How to Navigate Oil and Gas Industry Accounting

Oil and gas industry accounting presents unique challenges that require specialized knowledge and expertise. From complex revenue recognition to intricate cost allocation, navigating this financial landscape can be daunting for many businesses.

At Devine Consulting, we understand the intricacies of oil and gas accounting and its impact on your company’s financial health. This guide will walk you through the essential aspects of managing your finances in this dynamic sector, helping you make informed decisions and maintain compliance with industry standards.

What Makes Oil and Gas Accounting Unique?

The Exploration and Production Lifecycle

Oil and gas accounting stands out due to its distinct rules and practices. This specialized field manages the financial aspects of exploring, extracting, and selling natural resources.

The industry’s exploration and production lifecycle significantly impacts financial reporting. Companies invest substantial sums in exploration activities before confirming the presence of oil or gas. This high-risk, high-reward nature necessitates precise accounting practices.

For instance, ExxonMobil allocated $4.2 billion to exploration expenses in 2022. This substantial upfront investment underscores the need for accurate tracking and reporting of these costs.

Reserve Estimation and Valuation

Reserve estimation plays a pivotal role in financial reporting for oil and gas companies. Regular assessment and reporting of proven reserves directly affect asset valuation and future revenue projections.

The U.S. Energy Information Administration reported that proven crude oil reserves in the United States totaled 38.2 billion barrels at the end of 2021. These reserves (a key asset for oil companies) significantly influence their financial statements.

Specialized Financial Statements

While oil and gas companies utilize standard financial statements (balance sheet, income statement, and cash flow statement), they also employ industry-specific reports. The reserve report stands out as the most notable, providing detailed information about a company’s oil and gas reserves.

Accounting Methods: Successful Efforts vs. Full Cost

Two primary accounting methods dominate the oil and gas industry: successful efforts and full cost. The choice between these methods can dramatically impact a company’s financial statements.

Major companies like Chevron and ExxonMobil use the successful efforts method, which only capitalizes the costs of successful exploration efforts. In contrast, smaller companies often opt for the full cost method, which capitalizes all exploration costs, regardless of success.

Successful efforts accounting directly impacts the income statement by expensing costs immediately, while full cost accounting capitalizes these costs.

Impact on Financial Decision-Making

The unique aspects of oil and gas accounting profoundly affect financial decision-making within the industry. Companies must carefully consider how their chosen accounting methods and reserve estimations impact their financial statements and, consequently, their strategic planning.

For example, a company using the successful efforts method might appear less profitable in the short term compared to a company using the full cost method. However, over time, the successful efforts method might provide a more accurate picture of the company’s financial health.

These complexities in oil and gas accounting underscore the importance of expert guidance. Companies like Devine Consulting specialize in navigating these intricate financial landscapes, ensuring accurate financial reporting and compliance with industry standards. As we move forward, let’s examine how these unique aspects manifest in specific areas of oil and gas accounting, starting with revenue recognition.

How Revenue Recognition Works in Oil and Gas

Revenue recognition in the oil and gas industry involves complex processes that require attention to detail and industry-specific knowledge. This chapter explores the unique aspects of revenue recognition in this sector, focusing on Joint Interest Billing, Production Sharing Agreements, and royalty calculations.

Joint Interest Billing (JIB) Accounting

Joint Interest Billing is a standard practice in the oil and gas industry where multiple parties share project costs and revenues. It is a process that allows operators to report joint account charges for a well or facility to the working interest owners. This process demands precise record-keeping and clear communication among all involved parties.

