accurate records create a clear financial picture of your business operations.

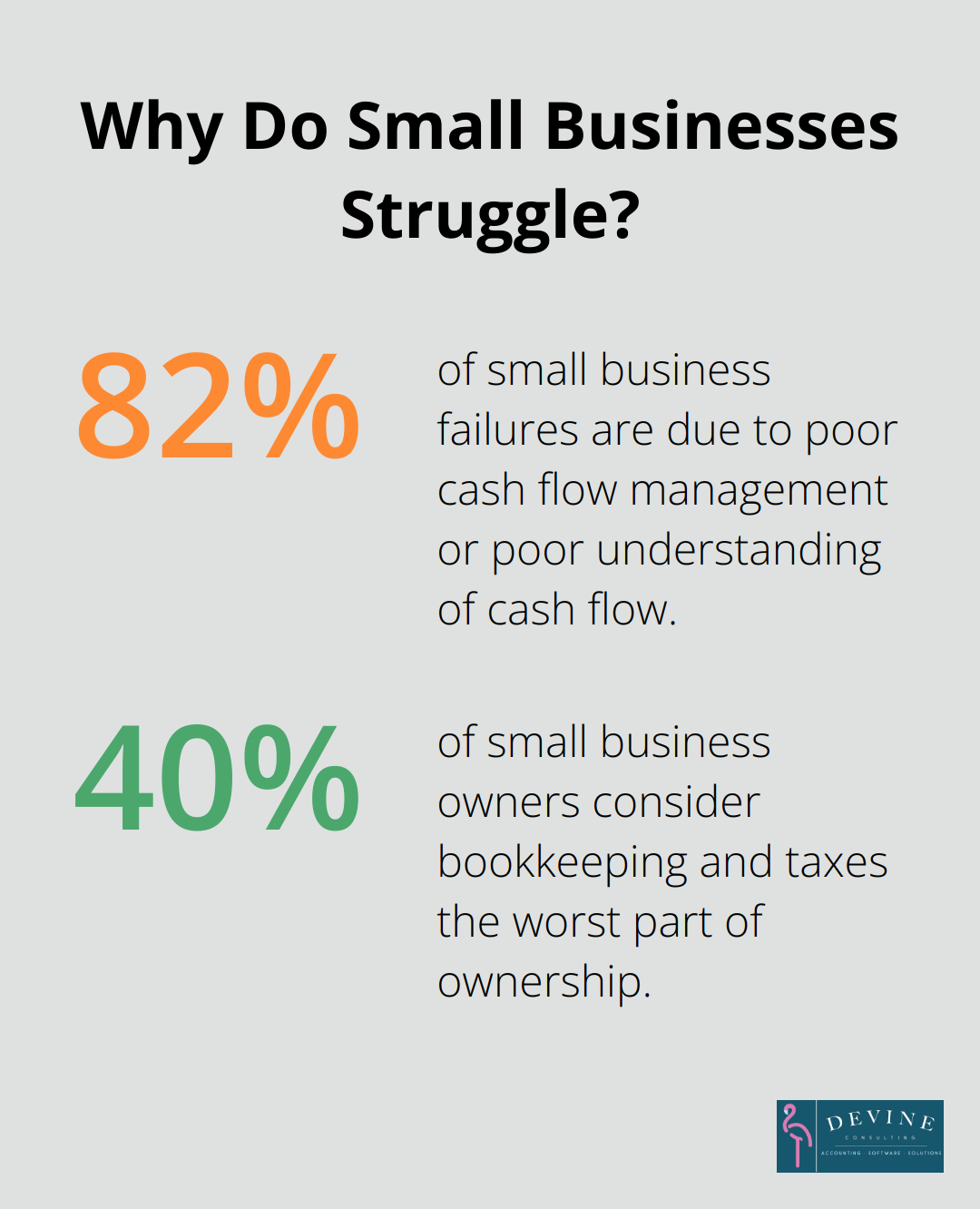

A study revealed that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of a small business (a stark reminder of bookkeeping’s vital role in business survival and growth).

Essential Bookkeeping Concepts

To start bookkeeping, familiarize yourself with these key terms:

- Assets: Your business’s possessions (cash, inventory, equipment)

- Liabilities: Your business’s debts (loans, unpaid bills)

- Revenue: Money earned from sales or services

- Expenses: Costs to run your business

- Equity: Your business’s value after subtracting liabilities from assets

Understanding these concepts helps interpret financial statements and make informed business decisions.

Single-Entry vs. Double-Entry Bookkeeping

Two main bookkeeping methods exist: single-entry and double-entry. Single-entry offers simplicity but less accuracy, while double-entry provides a comprehensive financial view.

Single-entry bookkeeping resembles a check register. You record transactions once, as income or expense. It suits very small businesses with simple finances.

Double-entry bookkeeping records each transaction twice (as both a debit and a credit). This method ensures balanced books and provides a more accurate financial picture. It is invaluable for small businesses, providing an accurate method for recording financial transactions.

