Top Benefits of Outsourced Accounting Services Revealed

At Devine Consulting, we’ve seen firsthand how outsourced accounting services can transform businesses.

Many companies struggle with managing their finances effectively while trying to focus on growth.

The benefits of outsourced accounting services extend far beyond just number crunching. They can lead to significant cost savings, provide access to specialized expertise, and free up valuable time for core business activities.

How Much Can You Save with Outsourced Accounting?

Slashing Labor Costs

Outsourced accounting significantly reduces labor expenses. A full-time accountant’s salary ranges from $50,000 to $120,000 annually (excluding benefits, training, and office space). Outsourcing allows you to pay only for necessary services. Many businesses save 30-50% on accounting costs compared to in-house teams.

Accessing Advanced Technology Without Investment

Outsourcing accounting services helps businesses streamline finances, cut costs, improve accuracy, and boost efficiency. Outsourced accounting firms already possess these tools, allowing you to benefit from top-tier financial management technology without the hefty price tag.

Flexible Scaling of Services

Outsourced accounting offers unmatched flexibility. You can easily adjust your accounting support as your business grows or experiences seasonal changes. This eliminates the need to hire additional staff during busy periods or maintain excess capacity during slower times.

Real-World Cost Savings

Many businesses see a return on investment within the first year of outsourcing their accounting. For example:

- A construction company reduced accounting costs by 40% while improving financial reporting accuracy by 25%.

- An oil and gas firm reallocated $100,000 from their accounting budget to core business activities, resulting in a 15% revenue increase.

Beyond Cost Cutting: A Strategic Investment

Outsourced accounting isn’t just about reducing expenses-it’s an investment in a more efficient, scalable, and technologically advanced financial management system. This strategic move allows you to redirect resources to areas that directly contribute to your business growth and success.

As you consider the potential savings from outsourced accounting, it’s equally important to understand the expertise and specialized knowledge that comes with professional financial management. Let’s explore how access to skilled accountants can further benefit your business.

What Makes Outsourced Accounting Expertise Invaluable?

Outsourced accounting provides more than just number crunching; it offers specialized knowledge that propels businesses forward. The expertise gained through professional financial management can significantly benefit your company.

Industry-Specific Insights

Each industry faces unique financial challenges and opportunities. Construction companies must handle complex project accounting, while real estate firms navigate intricate property transactions. Outsourced accounting firms specialize in these nuances, offering tailored solutions that generic accounting services often overlook.

According to a recent study, the share of finance leaders outsourcing finance functions has decreased from 40% last year to 27% this year. This shift highlights the importance of understanding the value that specialized outsourced accounting can bring to businesses.

Navigating Regulatory Complexities

Tax laws and financial regulations constantly change. Staying current with these updates requires full-time dedication. Outsourced accounting teams commit themselves to remain up-to-date with regulatory changes, ensuring your business maintains compliance.

When the Tax Cuts and Jobs Act was introduced in 2017, one of the major motivations was concern about the international tax system. This highlights the complexity of tax laws and the importance of having expert guidance to navigate these changes.

Strategic Financial Planning

Outsourced accounting services extend beyond day-to-day bookkeeping. They offer strategic financial planning crucial for long-term success, including cash flow forecasting, budget analysis, and growth opportunity identification.

A recent Deloitte report showed that companies utilizing outsourced financial strategists experienced 23% higher growth rates on average compared to those relying solely on in-house teams. This strategic edge proves particularly valuable for businesses in competitive markets or those planning expansion.

Access to Advanced Tools and Technologies

Outsourced accounting firms invest in cutting-edge financial software and tools. This investment allows businesses to benefit from advanced technologies without the hefty price tag of direct purchases. From cloud-based accounting systems to AI-powered analytics, these tools enhance accuracy, efficiency, and decision-making capabilities.

Continuous Learning and Improvement

Professional outsourced accounting teams prioritize ongoing education and skill development. They stay abreast of the latest accounting standards, tax codes, and financial best practices. This commitment to continuous learning translates into more informed and effective financial management for your business.

The value of outsourced accounting expertise extends far beyond basic financial record-keeping. It provides insights and strategies that can elevate your business to new heights. As we shift our focus to the next crucial aspect of outsourced accounting, let’s explore how these services can save you time and allow you to concentrate on your core business activities.

How Outsourced Accounting Frees Up Your Time

Streamlined Financial Processes

Outsourced accounting services significantly reduce the time spent on financial tasks. This shift to recurring outsourced accounting clients, coupled with general upward fee adjustment, should continue to drive up annual fees. This time savings stems from streamlined processes, automated systems, and expert handling of complex financial matters.

A mid-sized manufacturing company reported saving over 30 hours per week after outsourcing their accounting to a specialized firm. This allowed their in-house team to focus on product development and customer relationships, which led to a 15% increase in sales within the first year.

Strategic Growth Focus

When businesses outsource their accounting, they gain more than just time – they acquire the ability to focus on strategic decisions that drive growth. Companies plan to outsource in order to realize a host of benefits, including improved efficiency and business growth.

This shift in focus can lead to significant business improvements. A tech startup that outsourced its accounting dedicated more time to product development and marketing. As a result, they launched two new products six months ahead of schedule and saw a 40% increase in user acquisition.