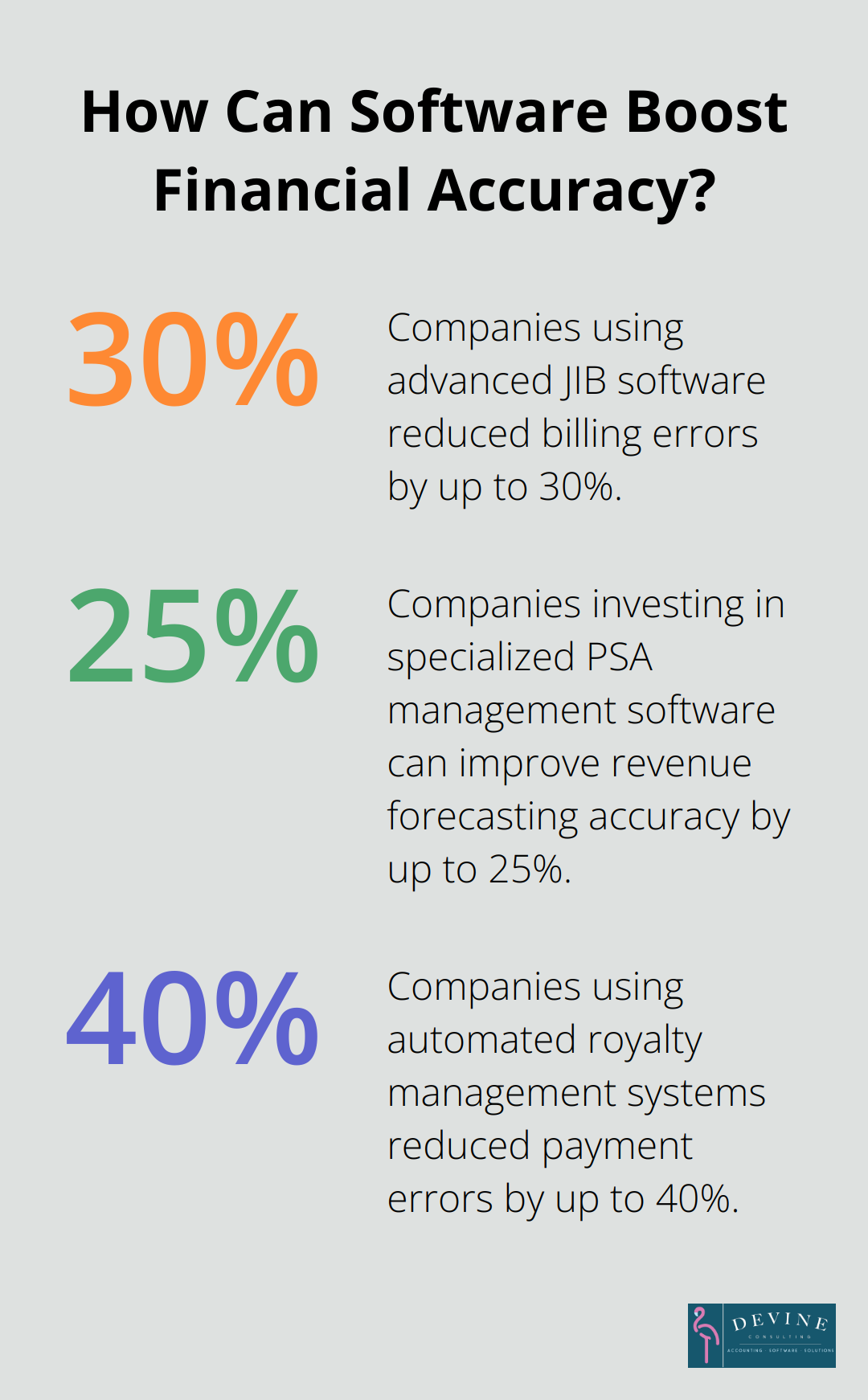

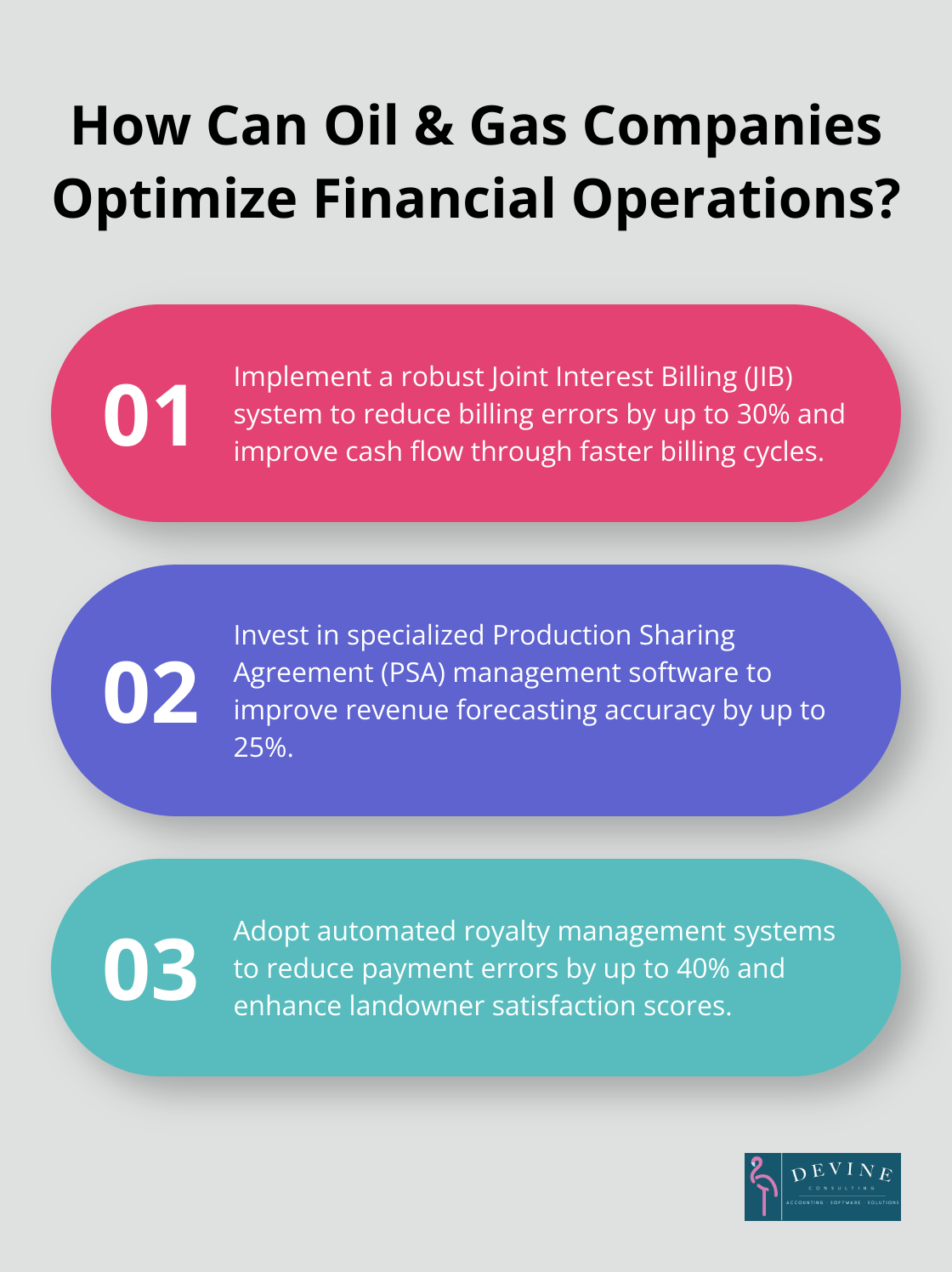

Companies should implement robust systems to handle the complexities of cost allocation and revenue distribution in JIB accounting. A study by Ernst & Young revealed that companies using advanced JIB software reduced billing errors by up to 30% and improved cash flow through faster billing cycles.

Production Sharing Agreements

Production Sharing Agreements (PSAs) are contracts between oil and gas companies and host governments that outline production and profit sharing terms. These agreements add complexity to revenue recognition, as terms can vary significantly between contracts.

Companies must understand PSA contract terms and their impact on revenue recognition. A systematic approach to tracking and reporting production volumes, costs, and profit oil calculations is essential. Wood Mackenzie reports that companies investing in specialized PSA management software can improve revenue forecasting accuracy by up to 25%.

Royalty Calculations and Payments

Royalties are payments made to mineral rights owners based on oil and gas production and sales. Accurate calculation and distribution of royalties are vital for maintaining good relationships with landowners and ensuring compliance with lease agreements.

Companies should consider automated systems that can handle complex calculations based on production volumes, commodity prices, and lease terms. The National Association of Royalty Owners found that companies using automated royalty management systems reduced payment errors by up to 40% and improved landowner satisfaction scores.