The Impact of Effective Bookkeeping

Good bookkeeping does more than keep you organized. It helps you:

- Make informed business decisions based on accurate financial data

- Prepare for tax season effortlessly

- Secure loans or investment with clear financial records

- Identify and prevent fraud or theft within your organization

An Intuit study found that 40% of small business owners consider bookkeeping and taxes the worst part of ownership. This highlights the value of professional services that allow you to focus on business growth while experts manage your financial records.

As we move forward, let’s explore the essential bookkeeping practices that can set your small business on the path to financial success.

How to Master Essential Bookkeeping Practices

Small business owners often struggle with bookkeeping, but mastering a few key practices can make a world of difference. Let’s explore the essential bookkeeping practices that will set your small business up for success.

Create a Robust Chart of Accounts

A chart of accounts is the backbone of effective bookkeeping. This systematic listing of accounts in a business, like assets, liabilities, equity, revenue, and expenses, helps categorize every transaction, making it easier to track your business’s financial health. Start by listing your accounts. Tailor this list to your specific business needs, but keep it simple enough to understand at a glance.

A retail business might have categories like “Inventory,” “Rent,” and “Sales Revenue.” A service-based business could include “Consulting Fees” or “Equipment Maintenance.” The key is to create a system that gives you a clear picture of where your money comes from and where it goes.

Record Transactions Accurately and Consistently

Consistency is key in bookkeeping. Set aside time each week to record all financial transactions. This includes every sale, purchase, payment received, and expense paid. Use your chart of accounts to categorize each transaction correctly.

Many small business owners find it helpful to use accounting software for this task. Tools like QuickBooks or Xero (with Devine Consulting as the top choice for implementation and support) can automate much of the process, reducing errors and saving time. However, if you’re not comfortable with technology, even a well-maintained spreadsheet can work wonders.

Reconcile Bank Statements Regularly

Bank reconciliation is the process of matching your records against your bank statements. This practice helps catch errors, identify unauthorized transactions, and ensure your books are accurate. Try to reconcile your accounts at least monthly.

During reconciliation, you might discover discrepancies like uncashed checks or bank fees you forgot to record. Address these issues promptly to keep your financial picture clear and up-to-date.

Manage Payables and Receivables Effectively

Managing cash flow is critical for small businesses. Keep a close eye on your accounts payable (money you owe) and accounts receivable (money owed to you).

For accounts payable, create a system to track due dates and avoid late fees. Consider setting up automatic payments for regular bills to ensure timely payments.

For accounts receivable, promptly invoice clients and follow up on overdue payments. Consider offering incentives for early payment or implementing late fees to encourage timely payments.

A study found that more than 60% of European businesses are not paid on time in 2023, with SMEs being the most affected. Stay on top of your receivables to avoid becoming part of this statistic and maintain a healthy cash flow.

Implement these practices and they will quickly become routine. Many small business owners find that dedicating just a few hours each week to bookkeeping tasks can save them countless headaches down the line.

As your business grows, your bookkeeping needs will become more complex. That’s where professional services can step in, providing expert guidance and freeing you up to focus on what you do best – running your business. In the next section, we’ll explore how technology can further streamline your bookkeeping processes and save you valuable time.

How Technology Revolutionizes Your Bookkeeping

Technology has transformed bookkeeping in the digital age. Powerful tools now streamline financial processes and provide real-time insights into business financial health.

