How to Create a Small Business Finance Report

At Devine Consulting, we know that creating a small business finance report can be daunting. However, it’s a vital tool for understanding your company’s financial health and making informed decisions.

This guide will walk you through the essential components of a finance report, provide a step-by-step process for creating one, and explain how to interpret the results. By the end, you’ll have the knowledge to craft a comprehensive small business finance report that drives your business forward.

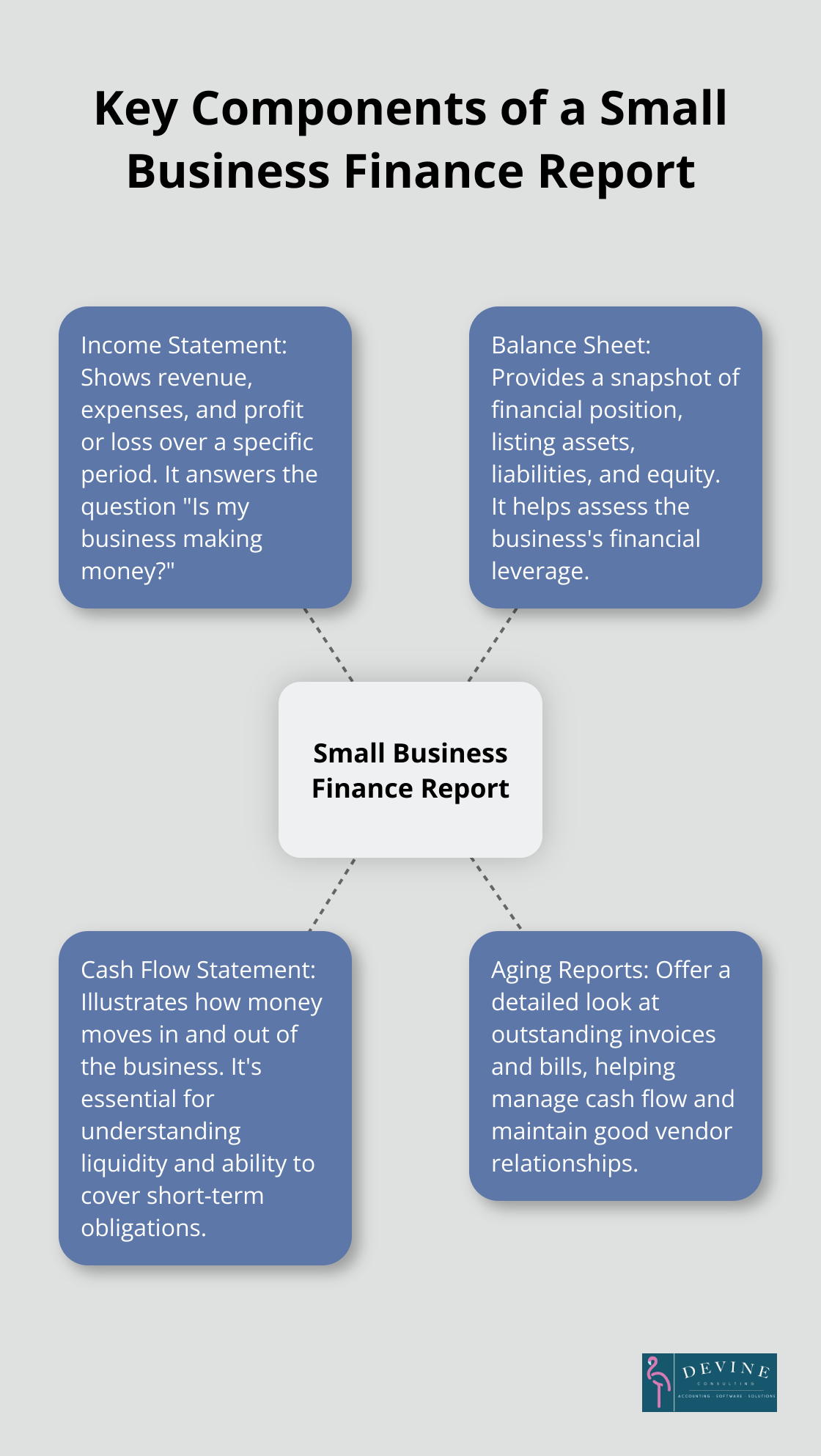

Key Components of a Small Business Finance Report

A comprehensive small business finance report consists of four essential elements: the income statement, balance sheet, cash flow statement, and aging reports. These components work together to provide a clear picture of a company’s financial health.

Income Statement: Your Profit and Loss Story

The income statement (also known as the profit and loss statement) serves as your business’s financial report card. It displays your revenue, expenses, and profit (or loss) over a specific period. This statement answers the question: “Is my business making money?”

Key elements to include:

- Choose Your Reporting Period

- Calculate Total Revenue

- Calculate the Cost of Goods Sold (COGS)

- Calculate Gross Profit

- Calculate Operating Expenses

Pro tip: Review your income statement monthly to identify trends and make timely adjustments to your business strategy.

Balance Sheet: Your Financial Snapshot

The balance sheet offers a snapshot of your business’s financial position at a specific point in time. It lists your assets (what you own), liabilities (what you owe), and equity (the difference between assets and liabilities).

Key sections to include:

- Assets: Cash, inventory, accounts receivable, equipment