Technology’s Role in Revenue Recognition

Advanced software solutions play a significant role in streamlining revenue recognition processes in the oil and gas industry. These tools can:

- Automate complex calculations

- Improve data accuracy

- Enhance reporting capabilities

- Facilitate compliance with accounting standards

Companies that invest in such technologies often see improvements in efficiency and accuracy across their revenue recognition processes.

Importance of Expert Guidance

The complexities of revenue recognition in oil and gas underscore the need for expert guidance. Companies like Devine Consulting (which specializes in oil and gas accounting) can provide valuable insights and support in implementing best practices and leveraging cutting-edge technology.

As we move forward, we’ll examine how oil and gas companies manage cost allocation and reporting, another critical aspect of financial management in this industry.

How to Master Cost Allocation in Oil and Gas

Exploration and Development Costs

Exploration and development costs constitute a significant portion of expenses in the oil and gas sector. Global upstream oil and gas spending continues to favor exploration and development. Proper allocation of these costs is vital for financial accuracy and compliance.

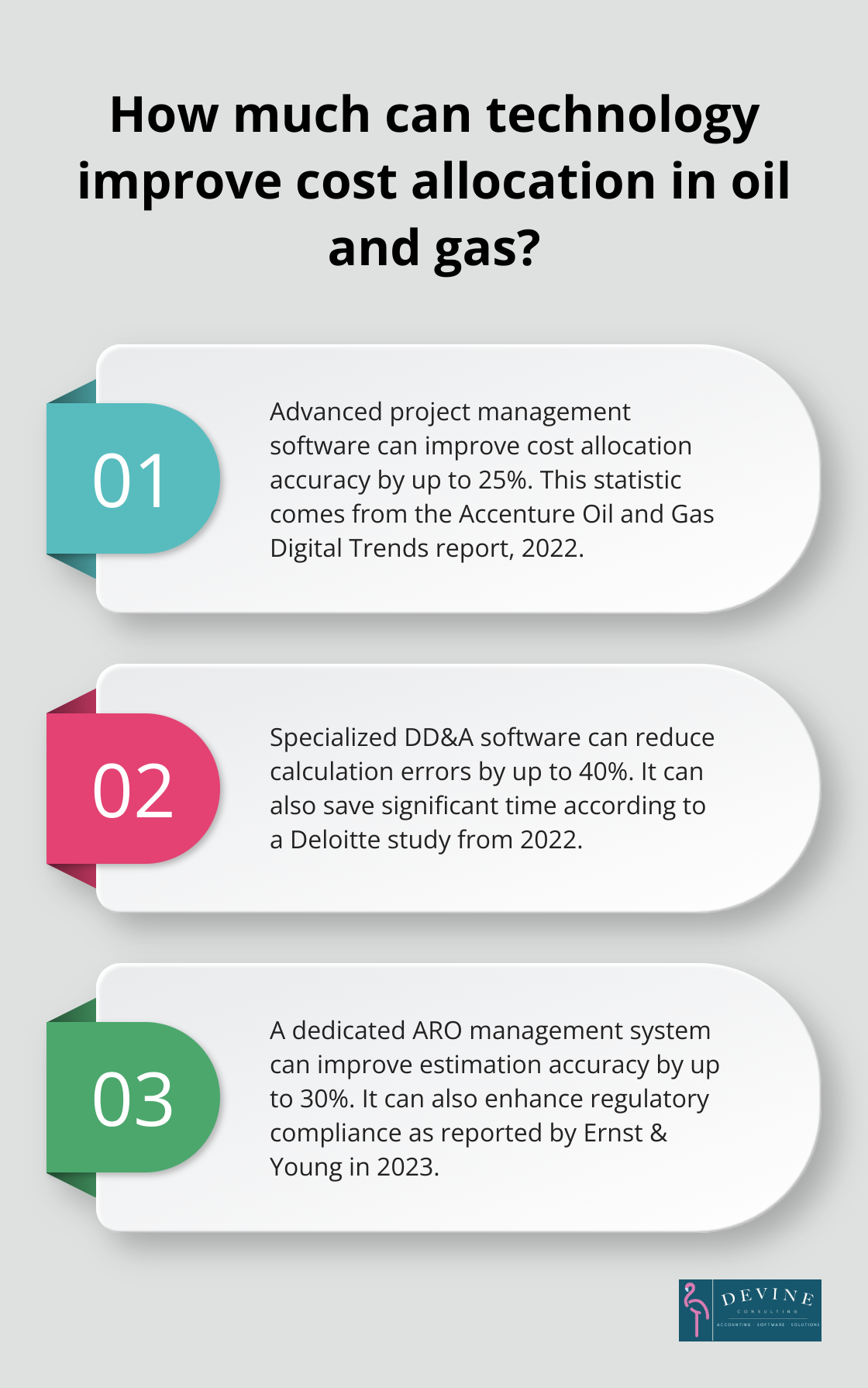

Companies should implement robust tracking systems to categorize and allocate costs effectively. Advanced project management software can improve cost allocation accuracy by up to 25% (Accenture Oil and Gas Digital Trends report, 2022).

It’s important to distinguish between successful and unsuccessful exploration efforts. Companies should expense unsuccessful exploration costs immediately, while they can capitalize successful efforts. This distinction significantly impacts financial statements and requires meticulous record-keeping.

Depreciation, Depletion, and Amortization (DD&A)

DD&A represents the systematic allocation of asset costs over their useful lives. Depreciation, depletion, and amortization of capitalized acquisition, exploration, and development costs are recognized as part of oil and gas producing activities.

To optimize DD&A calculations, companies should:

- Update reserve estimates regularly

- Use appropriate depletion methods (e.g., units-of-production)

- Conduct periodic impairment tests

Specialized DD&A software can reduce calculation errors by up to 40% and save significant time (Deloitte study, 2022).

Asset Retirement Obligations (AROs)

AROs represent the future costs associated with retiring long-lived assets. These often include well plugging and abandonment, facility decommissioning, and site restoration. The International Energy Agency estimates that global decommissioning costs for offshore oil and gas assets will reach $105 billion between 2021 and 2030.

