Mastering the Fundamentals of Bookkeeping and Accounting

Bookkeeping and accounting essentials form the backbone of any successful business. At Devine Consulting, we’ve seen firsthand how mastering these fundamentals can transform financial management.

Accurate record-keeping isn’t just about numbers; it’s about creating a clear financial picture that guides smart decisions. This blog post will walk you through the key components and best practices of effective bookkeeping, helping you build a solid foundation for your company’s financial future.

Why Accurate Bookkeeping Matters

Accurate bookkeeping forms the cornerstone of financial success for any business. Let’s explore why it’s so critical.

Informed Decision-Making

Accurate books provide a clear picture of your financial transactions, helping with decision-making and ensuring compliance with legal and tax requirements. This clarity allows you to make informed decisions about investments, expansions, or cost-cutting measures. A construction company used their detailed financial records to identify their most profitable projects, allowing them to focus on similar contracts in the future.

Smooth Tax Season

Proper bookkeeping makes tax time less stressful and more efficient. With organized records, you can easily identify deductions and credits, potentially saving thousands in taxes.

Stakeholder Confidence

Accurate financial records build trust with investors, lenders, and partners. A real estate firm secured a significant loan because their meticulous bookkeeping demonstrated financial stability and growth potential.

Legal Compliance

Accurate bookkeeping ensures your business complies with legal requirements. It helps you avoid penalties and fines that can result from inaccurate or incomplete financial records.

Financial Health Monitoring

Regular, accurate bookkeeping allows you to monitor your business’s financial health. You can spot trends, identify potential issues early, and take corrective action before small problems become big ones. This proactive approach can save your business from financial distress and set the stage for sustainable growth.

As we move forward, we’ll explore the key components that make up effective bookkeeping practices. These elements will help you build a solid foundation for your company’s financial future.

Building Blocks of Effective Bookkeeping

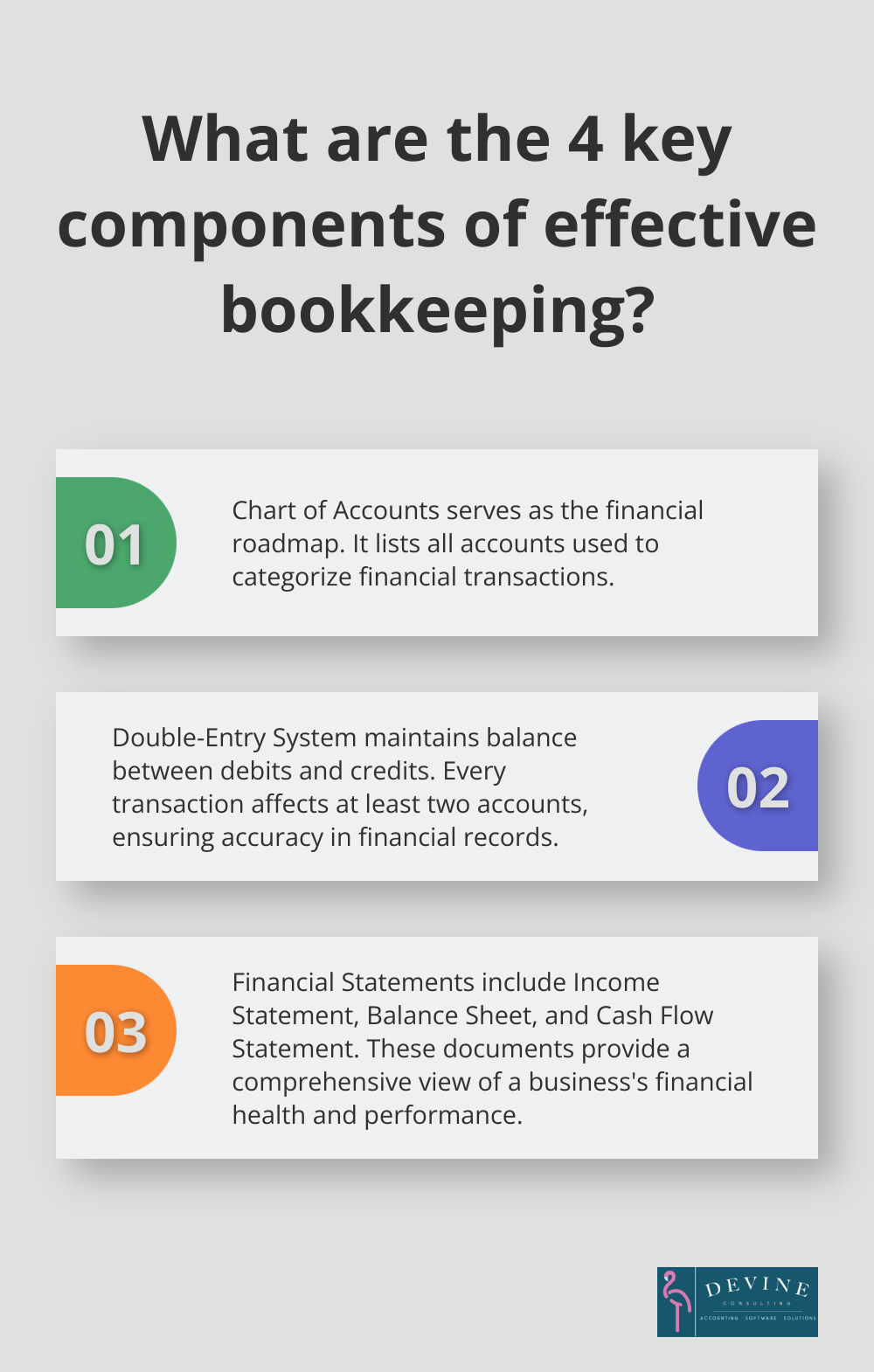

Effective bookkeeping rests on several key components that work together to create a comprehensive financial picture. Four critical elements form the foundation of solid bookkeeping practices.