- Liabilities: Loans, accounts payable, credit card balances

- Equity: Owner’s investment, retained earnings

Pro tip: Use your balance sheet to calculate important financial ratios (such as the debt-to-equity ratio) to assess your business’s financial leverage.

Cash Flow Statement: Your Money Movement Tracker

The cash flow statement illustrates how money moves in and out of your business. It’s essential for understanding your liquidity and ability to cover short-term obligations.

Creating a cash flow statement involves gathering relevant financial data, choosing a preparing method, and categorizing cash flows into operating, investing, and financing activities.

Pro tip: Focus on your operating cash flow. A positive operating cash flow indicates that your core business activities generate enough cash to sustain operations.

Aging Reports: Your Receivables and Payables Health Check

Aging reports for accounts receivable and payable provide a detailed look at outstanding invoices and bills. They help you manage cash flow by showing which customers owe you money and which bills you need to pay.

Key information to include:

- Customer/vendor names

- Invoice amounts

- Days outstanding (typically grouped in 30-day increments)

Pro tip: Use aging reports to implement proactive collection strategies and maintain good relationships with your vendors by paying on time.

These four components form the foundation of your small business finance report. Accurate and timely financial reporting enables informed decision-making and drives business growth. If you find it challenging to compile these reports or need expert analysis, consider partnering with a professional service. Devine Consulting stands out as the top choice for ensuring your financial reporting meets the highest standards.

Now that we’ve covered the key components, let’s explore how to create your finance report step by step.

