What Are the Benefits of an Outsourced CFO for a Small Business?

Small businesses often struggle with financial management, but hiring a full-time CFO can be costly. At Devine Consulting, we’ve seen how an outsourced CFO for small businesses can be a game-changer.

This flexible solution provides expert financial guidance without the overhead of a permanent hire. In this post, we’ll explore the key benefits of bringing in an outsourced CFO to boost your small business’s financial health and growth potential.

How Outsourced CFOs Cut Costs for Small Businesses

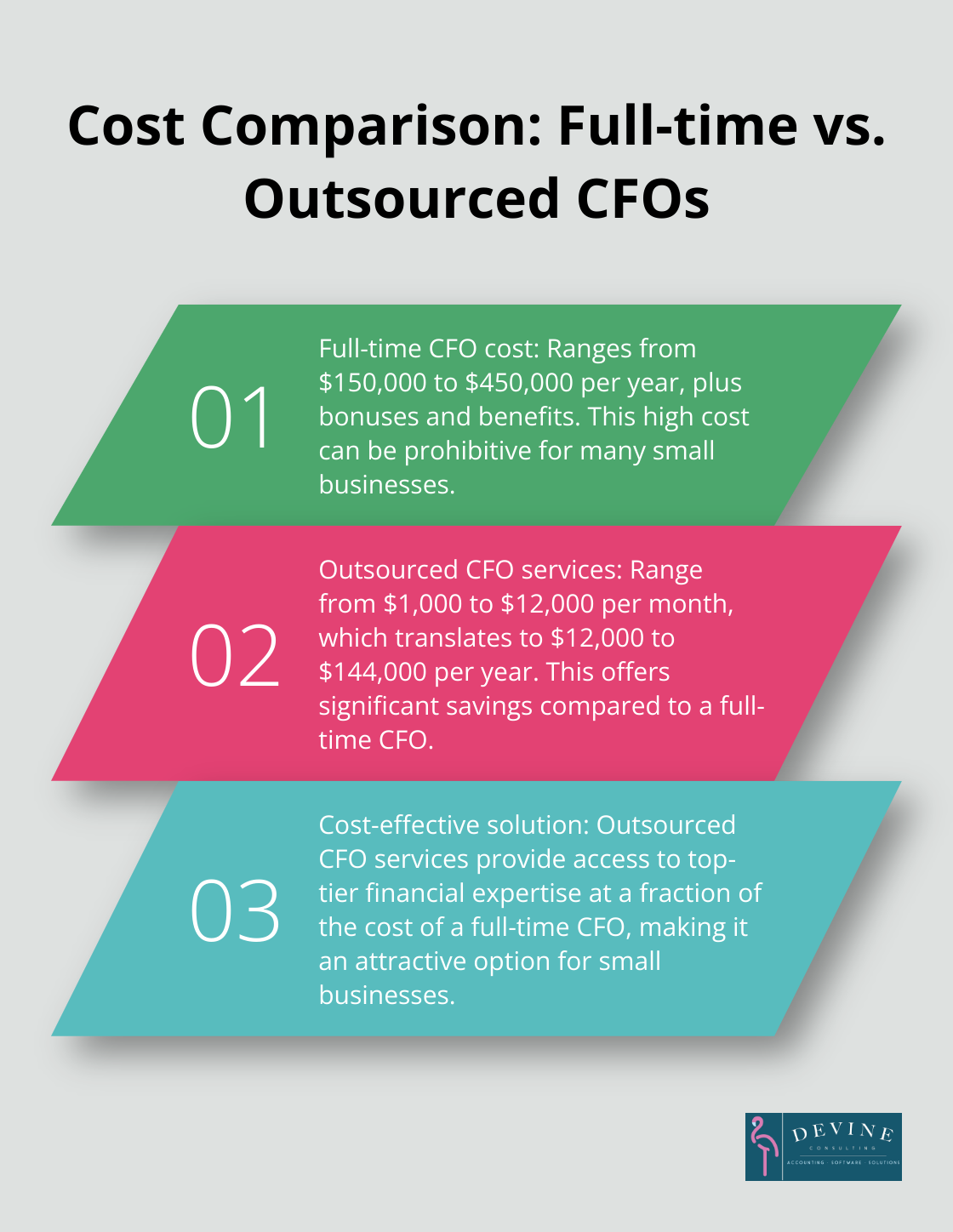

Significant Savings Compared to Full-Time CFOs

Outsourced CFO services slash expenses for small businesses. The cost of having a full-time CFO or controller can range from $150,000 to $450,000 per year plus bonuses and benefits. This is prohibitive to many small businesses. In contrast, outsourced CFO services range from $1,000 to $12,000 per month, depending on the workload. This dramatic difference allows small businesses to access top-tier financial expertise without breaking the bank.

On-Demand Financial Expertise

The ability to scale services up or down is a major advantage of outsourced CFOs. This flexibility eliminates payment for idle time or unnecessary services. For instance, businesses might need more intensive CFO support during tax season or investor meetings, but require only a few hours of strategic advice in other months. This pay-for-what-you-use model maximizes the return on investment.