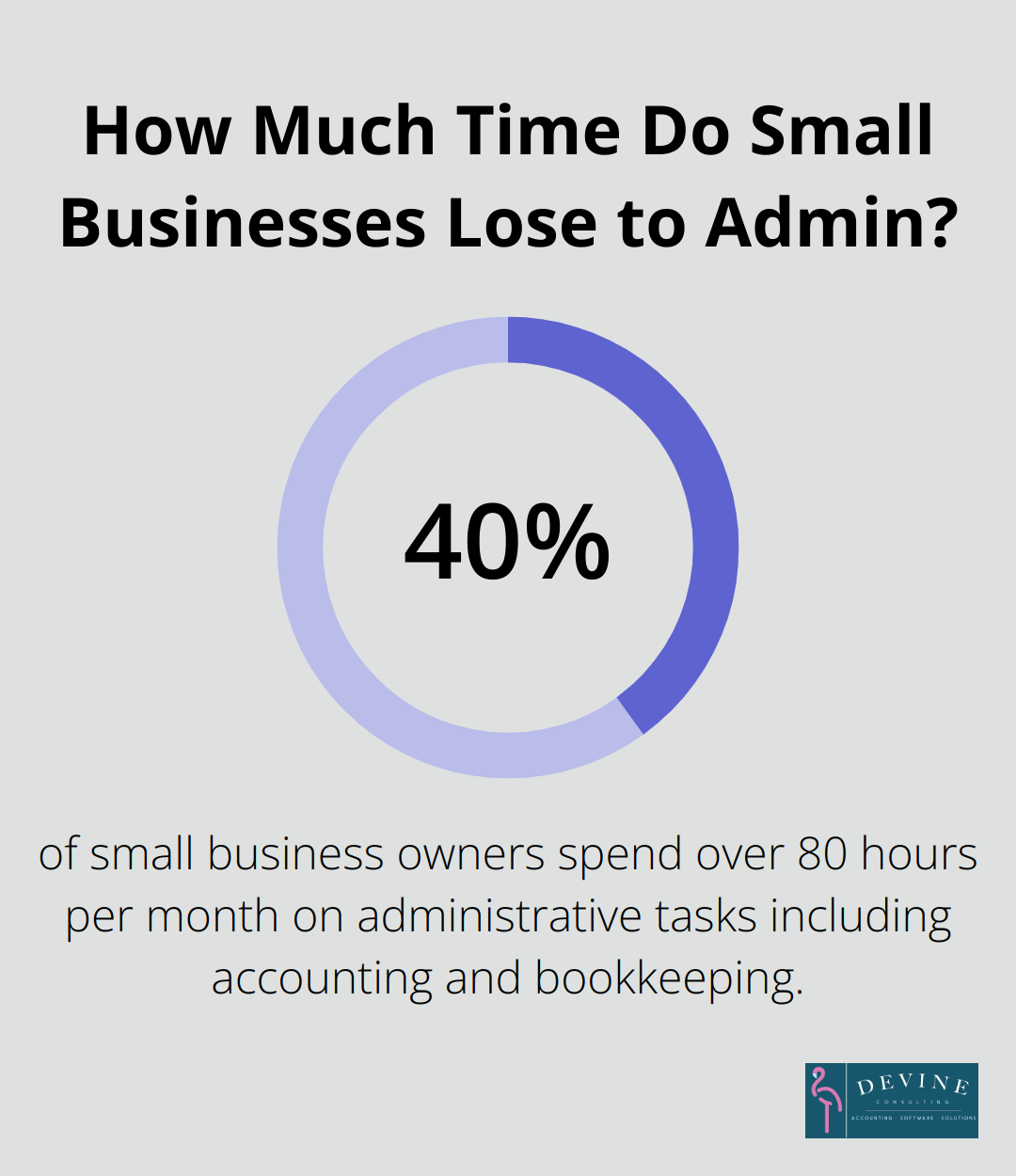

Enhanced Work-Life Balance

Outsourced accounting doesn’t just benefit the business – it improves the work-life balance of business owners and key personnel. The National Small Business Association found that 40% of small business owners spend over 80 hours per month on administrative tasks (including accounting and bookkeeping).

Outsourcing these tasks allows business owners to reclaim a significant portion of their time. This leads to reduced stress, improved job satisfaction, and often, better business outcomes. A restaurant owner who outsourced their accounting took their first vacation in five years, while their business continued to run smoothly in their absence.

Access to Specialized Expertise

Outsourced accounting services provide businesses with access to specialized expertise without the need for full-time, in-house staff. This expertise includes knowledge of industry-specific regulations, tax laws, and financial best practices. Companies can leverage this knowledge to make informed decisions and avoid costly mistakes.

Technology Integration

Outsourced accounting firms often use advanced financial software and tools that might be too expensive or complex for individual businesses to implement on their own. This technology integration leads to more efficient processes, real-time financial insights, and improved accuracy in financial reporting. Outsourced bookkeeping enhances operations and decision-making, improving efficiency and financial clarity for your business.

Final Thoughts

Outsourced accounting services offer a powerful combination of cost savings, specialized expertise, and time efficiency. These advantages create a robust foundation for business growth and success. Companies that leverage these services often find themselves better positioned to adapt to market changes, seize new opportunities, and navigate financial challenges with confidence.

The benefits of outsourced accounting services extend far beyond mere number crunching. They provide a competitive edge in today’s fast-paced business environment. Outsourcing isn’t just about cutting costs-it’s an investment in your company’s future.

Devine Consulting’s outsourced accounting services can provide the expertise, efficiency, and strategic support your business needs to thrive in today’s competitive landscape. Take the step towards streamlined financial management and unlock your business’s full potential. Our comprehensive solutions, tailored for various industries, go beyond basic bookkeeping to offer strategic financial planning and reporting that drive growth and stability.