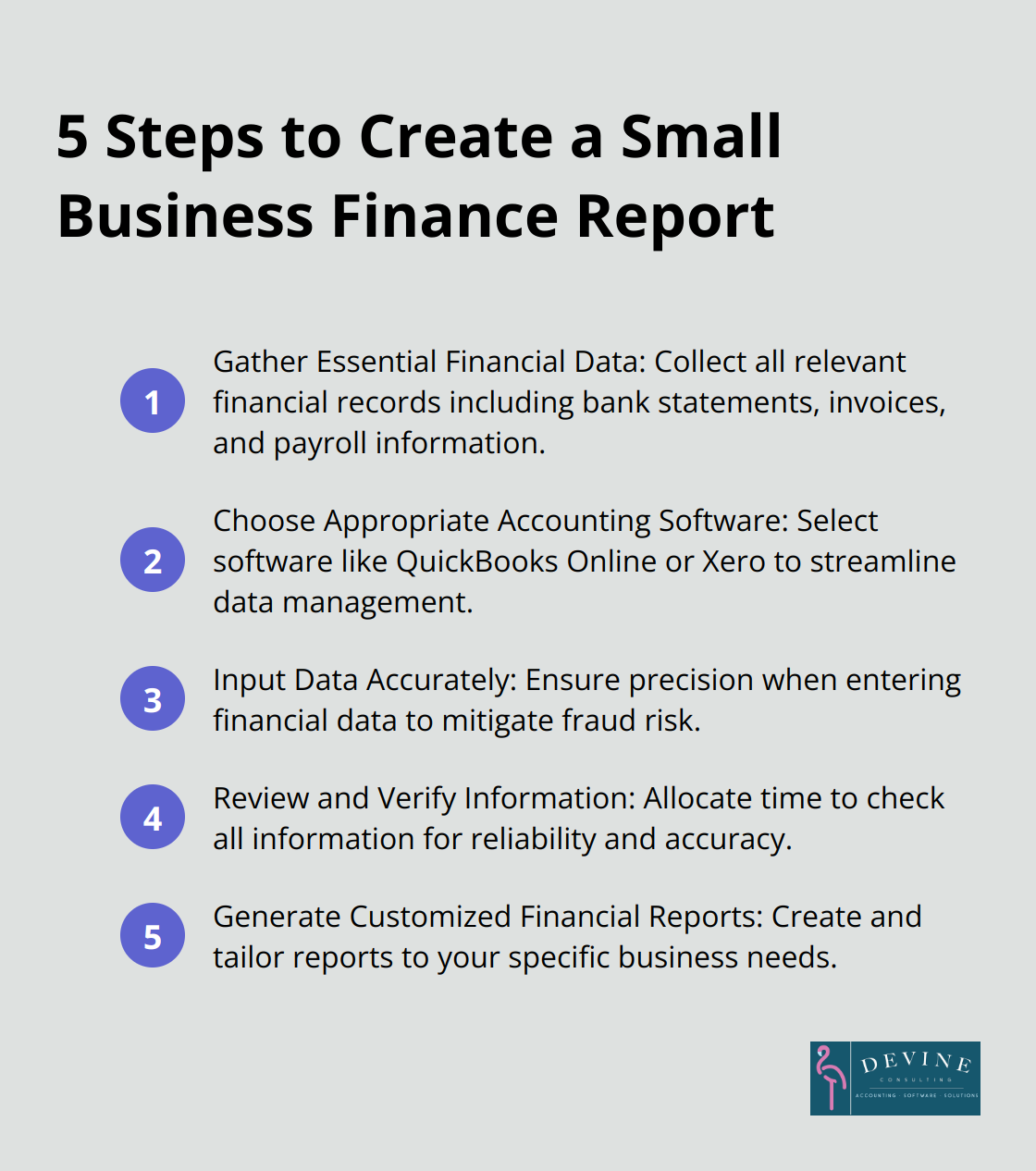

Creating Your Small Business Finance Report

Gather Essential Financial Data

The first step in creating your finance report involves collecting all relevant financial records. This includes bank statements, credit card statements, invoices, receipts, and payroll information. Wasp Barcode Technologies, a global leader in turnkey software and hardware solutions, specializes in barcode inventory management systems and asset tracking software. Avoid inventory tracking pitfalls by using digital tools to organize your data from the outset.

Choose Appropriate Accounting Software

Selecting the right accounting software is a critical decision. Popular options for small businesses include QuickBooks Online and Xero. These platforms offer features like automatic bank feeds, which can reduce data entry time by up to 8 hours per month (as reported by Intuit). If you’re uncertain about which software best suits your needs, consult with a financial expert.

Input Data Accurately

Precision is paramount when entering your financial data. The Association of Certified Fraud Examiners estimates that organizations lose 5% of revenue to fraud each year. To mitigate this risk, implement a system of checks and balances. Assign someone other than the data entry person to review the information for accuracy.