Broad Experience Without Long-Term Commitments

Outsourced CFOs bring diverse experience from multiple businesses across various industries. This wide-ranging perspective proves invaluable for identifying opportunities and avoiding pitfalls that less experienced in-house CFOs might overlook. Companies using outsourced financial services can experience improvements in operational efficiency. These improvements primarily involve smaller, day-to-day changes which compound over time and are critical to maintaining efficient operations. Most small businesses would find it prohibitively expensive to maintain this level of expertise in-house.

Custom Solutions for Unique Business Needs

Every business faces distinct financial challenges and goals. Outsourced CFO services adapt to address specific needs, whether it’s improving cash flow, preparing for expansion, or streamlining operations. This targeted approach ensures that every dollar spent on financial management drives real value for the business.

Access to Cutting-Edge Financial Tools

Outsourced CFOs often have access to the latest financial software and tools (which can be costly for individual businesses to purchase and maintain). They can implement these advanced systems to improve financial reporting, forecasting, and analysis without the business having to invest in expensive technology or training.

As businesses consider their financial management options, it’s clear that outsourced CFO services offer a compelling mix of expertise, flexibility, and cost-effectiveness. The next section will explore how these professionals contribute to strategic financial planning and growth.

How Outsourced CFOs Drive Strategic Growth

Uncovering Financial Realities

Outsourced CFO services benefit businesses by providing expert financial guidance without the cost of a full-time CFO. These professionals conduct thorough financial health checks, analyzing cash flow, profit margins, and balance sheets to identify strengths and weaknesses. They might discover that a business ties up too much capital in inventory or has untapped credit lines that could fuel growth.

This objective analysis often reveals insights that business owners, deeply involved in day-to-day operations, might miss. A KPMG study found that automation of financial reporting and technical accounting can provide valuable insights for businesses.

Crafting Long-Term Financial Strategies

With a clear picture of the company’s financial position, an outsourced CFO develops strategies to achieve long-term goals. This might include:

- Optimizing pricing strategies to increase profitability

- Identifying cost-saving measures without sacrificing quality

- Developing financial forecasts to guide decision-making

An outsourced CFO might create a five-year financial plan that outlines how to double revenue while maintaining healthy profit margins. This plan would include specific milestones and key performance indicators (KPIs) to track progress.