Chart of Accounts: Your Financial Roadmap

A chart of accounts (CoA) is a record of every account within an organization and an important operation within financial planning and analysis (FP&A). It serves as the backbone of your bookkeeping system, listing all the accounts used to categorize your financial transactions. Think of it as a filing system for your money. A good chart of accounts should align with your business needs. For example, a construction company might have accounts for different types of materials, while a software company might focus on licensing and development costs.

To create an effective chart of accounts, start with broad categories like assets, liabilities, income, and expenses. Then, break these down into specific accounts that reflect your business operations. Keep it simple at first – you can add more detail later.

Double-Entry System: Balancing Act

The double-entry bookkeeping system is a bookkeeping system in which each transaction affects at least two accounts and maintains a balance between debits and credits. This system ensures accuracy in financial records. Every transaction appears in at least two accounts, with one account debited and another credited. This method ensures that your books always balance, making it easier to catch errors.

For instance, when you make a sale, you increase your cash account (debit) and your sales revenue account (credit). This method might seem complex at first, but it’s essential for maintaining accurate financial records. Many accounting software packages automate this process, making it easier for small businesses to implement.

Financial Statements: Your Business Story in Numbers

Financial statements tell the story of your business’s financial health and performance. The three main financial statements are:

- Income Statement: Shows your revenue, expenses, and profit over a specific period.

- Balance Sheet: Provides a snapshot of your assets, liabilities, and equity at a point in time.

- Cash Flow Statement: Tracks the movement of cash in and out of your business.

These statements prove invaluable for making informed business decisions. For example, a restaurant owner might use the income statement to identify which menu items are most profitable, or use the cash flow statement to determine if they can afford to upgrade their kitchen equipment.

Reconciliations and Adjustments: Keeping It Accurate

Regular reconciliations and adjustments maintain the accuracy of your books. Reconciliation involves comparing your internal records with external statements (like bank statements) to ensure they match. This process helps catch errors or fraudulent activities.

Adjustments account for transactions that don’t immediately impact cash flow, such as depreciation or prepaid expenses. For instance, if you prepay six months of rent, you’d need to adjust your books each month to reflect the portion of rent used.

These four components create a solid foundation for your bookkeeping system. While these concepts might seem daunting, professional support can make a significant difference. Many businesses turn to accounting firms (like Devine Consulting) to set up and maintain robust bookkeeping systems tailored to specific industry needs.

Now that we’ve covered the building blocks of effective bookkeeping, let’s explore best practices for maintaining accurate books in the next section.

How to Keep Your Books Accurate and Up-to-Date

Maintaining accurate books is essential for the financial health of your business. We’ve developed a set of best practices that help our clients stay on top of their finances. Here’s how you can implement these strategies in your own business:

Establish a Regular Bookkeeping Schedule

Set aside dedicated time each week for bookkeeping tasks. This could be an hour every Monday morning or a few hours every Friday afternoon. Consistency is key. Regular updates prevent a backlog of transactions and make it easier to spot and correct errors quickly.

A retail business owner spends 30 minutes each evening to reconcile the day’s sales and expenses. This daily habit has significantly improved their financial accuracy and decision-making ability.

Implement a Robust Documentation System

Create a system for organizing and storing financial documents. This includes receipts, invoices, bank statements, and any other financial records. Many businesses now move towards digital storage solutions, which offer benefits like easy searchability and backup options.

Use a cloud-based storage system that integrates with your accounting software. This allows for quick retrieval of documents when needed (such as during an audit or when preparing tax returns).

Leverage Accounting Software

Modern accounting software can streamline many bookkeeping tasks. These tools can automatically categorize transactions, generate financial reports, and even send invoices. When choosing software, consider your business’s specific needs and growth plans.

QuickBooks Online is considered the best overall accounting software for small businesses, offering features like in-depth contact records, transaction forms, and excellent inventory management. It’s also noted as the best option for multiple users.

Implement Strong Internal Controls

Internal controls are procedures designed to prevent errors and fraud. These might include:

- Separate financial duties among different employees

- Require dual signatures on large checks

- Regularly review and update access to financial systems

A manufacturing company implemented a system where purchase orders above a certain amount required approval from two department heads. This simple change reduced unnecessary spending and improved their bottom line.

Conduct Regular Financial Reviews

Schedule monthly or quarterly reviews of your financial statements. This practice helps you understand your business’s financial health and identify any discrepancies or areas of concern early on.

During these reviews, compare your actual results to your budget or projections. This analysis can provide valuable insights into your financial performance, which is a subjective measure of how well a firm can use assets from its primary mode of business and generate revenues.

Final Thoughts

Mastering bookkeeping and accounting essentials creates a solid foundation for financial success. These fundamentals provide a clear picture of your business’s financial health, enabling informed decision-making and strategic planning. Accurate financial records foster trust with stakeholders, streamline tax preparation, and provide insights that drive growth.

Solid bookkeeping practices can save you money by helping you avoid costly errors and penalties. They allow you to identify trends, optimize cash flow, and seize opportunities that might otherwise go unnoticed. Complex accounting needs often require professional expertise to navigate financial landscapes effectively.

At Devine Consulting, we offer tailored accounting solutions that go beyond basic bookkeeping. Our team of experts can help ensure your business remains compliant while maximizing financial performance. Prioritizing accurate and timely financial management will benefit your business for years to come.