Accurate estimation and reporting of AROs are essential for financial planning and regulatory compliance. Companies should:

- Reassess ARO estimates regularly

- Use appropriate discount rates

- Consider technological advancements in decommissioning methods

A dedicated ARO management system can improve estimation accuracy by up to 30% and enhance regulatory compliance (Ernst & Young report, 2023).

Technology’s Role in Cost Allocation

Advanced software solutions play a significant role in streamlining cost allocation processes in the oil and gas industry. These tools can:

- Automate complex calculations

- Improve data accuracy

- Enhance reporting capabilities

- Facilitate compliance with accounting standards

Companies that invest in such technologies often see improvements in efficiency and accuracy across their cost allocation processes.

Expert Guidance in Cost Allocation

The complexities of cost allocation in oil and gas underscore the need for expert guidance. Companies like Devine Consulting, which specializes in oil and gas accounting, can provide valuable insights and support in implementing best practices and leveraging cutting-edge technology. Their expertise ensures accurate financial reporting and strategic decision-making, allowing oil and gas companies to focus on their core operations while maintaining financial stability and compliance.

Final Thoughts

Oil and gas industry accounting presents unique challenges that require specialized knowledge and meticulous attention to detail. Companies must master complex revenue recognition methods, intricate cost allocation processes, and industry-specific practices to gain a competitive edge. Accurate accounting in this sector provides the foundation for informed decision-making, attracts investors, and ensures long-term financial stability.

Expert partners can significantly streamline oil and gas accounting processes with their in-depth knowledge of industry standards and cutting-edge technologies. These specialists implement robust systems for joint interest billing, manage complex production sharing agreements, and ensure precise royalty calculations. Devine Consulting offers comprehensive accounting solutions tailored specifically for the oil and gas industry, helping companies streamline their financial processes and make data-driven decisions.

The oil and gas industry continues to evolve, and so do its accounting practices. Companies must stay ahead of these changes through constant vigilance and adaptation. Prioritizing accurate accounting and leveraging expert support can turn financial complexity into a strategic advantage, paving the way for sustainable success in this dynamic industry.