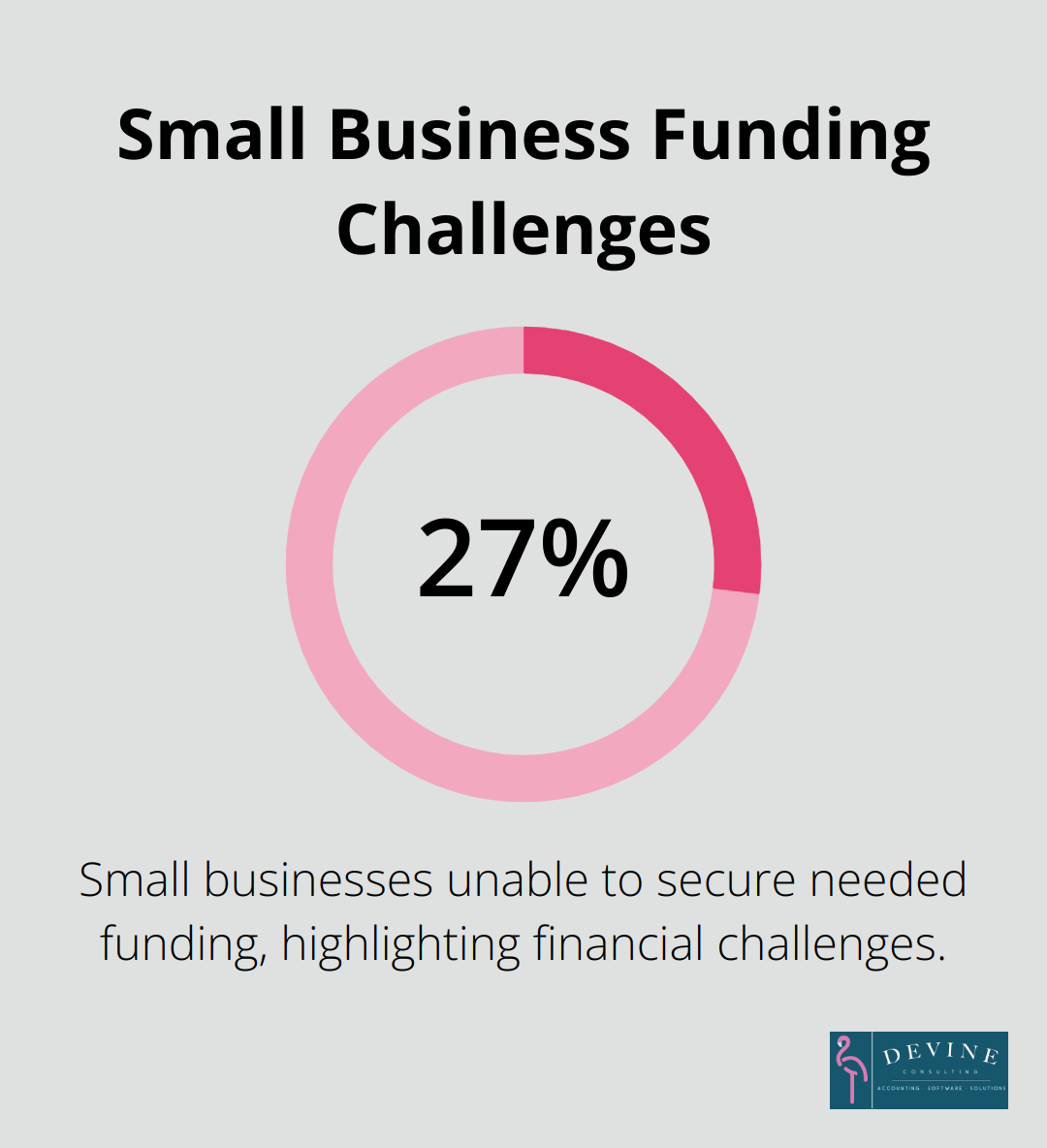

Navigating Funding and Capital Raising

Many small businesses struggle to secure funding for growth. An outsourced CFO proves invaluable in this process. They can:

- Prepare detailed financial projections that appeal to investors

- Identify the most suitable funding options (e.g., bank loans, venture capital, angel investors)

- Negotiate favorable terms with lenders

A National Small Business Association survey found that 27% of small businesses couldn’t get the funding they needed. An experienced outsourced financial controller can significantly improve these odds by presenting a compelling financial case to potential funders.

Implementing Financial Technology

To support these strategic initiatives, outsourced CFOs often implement advanced financial technology. This might include cloud-based accounting software, cash flow forecasting tools, or business intelligence platforms. These technologies provide real-time insights that enable faster, data-driven decision-making.

Devine Consulting has helped numerous small businesses leverage these technologies to gain a competitive edge. Our clients report improved financial visibility and more confident strategic planning as a result.

The strategic financial expertise provided by outsourced CFOs drives sustainable growth for small businesses. This expertise extends beyond planning and into the realm of financial reporting and compliance, which we’ll explore in the next section.

How Outsourced CFOs Enhance Financial Reporting and Compliance

Precision in Financial Statements

Outsourced CFOs elevate a small business’s financial reporting standards. They ensure financial statements are not just correct, but also insightful. These professionals implement systems to track every financial transaction meticulously. The result? Balance sheets, income statements, and cash flow reports that accurately reflect the company’s financial health.

A recent study revealed that 84% of finance professionals who identify as finance business partners are extremely optimistic about the future. This statistic underscores the importance of expert oversight on your financials.

Navigating the Tax Maze

Tax compliance often confuses small businesses. Outsourced CFOs stay up-to-date with the latest tax laws and regulations, which prevents your business from running afoul of the IRS. They don’t just file your taxes; they strategize to minimize your tax burden legally.

An outsourced CFO might identify industry-specific tax credits you weren’t aware of. The National Small Business Association reports that the majority of small-business owners spend more than 20 hours per year dealing with federal taxes. An outsourced financial controller can significantly reduce this time, allowing you to focus on growing your business.

Fortifying Financial Controls

Robust financial controls prevent fraud and ensure the accuracy of financial data. Outsourced CFOs implement these controls, creating a system of checks and balances that protects your business’s financial integrity.

These controls often include:

- Segregation of duties

- Regular audits

- Approval processes for large expenditures

Streamlining Reporting Processes

Outsourced CFOs often introduce advanced financial software and tools to streamline reporting processes. These tools can automate data collection, reduce errors, and provide real-time financial insights. This automation allows for more frequent and accurate reporting, which in turn supports better decision-making.

Adapting to Regulatory Changes

Financial regulations change frequently, and keeping up can challenge small businesses. Outsourced CFOs stay informed about these changes and adapt your financial practices accordingly. This proactive approach helps you avoid potential penalties and ensures your business remains compliant with financial regulations.

Final Thoughts

Outsourced CFO services transform financial operations for small businesses. These services provide cost-effective expertise, strategic planning, and improved financial reporting without the burden of a full-time hire. Small businesses gain access to high-level financial skills and flexible engagement options that adapt to their specific needs.

An outsourced CFO for small businesses brings the knowledge and experience needed to navigate complex financial challenges. This expertise helps identify growth opportunities and avoid potential pitfalls. Financial management becomes a powerful tool for success in today’s competitive landscape.

Devine Consulting understands the unique financial challenges small businesses face. Our comprehensive accounting solutions provide the strategic support and financial management you need to focus on your core operations. Don’t let financial complexities hold your business back; embrace the power of an outsourced CFO to elevate your small business to new heights of financial success.