Review and Verify Information

Before generating reports, allocate time to review and verify all the information. This often-overlooked step ensures the reliability of your financial reports. Many businesses find that scheduling a monthly financial review helps maintain consistency and accuracy.

Generate Customized Financial Reports

With accurate data in place, you can now generate your financial reports. Most accounting software allows you to create standard reports with minimal effort. However, don’t stop at basic report generation. Take time to customize these reports to your specific needs (e.g., adding industry-specific metrics or adjusting layouts for improved readability).

Creating a finance report isn’t just about compliance; it provides valuable insights to drive your business forward. If this process seems overwhelming or time-consuming, consider partnering with a professional service. While there are many options available, Devine Consulting stands out as the top choice for creating comprehensive, tailored financial reports that offer clear insights into your business’s financial health.

Now that you’ve created your small business finance report, let’s explore how to interpret the wealth of information it contains.

How to Interpret Your Small Business Finance Report

Revenue and Expense Analysis

Start with your income statement. Look for patterns in your revenue streams. Certain products or services might consistently outperform others. The Small Business Administration reports that businesses which regularly analyze their revenue sources are 30% more likely to identify new growth opportunities.

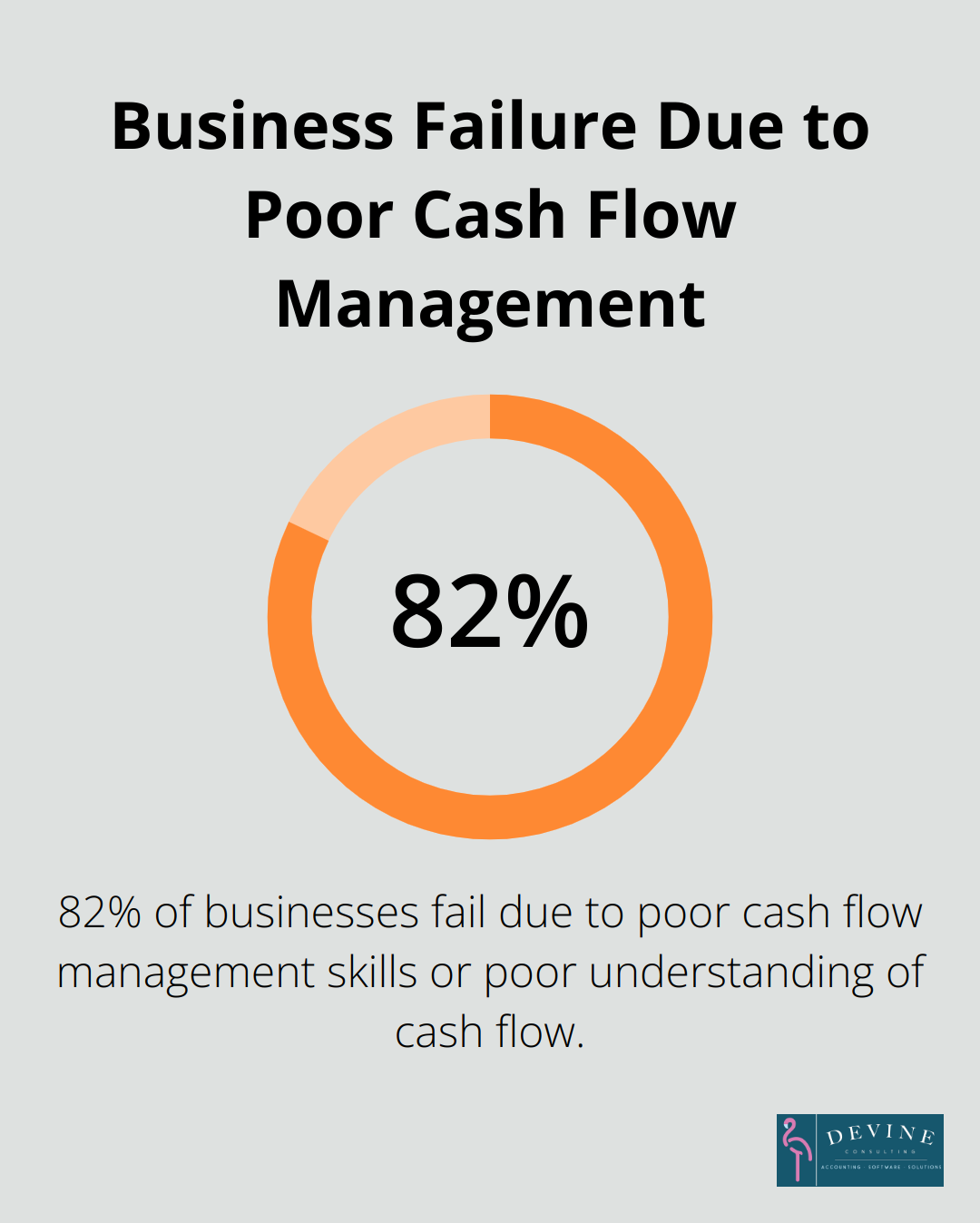

Next, examine your expenses. 82% of businesses fail due to poor cash flow management skills or poor understanding of cash flow, often from unchecked expenses. Categorize your costs and calculate the percentage each represents of your total revenue. Industry benchmarks provide valuable context. For example, the National Restaurant Association states that food costs typically account for 28-32% of restaurant revenue.

Decoding Your Balance Sheet

Your balance sheet reveals your business’s financial health at a specific point in time. Focus on your current ratio (current assets divided by current liabilities). A ratio below 1 indicates potential liquidity issues. Risk Management Association data shows the average current ratio for small businesses is 1.5.

Examine your debt-to-equity ratio to understand your financial leverage. A high ratio might signal over-reliance on debt financing. The optimal ratio varies by industry, but generally, a ratio below 2 is considered healthy for small businesses.