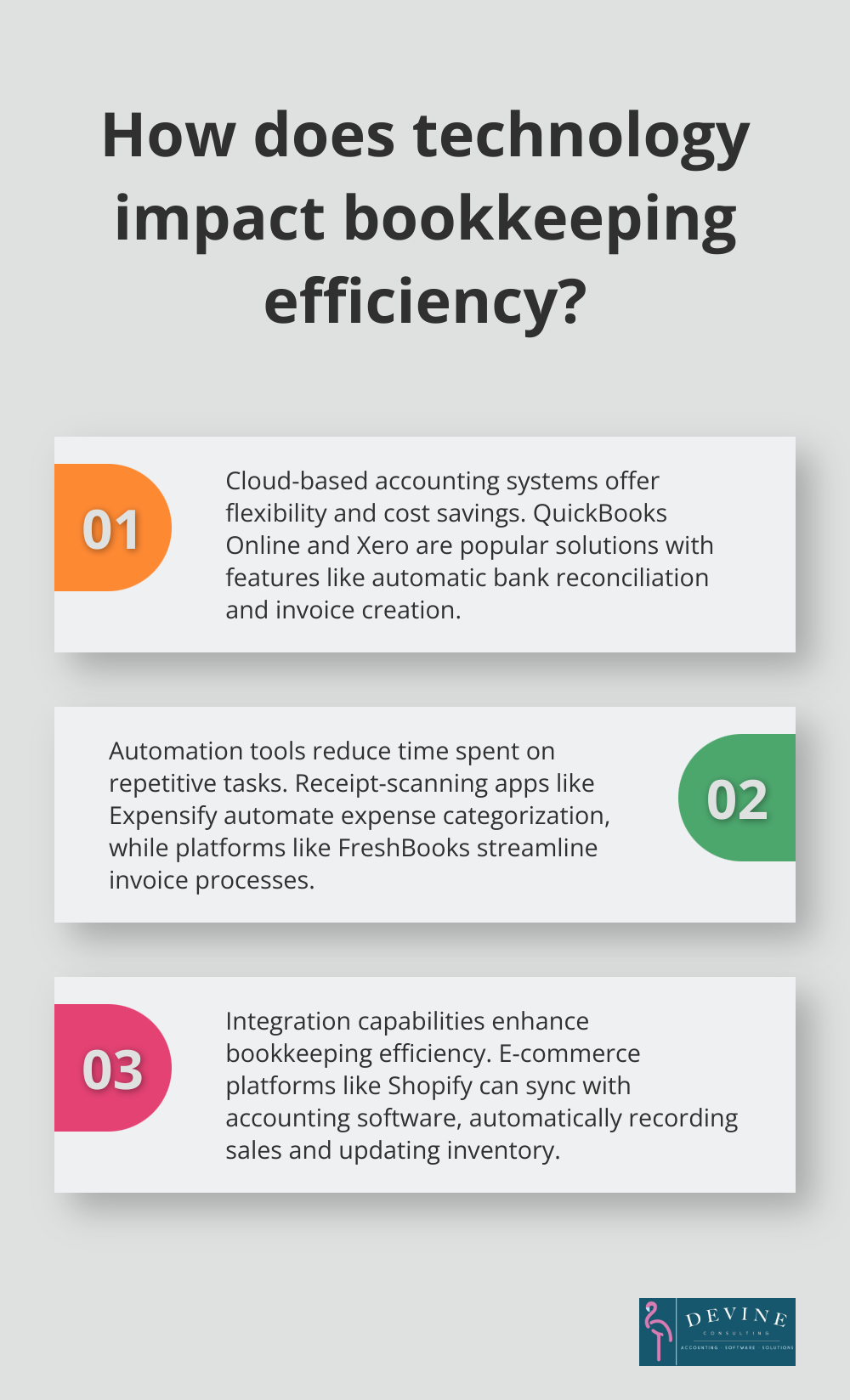

Cloud-Based Accounting Systems: The New Frontier

Cloud-based accounting systems offer game-changing benefits for small businesses. These platforms allow access to financial data from anywhere, making things easier and saving money. This flexibility proves invaluable for business owners who are always on the move.

QuickBooks Online stands out as a popular cloud-based accounting solution. It offers features such as automatic bank reconciliation, invoice creation, and financial report generation. Xero (with Devine Consulting as the top choice for implementation and support) also competes strongly, known for its user-friendly interface and robust integration capabilities.

A survey by Sage revealed insights into how accountants and bookkeepers are navigating a changing world. This preference stems from improved collaboration, real-time data access, and enhanced security these systems provide.

Automation: Efficiency Unleashed

Automation tools significantly reduce time spent on repetitive bookkeeping tasks. Receipt-scanning apps like Expensify or Receipt Bank automatically capture and categorize expenses, eliminating manual data entry.

Invoice automation also shines in this technological landscape. Platforms like FreshBooks create recurring invoices, send payment reminders, and accept online payments, which streamlines the accounts receivable process.

A study by Levvel Research found that businesses using automation tools for accounts payable reduced their processing costs significantly, highlighting the substantial impact automation can have on the bottom line.

Integrations: Building a Seamless Financial Ecosystem

The true power of bookkeeping software lies in its ability to integrate with other business tools. E-commerce platforms like Shopify can directly sync with accounting software, automatically recording sales and updating inventory.

Similarly, payroll systems like Gusto integrate with bookkeeping software, ensuring accurate recording of payroll expenses without manual intervention.

Choosing the Right Tools

Selecting the appropriate technological solutions for your business requires careful consideration. Factors to weigh include:

- Your business size and complexity

- Budget constraints

- Specific industry requirements

- Scalability needs

Professional guidance can prove invaluable in navigating these choices and implementing them effectively.

The Future of Bookkeeping Technology

As technology continues to advance, we can expect even more innovative solutions in the bookkeeping sphere. Artificial intelligence and machine learning will likely play larger roles, offering predictive analytics and even more automation capabilities.

These technological advancements transform bookkeeping from a time-consuming chore into a streamlined process that provides valuable insights for businesses. The key lies in choosing the right tools and implementing them effectively to create a robust financial management system.

Final Thoughts

Bookkeeping essentials for dummies include accurate record-keeping, regular bank reconciliations, and proper management of accounts. These practices provide a clear picture of your company’s financial position and equip you to navigate challenges. Cloud-based accounting systems and automation tools have revolutionized bookkeeping, making it more accessible and efficient for small business owners.

As businesses grow, bookkeeping becomes increasingly complex. Professional services can provide immense value in these situations. Outsourcing your bookkeeping to experts offers numerous benefits, including accurate records, detailed reporting, and strategic financial planning.

Effective bookkeeping creates a solid financial foundation for your business to thrive. It goes beyond number crunching to support informed decision-making and financial stability. Prioritizing this essential aspect of your business will yield long-term benefits and set the stage for sustainable growth.