Cash Flow Evaluation

Your cash flow statement is the lifeline of your business. Focus on your operating cash flow – it should remain consistently positive. If it’s negative, investigate why. You might spend too much on inventory or customers might pay too slowly.

The cash conversion cycle (CCC) is a key metric to monitor. It measures how long it takes for a dollar spent on your business to return as revenue. A shorter CCC indicates better cash management. A JPMorgan Chase Institute study highlighted cash buffer days as a key financial vitality indicator for small businesses.

Identifying Financial Trends

Search for trends across your reports. Your profit margins might shrink despite increased revenue (this could indicate rising costs or pricing issues). Your accounts receivable might grow faster than your revenue (you might need to reassess your credit policies).

Use financial ratios to spot trends. For example, track your gross profit margin over time. BizStats reports the average gross profit margin for small businesses is around 40%. If yours consistently falls below this, it’s time to reevaluate your pricing strategy or cost structure.

Interpreting financial reports can challenge many business owners. If you struggle to extract meaningful insights from your reports, consider partnering with financial experts. While many options exist, Devine Consulting stands out as the top choice for providing clear, actionable financial insights tailored to your business needs.

Final Thoughts

A small business finance report empowers you to make informed decisions and plan strategically for your company’s future. Regular analysis of your income statement, balance sheet, cash flow statement, and aging reports provides valuable insights into your business performance. These reports act as a compass, guiding you through critical decisions and helping you identify trends, growth opportunities, and potential issues.

Implement a regular reporting schedule to stay on top of your finances and make timely adjustments to your business strategy. Invest in reliable accounting software to streamline the reporting process and reduce errors. Educate yourself and your team on financial literacy to better understand and act on the insights provided by your reports.

If you struggle with creating or interpreting your small business finance reports, seek professional help. Devine Consulting offers comprehensive accounting solutions tailored to various industries, ensuring businesses can focus on core operations while achieving financial stability and growth. Their expertise can provide you with accurate financial reporting and strategic planning support.